概述

该策略运用ATR通道和破口理论,在突破通道时踏入趋势,属于趋势跟踪策略。策略简单易懂,运用均线通道和ATR指标判断趋势方向,在关键点位发出交易信号。

策略原理

该策略使用高、低、收盘价和ATR指标构建上下轨,形成ATR通道。通道宽度决定于ATR参数的大小。当价格突破通道时,判断为趋势开始,此时进入做多或做空方向。策略分为两档交易信号,价格突破一个ATR宽度视为趋势初现,此时第一档买卖点被触发;价格突破两个ATR宽度则视为趋势加速,第二档买卖点被触发。

优势分析

该策略主要优势如下: 1. 采用ATR指标构建通道,考虑市场波动率,优于简单均线。 2. 两档买卖点设定,分批进入,风险可控。 3. 突破理论判断趋势,精准定位关键点位。 4. 代码精简,容易理解实施。

风险分析

该策略主要风险如下: 1. 单一指标判断,当ATR失效时,策略失效概率大。 2. 未设立止损限制和头寸管理,风险控制不足。 3. 效用待验证,实盘条件下可能效果欠佳。 4. 参数不合适可能导致穿越或过度交易。

优化方向

该策略可以优化的方向如下: 1. 增加多种指标过滤和确认,防止误判。 2. 增加止损模块,加强风险控制。 3. 增加仓位控制和头寸管理。 4. 增加参数优化,针对不同品种参数调整。 5. 减少交易频率和仓位规模,考虑实盘条件。

总结

该策略整体框架清晰,作为概念验证策略可以理解使用。但距离实盘还存在一定差距,有较大优化空间。如果能进一步完善风控和交易频率控制,则该策略应用前景较好。

策略源码

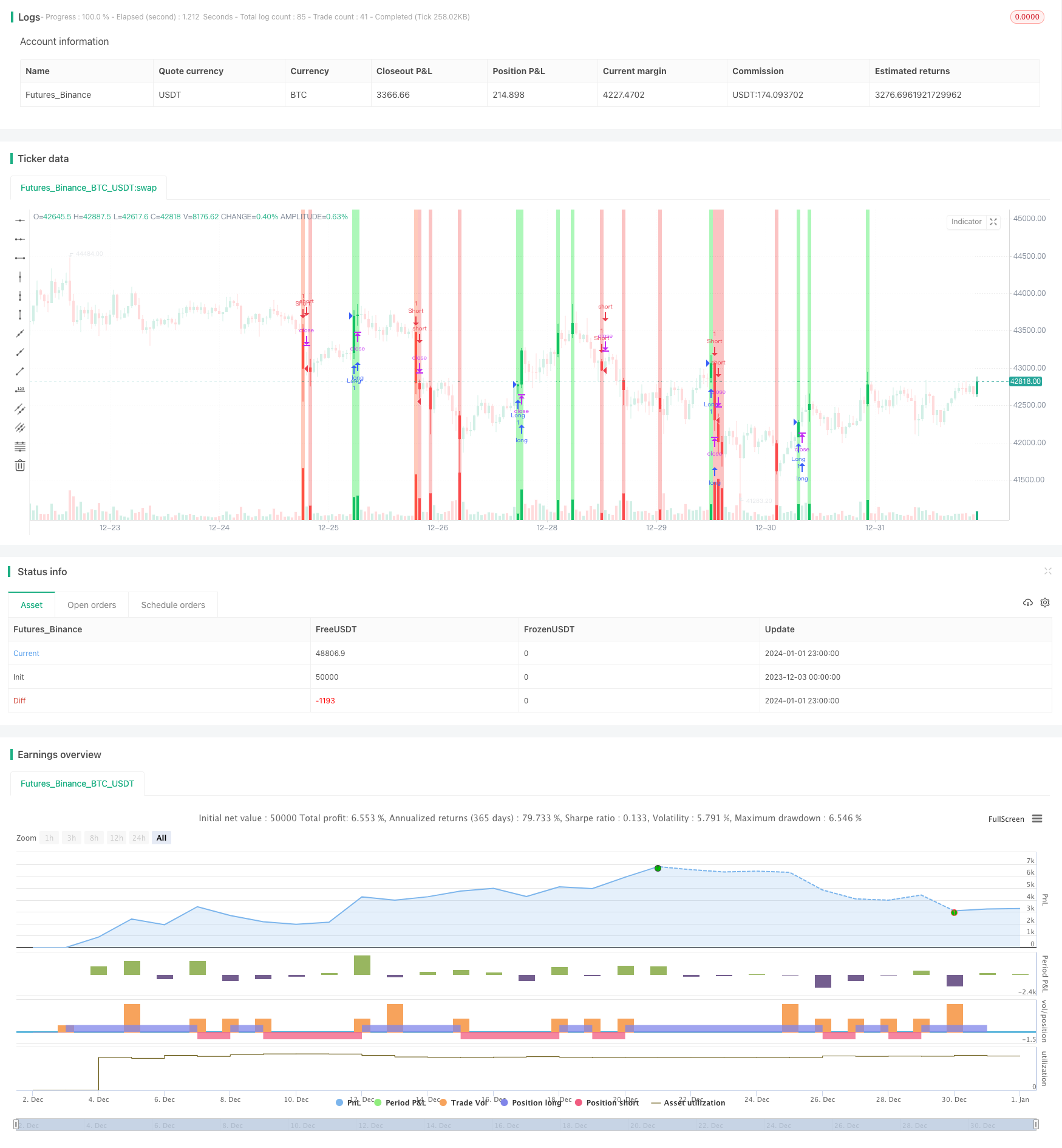

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Myhaj_Lito

//@version=5

strategy("Renko Trend Strategy",shorttitle = "RENKO-Trend str.",overlay = true)

TF = input.timeframe(title='TimeFrame', defval="60")

ATRlength = input.int(title="ATR length", defval=60, minval=2, maxval=1000)

HIGH = request.security(syminfo.tickerid, TF, high)

LOW = request.security(syminfo.tickerid, TF, low)

CLOSE = request.security(syminfo.tickerid, TF, close)

ATR = request.security(syminfo.tickerid, TF, ta.atr(ATRlength))

RENKOUP = float(na)

RENKODN = float(na)

H = float(na)

COLOR = color(na)

BUY = int(na)

SELL = int(na)

UP = bool(na)

DN = bool(na)

CHANGE = bool(na)

RENKOUP := na(RENKOUP[1]) ? (HIGH + LOW) / 2 + ATR / 2 : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? (HIGH + LOW) / 2 - ATR / 2 : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP - RENKODN : RENKOUP[1] - RENKODN[1]

COLOR := na(COLOR[1]) ? color.white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

// calculating

if not CHANGE and close >= RENKOUP[1] + H * 2

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 2

RENKODN := RENKOUP[1] + ATR

COLOR := color.rgb(0, 255, 170,60)

SELL := 0

BUY += 2

BUY

if not CHANGE and close >= RENKOUP[1] + H

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR

RENKODN := RENKOUP[1]

COLOR := color.rgb(0, 230, 38,60)

SELL := 0

BUY += 1

BUY

if not CHANGE and close <= RENKODN[1] - H * 2

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 2

RENKOUP := RENKODN[1] - ATR

COLOR := color.rgb(255, 92, 43,60)

BUY := 0

SELL += 2

SELL

if not CHANGE and close <= RENKODN[1] - H

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR

RENKOUP := RENKODN[1]

COLOR := color.rgb(245, 69, 69,60)

BUY := 0

SELL += 1

SELL

//// STRATEGY

if(UP)

strategy.entry("Long",strategy.long)

if(DN)

strategy.entry("Short",strategy.short)

// ploting

bgcolor(COLOR)