概述

该策略综合利用双移动均线、布林带和MACD指标,设定买入和卖出条件,对银行Nifty指数进行5分钟周期的交易。当MACD金叉且收盘价突破布林带上轨时买入;当MACD死叉且收盘价跌破布林带下轨时卖出。该策略结合多种指标优势,既能发现趋势也能定位极值点,实现高效率交易。

策略原理

- 设置MACD参数:快线长度12,慢线长度26,信号线长度9

- 计算MACD值:快线-慢线

- 设置布林带参数:中轨周期20,标准差倍数2

- 计算布林带上下轨:中轨±标准差*倍数

- 买入条件:MACD金叉(上穿信号线)且收盘价大于布林带上轨

- 卖出条件:MACD死叉(下穿信号线)且收盘价小于布林带下轨

- 设置止盈止损位

- 进入多单:买入条件成立时做多

- 平多单:止盈或止损

- 进入空单:卖出条件成立时做空

- 平空单:止盈或止损

以上便是该策略的整体交易逻辑。

优势分析

这是一个非常实用的趋势策略,具有如下优势:

- MACD指标能识别趋势方向和力度

- 布林带能判定超买超卖区域,与MACD指标形成互补

- 双均线过滤增加判断准确性

- 结合多种指标,可靠性更高

- 实现止盈止损,风险可控

- Parameter可调整,适应市场变化

综上,该策略充分利用各种指标的优势,判断准确,操作规范,是一种可靠、可控的趋势策略。

风险分析

尽管该策略优势明显,但仍存在一定的风险需要注意:

- 市场出现剧烈波动时,止损可能被突破

- 多种参数组合判断,存在误判风险

- 短线操作频繁,交易成本较高

- Parameter设置不当,可能错过最佳操作点

对策与解决方法如下:

- 严格止损,控制单笔损失

- 优化Parameter,提高判断准确率

- 适当调整操作周期,降低交易频次

- 测试不同Parameter,找到最优参数组合

优化方向

该策略仍有优化空间:

- 利用机器学习技术训练最优参数

- 增加自适应交易技术,优化Parameter

- 结合更多指标判断,如能量指标、波动率指标等

- 增加仓位管理模块,根据资金、风险等调整仓位大小

- 结合公式指标或自定义指标,创新信号判断方法

总体来说,该策略具有非常好的框架,通过 Parameter优化、指标创新、自适应方式等进一步完善,可成为更加强大、稳定的交易策略。

总结

该双均线布林带MACD策略充分利用各种指标判断买入卖出时机。它结合趋势识别与极值判断,操作规范,风险可控,是一种高效稳定的交易策略。通过持续优化和创新,该策略具有很大的应用前景。它为投资者在交易市场中实现稳定、可控的盈利提供了重要的技术工具。

策略源码

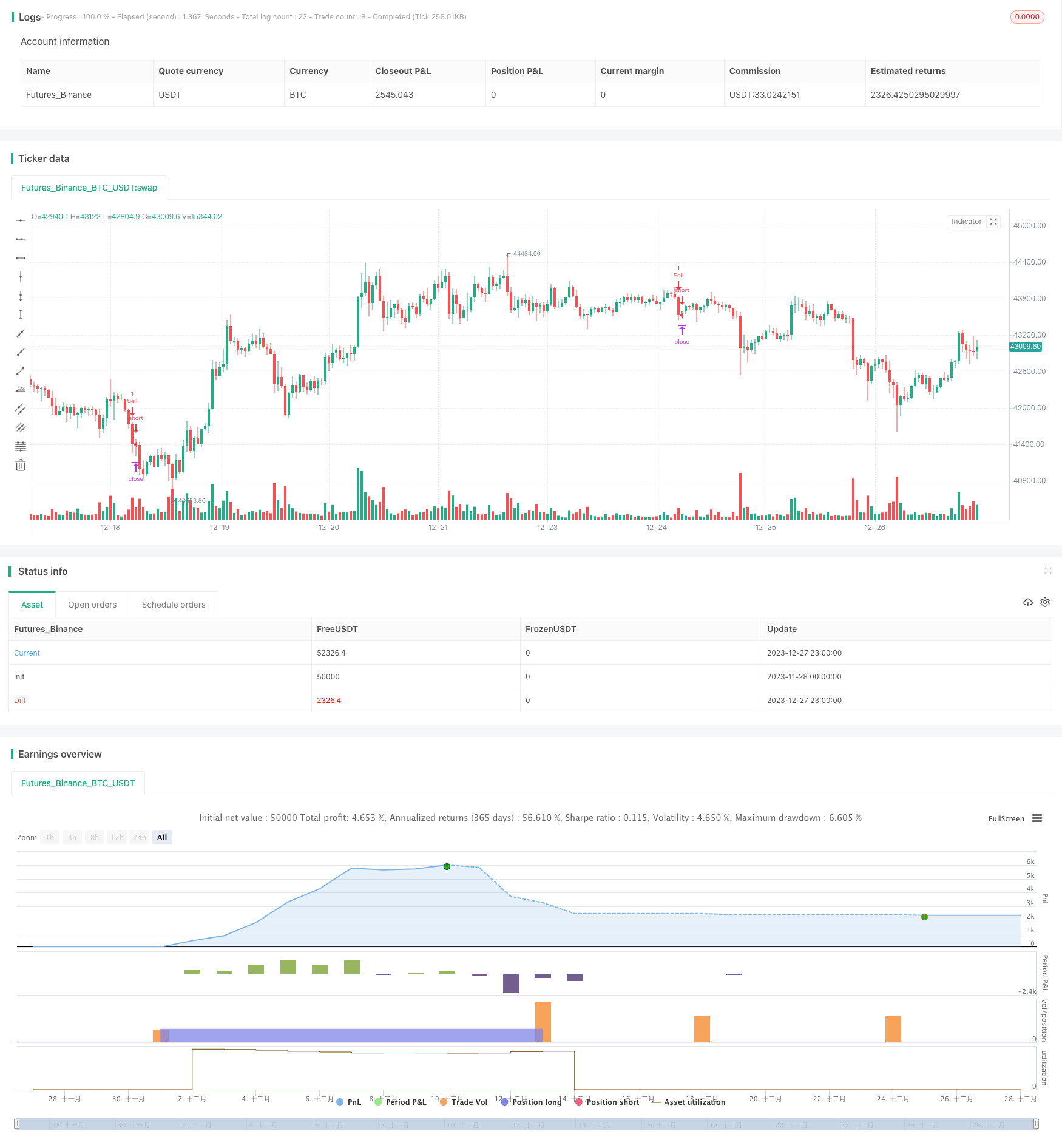

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Modified MACD and Bollinger Band Strategy", shorttitle="Mod_MACD_BB", overlay=true)

var bool open_buy_position = na

var bool open_sell_position = na

// MACD settings

fast_length = input(12, title="Fast Length")

slow_length = input(26, title="Slow Length")

signal_length = input(9, title="Signal Length")

src = close

[macdLine, signalLine, _] = macd(src, fast_length, slow_length, signal_length)

// Bollinger Band settings

bb_length = input(20, title="Bollinger Band Length")

bb_mult = input(2, title="Bollinger Band Multiplier")

basis = sma(src, bb_length)

dev = bb_mult * stdev(src, bb_length)

upper_band = basis + dev

lower_band = basis - dev

// Define profit target and stop loss

profit_target = input(60, title="Profit Target (Points)")

stop_loss = input(30, title="Stop Loss (Points")

// Buy condition: MACD crosses up the signal line and close is above upper Bollinger Band

buy_condition = crossover(macdLine, signalLine) and close > upper_band

// Sell condition: MACD crosses below the signal line and close is below the lower Bollinger Band

sell_condition = crossunder(macdLine, signalLine) and close < lower_band

// Check for open positions

if (buy_condition)

open_buy_position := true

if (sell_condition)

open_sell_position := true

// Strategy Orders

strategy.entry("Buy", strategy.long, when = buy_condition and not open_sell_position)

strategy.exit("Take Profit/Stop Loss", from_entry = "Buy", limit = close + profit_target, stop = close - stop_loss)

strategy.entry("Sell", strategy.short, when = sell_condition and not open_buy_position)

strategy.exit("Take Profit/Stop Loss", from_entry = "Sell", limit = close - profit_target, stop = close + stop_loss)

// Reset open position status

if (sell_condition)

open_buy_position := na

if (buy_condition)

open_sell_position := na