概述

逆向线性回归策略是一种基于价格波动的反转交易策略。它结合了线性回归分析和AVERAGE TRUE RANGE指标,设定了连续上涨K线或连续下跌K线的条件,在线性回归分析判断价格反转时,进行反向操作。

策略原理

该策略首先计算出线性回归的斜率。当线性回归斜率大于等于0时,表示价格处于上升趋势;当小于0时,表示价格下降趋势。同时结合最后一个K线的收盘价与开盘价的对比,判断最后一个K线是上涨还是下跌。在线性回归斜率大于等于0,且最后一个K线收盘价低于开盘价时,产生买入信号;在线性回归斜率小于0,且最后一个K线收盘价高于开盘价时,产生卖出信号。

通过连续上涨K线个数和连续下跌K线个数的设置,可以控制交易频率。在判断到连续上涨K线达到设定个数时,线性回归斜率小于0的情况下产生卖出信号,实现高点附近反转交易;在判断到连续下跌K线达到设定个数时,线性回归斜率大于等于0的情况下产生买入信号,实现低点附近反转交易。

优势分析

该策略结合了趋势和反转交易,能够在关键点附近进行反转操作,从而获取价格调整后的优势。线性回归分析提供了判断价格总体趋势的手段,避免在价格还在持续上涨或下跌的时候就反转做空或做多。连续K线条件控制了交易频率,在关键反转点附近进行操作。

相比简单的反转策略,该策略结合多种技术指标,对交易时机把控更加准确,可以有效规避虚假突破的风险,提高获利概率。

风险分析

该策略主要面临反转失败的风险。如果判断到价格反转信号后,价格继续保持原有趋势运行,则会造成损失。此外,线性回归分析和ATR指标的参数设置也会对策略收益产生影响。

可以通过止损来控制单笔损失。合理评估市场波动频率,适当调整连续K线个数,降低交易频率。优化线性回归周期参数和ATR参数,使之更符合不同品种的特点。

优化方向

该策略可以从以下几个方面进行优化:

增加其他技术指标判断,结合不同时间周期指标,提高判断准确性。例如加入MACD、Bollinger Band等。

增加机器学习成分,通过算法自动优化参数,并动态调整交易规则。

加入风险管理机制,例如资金管理、止损策略等,控制交易风险。

进行组合优化,将策略与其他非相关策略组合,降低整体回撤,提高稳定性。

扩展到更多品种,评估不同品种的参数设置,使策略更具普适性。

总结

逆向线性回归策略整合多种技术指标,在判断到价格反转时机时进行反向操作,是一种有效的反转交易策略。该策略通过参数优化和风险管理的加强,可以进一步扩大获利空间,具有很大的改进潜力。作为一种典型的反转策略思路,它为我们提供了宝贵的参考。

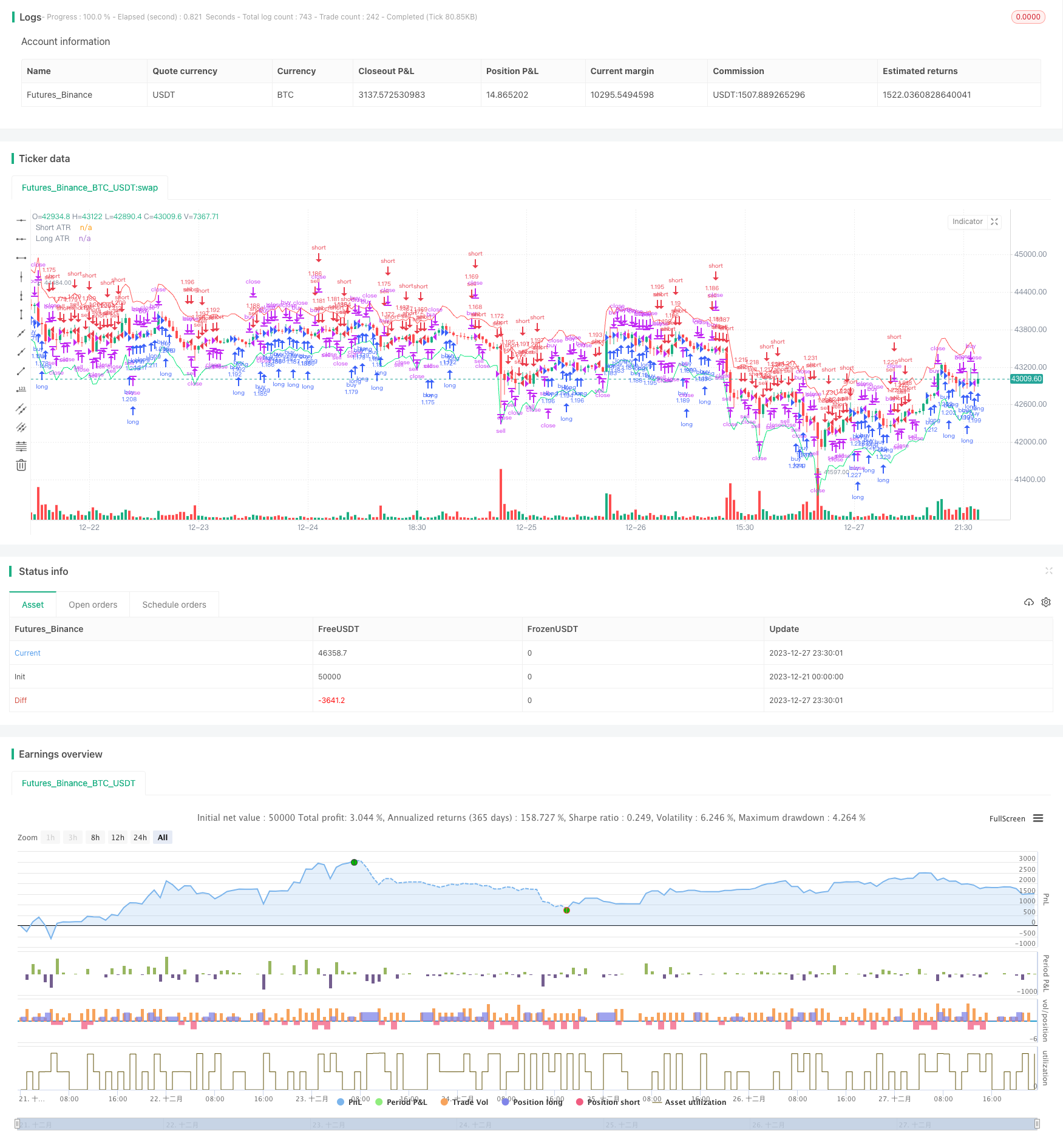

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Reverse Up/Down Strategy", currency=currency.USD, initial_capital=1000, pyramiding=2, default_qty_type=strategy.percent_of_equity, default_qty_value=100,overlay=true)

//User Options

consecutiveBarsUp = input(title="Sell after how many bars up?", type=input.integer, minval=1, defval=1)

consecutiveBarsDown = input(title="Buy after how many bars down?", type=input.integer, minval=1, defval=1)

atrLength = input(title="ATR Length", type=input.integer, minval=1, defval=14)

atrMult = input(title="ATR Multiplier", type=input.float, minval=0.1, defval=2.33)

//ATR Channel

adjustedATR = sma(atr(atrLength),atrLength) * atrMult

longATR = low - adjustedATR

shortATR = high + adjustedATR

plot(shortATR, title="Short ATR", color=color.red)

plot(longATR, title="Long ATR", color=color.lime)

// This is the true linear regression slope rather than an approximation given by numerical differentiation

src = hlc3

len = input(defval=14, minval=1, title="Slope Length")

lrc = linreg(src, len, 0)

lrc1 = linreg(src, len,1)

lrs = (lrc-lrc1)

//Check if last candle was up or down

priceOpen = open

priceClose = close

longCondition = priceOpen > priceClose

shortCondition = priceOpen < priceClose

ups = 0.0

dns = 0.0

ups := shortCondition ? nz(ups[1]) + 1 : 0

dns := longCondition ? nz(dns[1]) + 1 : 0

if (shortCondition)

strategy.close("buy", qty_percent=100, comment="Close")

if (ups >= consecutiveBarsUp and lrs <= 0)

strategy.entry("sell", strategy.short, comment="Sell")

if (longCondition)

strategy.close("sell", qty_percent=100, comment="Close")

if (dns >= consecutiveBarsDown and lrs >= 0)

strategy.entry("buy", strategy.long, comment = "Buy")