概述

均价成交量价值(VWAP)策略是一个跟踪股票在特定时间内的平均价格的策略。该策略使用VWAP作为一个基准,当价格高于或低于VWAP时开仓做多或做空。它还设置了止损和止盈条件来管理交易。

策略原理

该策略首先计算典型价格(最高价、最低价和收盘价的平均值)与成交量的乘积之和,以及成交量之和。然后用乘积之和除以成交量之和,计算出VWAP值。当价格上穿VWAP时,做多;当价格下穿时,做空。

做多仓位的止盈条件是价格较入场价上涨3%时止盈;止损条件是价格较入场价下跌1%时止损。做空仓位也是类似的条件。

优势分析

VWAP策略的主要优势有:

使用了VWAP这个公认的重要统计指标作为交易信号的基准,使策略更有效;

同时使用vwap信号与止盈止损,可以在趋势中获利,也可以减少损失;

策略逻辑简单清晰,容易理解和实现。

风险分析

该策略也存在一些风险:

VWAP无法预测未来价格,因此VWAP信号可能发生滞后;

止损条件设置过于宽松,可能增加损失;

回测时间越长,交易信号越多,实盘效果可能会有差异。

这些风险可以通过调整参数、优化止损算法等方法来降低。

优化方向

该策略可以从以下几个方向进行优化:

对VWAP参数进行优化,找到最佳计算周期;

可以测试其他跟踪止损算法,如移动止损、指数移动止损等;

可以结合其他指标作为过滤器,避免VWAP信号错误;例如量能指标、布林带指标等。

总结

总的来说,均价成交量价值策略利用了vwap这个重要指标的predictive力,设置了止盈止损条件,可以获取长期正收益。但仍需进一步优化和组合其他策略,以减少市场波动带来的风险,提高策略盈利空间。

策略源码

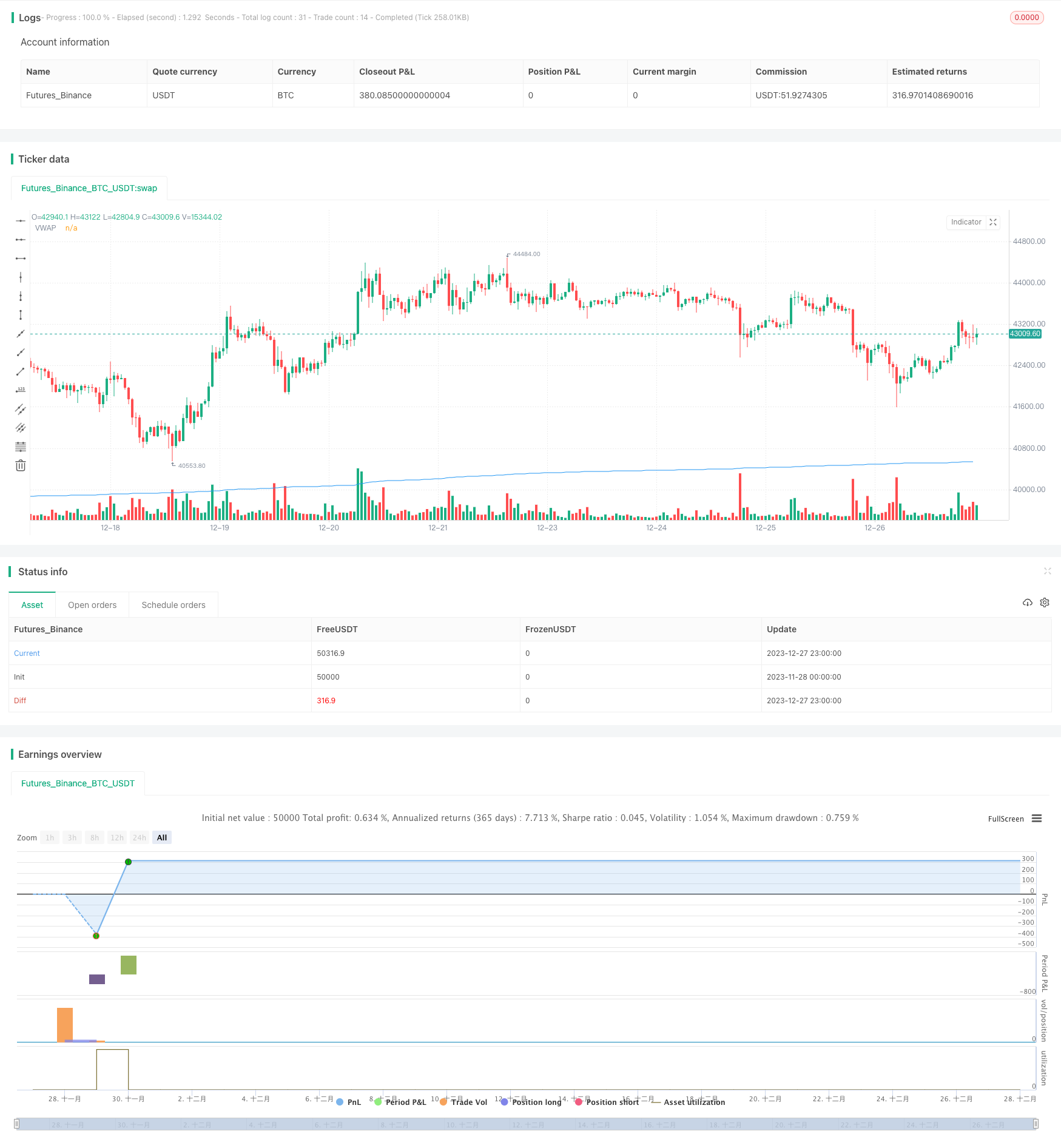

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("VWAP Strategy by Royce Mars", overlay=true)

cumulativePeriod = input(14, "Period")

var float cumulativeTypicalPriceVolume = 0.0

var float cumulativeVolume = 0.0

typicalPrice = (high + low + close) / 3

typicalPriceVolume = typicalPrice * volume

cumulativeTypicalPriceVolume := cumulativeTypicalPriceVolume + typicalPriceVolume

cumulativeVolume := cumulativeVolume + volume

vwapValue = cumulativeTypicalPriceVolume / cumulativeVolume

// Buy condition: Price crosses over VWAP

buyCondition = crossover(close, vwapValue)

// Short condition: Price crosses below VWAP

shortCondition = crossunder(close, vwapValue)

// Profit-taking condition for long positions: Sell long position when profit reaches 3%

profitTakingLongCondition = close / strategy.position_avg_price >= 1.03

// Profit-taking condition for short positions: Cover short position when profit reaches 3%

profitTakingShortCondition = close / strategy.position_avg_price <= 0.97

// Stop loss condition for long positions: Sell long position when loss reaches 1%

stopLossLongCondition = close / strategy.position_avg_price <= 0.99

// Stop loss condition for short positions: Cover short position when loss reaches 1%

stopLossShortCondition = close / strategy.position_avg_price >= 1.01

// Strategy Execution

strategy.entry("Buy", strategy.long, when=buyCondition)

strategy.close("Buy", when=shortCondition or profitTakingLongCondition or stopLossLongCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Short", when=buyCondition or profitTakingShortCondition or stopLossShortCondition)

// Plot VWAP on the chart

plot(vwapValue, color=color.blue, title="VWAP")