概述

本策略通过计算两组不同参数的简单移动平均线,并以其作为建仓与平仓的信号,实现获利。该策略首先由美国交易员Richard Dennis于1983年提出,依靠简单的规则实现稳定盈利,后被Curtis Faith进一步推广,广为人知。

策略原理

该策略同时计算两组快线和慢线。快线参数设置为建仓周期20天,平仓周期10天;慢线参数为建仓周期55天,平仓周期20天。当价格上穿快线建仓周期的最高值时触发建多单信号;当价格下破建仓周期的最低值时触发建空单信号。同理,当价格下穿平仓周期的最低值时平多单;当价格上破平仓周期的最高值时平空单。慢线的建仓和平仓逻辑同快线。

该策略依靠移动平均线的均线理论实现获利。即当短期平均线上穿长期平均线时,被视为价格上涨信号;下穿时则为价格下跌信号。本策略中的快线和慢线发挥着类似的作用。

策略优势

- 规则简单清晰,容易理解和实现,适合初学者学习;

- 建仓和平仓标准明确,避免频繁交易;

- 结合快线和慢线双重移动平均线,可以平滑价格变动带来的噪音,产生较为清晰的交易信号;

- 利用多组参数进行组合,可以控制风险,防止失误交易;

- 长期稳定盈利,已在实盘中验证。

风险及解决方法

- 策略本身较为机械化,无法对特殊行情作出判断,存在一定盈利上限;

- 可尝试引入更多指标或基于机器学习的模型辅助决策

- 移动平均线作为标志指标,存在一定滞后性;

- 可适当缩短建仓和平仓周期

- 无法限制最大回撤。

- 可设置止损点

优化方向

- 增加止损模块,控制最大回撤

- 结合其他指标过滤信号

- 动态调整移动平均线参数

- 增加数据处理模块,剔除异常数据的影响

- 结合机器学习模型判定趋势

总结

本策略属于典型的趋势跟随策略。依靠简单的双重移动平均线建立交易规则,通过追踪市场趋势获得稳定收益。该策略易于理解实现,建仓信号清晰,长期实盘验证收益,非常适合初学者学习研究。同时也为更复杂的量化交易奠定基础。通过不断优化,可望获得更佳的绩效。

策略源码

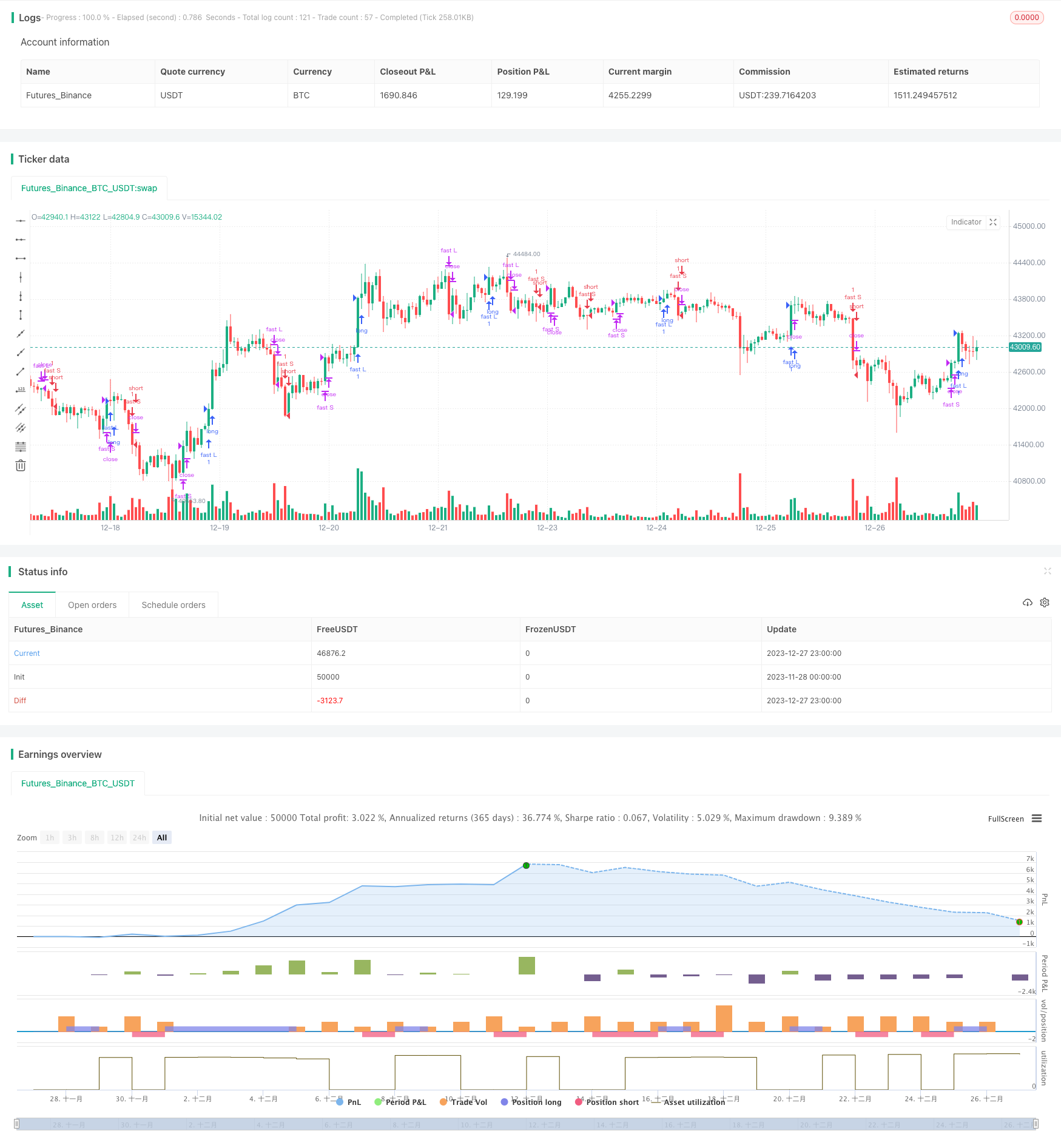

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//coded by tmr0

//original idea from «Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders» (2007) CURTIS FAITH

strategy("20 years old Turtles strategy by tmr0", shorttitle = "Turtles", overlay=true)

enter_fast = input(20, minval=1)

exit_fast = input(10, minval=1)

enter_slow = input(55, minval=1)

exit_slow = input(20, minval=1)

fastL = highest(enter_fast)

fastLC = lowest(exit_fast)

fastS = lowest(enter_fast)

fastSC = highest(exit_fast)

slowL = highest(enter_slow)

slowLC = lowest(exit_slow)

slowS = lowest(enter_slow)

slowSC = highest(exit_slow)

enterL1 = high > fastL[1]

exitL1 = low <= fastLC[1]

enterS1 = low < fastS[1]

exitS1 = high >= fastSC[1]

enterL2 = high > slowL[1]

exitL2 = low <= slowLC[1]

enterS2 = low < slowS[1]

exitS2 = high >= slowSC[1]

//bgcolor(exitL1 or exitL2? red: enterL1 or enterL2? navy:white)

strategy.entry("fast L", strategy.long, when = enterL1)

strategy.entry("fast S", strategy.short, when = enterS1)

strategy.close("fast L", when = exitL1)

strategy.close("fast S", when = exitS1)

strategy.entry("slow L", strategy.long, when = enterL2)

strategy.entry("slow S", strategy.short, when = enterS2)

strategy.close("slow L", when = exitL2)

strategy.close("slow S", when = exitS2)

//zl=0

//z=strategy.netprofit / 37 * koef //ежемесячная прибыль

//z=strategy.grossprofit/strategy.grossloss

//z1=plot (z, style=line, linewidth=3, color = z>zl?green:red, transp = 30)

//hline(zl, title="Zero", linewidth=1, color=gray, linestyle=dashed)