概述

本策略的名称为“RSI指标与包容形态量化交易策略”。该策略的主要思路是同时利用RSI指标和包容形态来识别市场趋势,发出买入和卖出信号。

当RSI指标显示多空头极端状态并且出现向上或向下的包容形态时,我们认为是建立仓位的机会。RSI指标可以有效识别超买超卖现象,包容形态则可以进一步验证趋势的可靠性。

策略原理

首先,我们设置RSI指标的参数,包括RSI的周期长度(一般为9或14)、超买水平(一般为70)和超卖水平(一般为30)。

然后,我们识别包容形态,判断是否出现了向上或向下的大阳线或大阴线包住了前一根K线。这表示目前的趋势正在发生转折。

此后,如果RSI显示超卖区域(超买或超卖),并且出现向上的阳包或向下的阴包,那么就产生买入信号或卖出信号。最后,我们利用RSI金叉和死叉来确定止盈止损。

策略优势

这种策略结合了趋势指标RSI和特征技术指标包容形态,综合判断市场走势,较单一指标具有更强确认效果,可以有效过滤噪音交易信号。

RSI指标对市场中出现的多头空头状态的判断非常准确和清晰,而包容形态中蕴含的量价特征则可以进一步验证趋势转折的可靠性。

这种策略可以及时抓住超买超卖现象带来的反转机会,同时也避免在盘整时造成不必要的交易亏损。

策略风险

这种策略最大的风险在于,RSI指标和包容形态出现错误信号的概率并不低。RSI指标容易形成失真,发生背离。而包容形态的识别可以通过调整K线窗口大小等参数进行操纵。

此外,反转信号出现时,不能完全排除震荡盘整的可能性。仓位建立后,市场短期内可能出现回调甚至反转。这都可能导致止损而亏损离场。

为了降低风险,我们要对RSI指标的设置参数进行优化,寻找最佳参数组合。此外选择具有代表性和流动性较好的交易品种也很重要。在仓位建立之后,需要控制好仓位规模并及时止损。

策略优化方向

这种策略可以从以下几个方面进行进一步优化:

结合更多指标进行组合,例如KDJ、MACD等,形成多指标验证体系,提高信号的准确性。

对交易品种的流动性、振幅、交易成本等进行考量,选择最优品种,降低交易成本和滑点风险。

利用机器学习等方法对参数进行训练和优化。例如利用深度学习对RSI背离情况进行识别。

增加止损策略,通过移动止损、均线止损等方式来保护利润。

总结

本策略利用RSI指标和包容形态的优势,设计出一套同时兼顾趋势判断和特征验证的量化交易体系。这可以有效利用反转机会且具有较强的可靠性。通过持续优化,这套策略可以成为一个稳定可靠的量化策略。

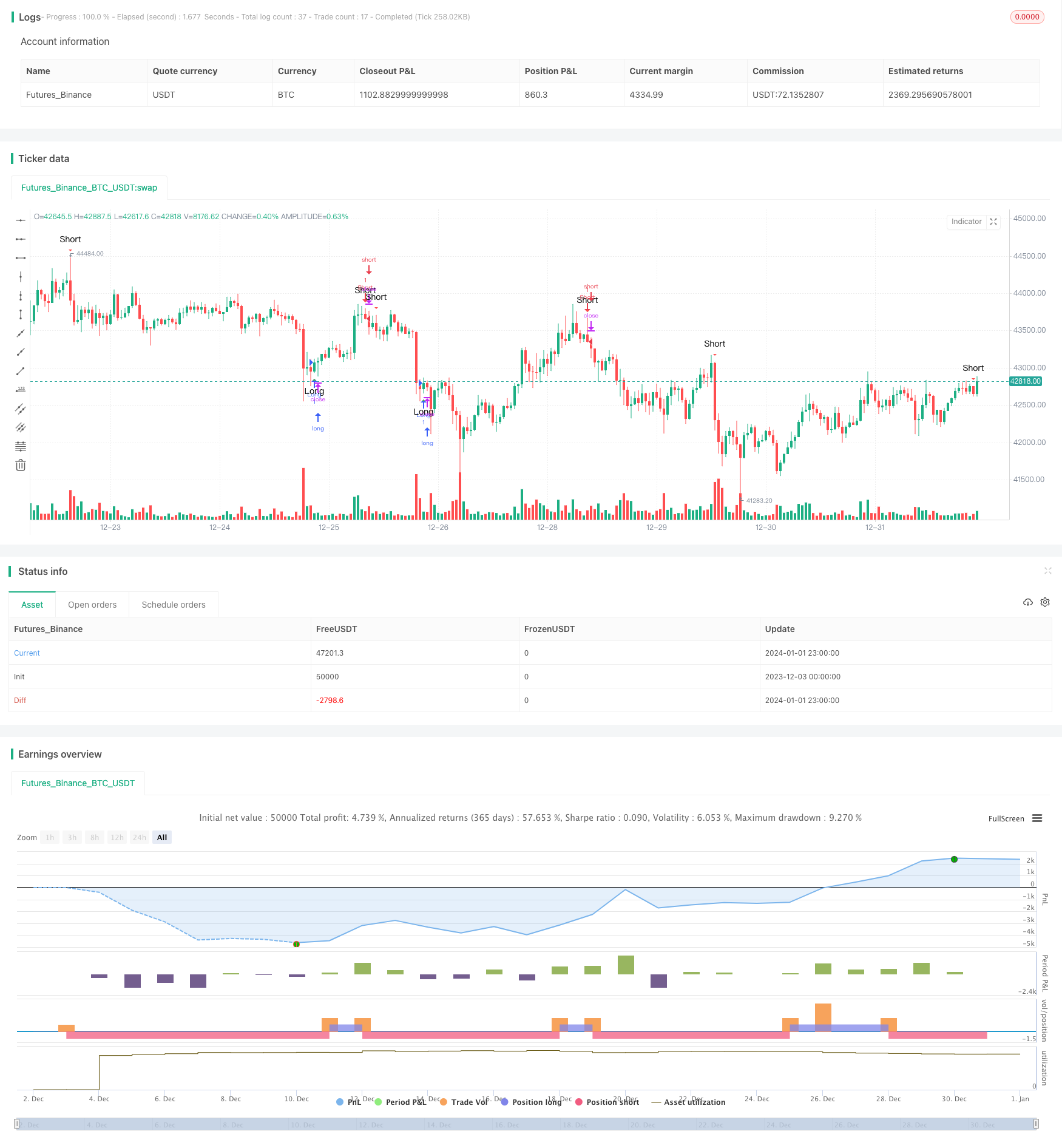

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Lesson 6", shorttitle="RSI Swing Signals", overlay=true)

// Get user input

rsiSource = input(title="RSI Source", type=input.source, defval=close)

rsiLength = input(title="RSI Length", type=input.integer, defval=9)

rsiOverbought = input(title="RSI Overbought Level", type=input.integer, defval=60)

rsiOversold = input(title="RSI Oversold Level", type=input.integer, defval=25)

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

rsiOB = rsiValue >= rsiOverbought

rsiOS = rsiValue <= rsiOversold

// Identify engulfing candles

bullishEC = close > open[1] and close[1] < open[1]

bearishEC = close < open[1] and close[1] > open[1]

// Define entry and exit conditions

longCondition = (rsiOS or rsiOS[1]) and bullishEC

shortCondition = (rsiOB or rsiOB[1]) and bearishEC

// Plot signals to chart

plotshape(longCondition, title="Long", location=location.belowbar, color=color.green, transp=0, style=shape.triangleup, text="Long")

plotshape(shortCondition, title="Short", location=location.abovebar, color=color.red, transp=0, style=shape.triangledown, text="Short")

// Strategy entry and exit

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Define exit conditions

longExitCondition = crossover(rsiValue, 60) // You can customize this exit condition

shortExitCondition = crossunder(rsiValue, 40) // You can customize this exit condition

// Strategy exit

strategy.exit("ExitLong", from_entry="Long", when=longExitCondition)

strategy.exit("ExitShort", from_entry="Short", when=shortExitCondition)

// Send out an alert if this candle meets our conditions

alertcondition(longCondition or shortCondition, title="RSI Trade Alert!", message="RSI Swing Signal for XXX")