概要

该策略充分利用了多时框架指数移动平均线(MTF EMA)判断趋势方向和MACD指标产生买卖信号的功能,同时结合ATR指标设定止损止盈价格。策略适用于有强势趋势的数字货币和法定货币交易对,在趋势较强的市场中表现较佳。

策略原理

1. MTF EMA判断趋势

多时框架指数移动平均线(MTF EMA)可以在同一个图表上显示多个时间周期的移动平均线,从而判断资产的总体多空状态。策略这里采用1小时周期和15分钟周期的MTF EMA。

当价格高于1小时MTF EMA且1小时MTF EMA低于15分钟MTF EMA时,定义为上升趋势;当价格低于1小时MTF EMA且1小时MTF EMA高于15分钟MTF EMA时,定义为下跌趋势。

2. MACD产生买卖信号

当MACD线从下方向上突破Signal线时,产生买入信号;当从上方向下跌破时,产生卖出信号。同时设定MACD线和Signal线的交叉限制值,避免虚假信号。

3. ATR设置止损止盈

采用ATR指标设置止损止盈价格。ATR能够根据市场波动程度动态设定合理的止损止盈距离。同时根据高低点回测设置止损止盈的倍数,使止损止盈更为灵活。

交易策略

开仓信号

多头信号:上升趋势且MACD上穿Signal线且交叉值小于限制值 空头信号:下跌趋势且MACD下穿Signal线且交叉值大于限制值

平仓信号

多头止盈:价格突破ATR止盈价 多头止损:价格突破ATR止损价 空头止盈:价格突破ATR止盈价 空头止损:价格突破ATR止损价

优势分析

该策略最大的优势在于充分利用了MTF EMA判断趋势和MACD产生买卖信号的优势。MTF EMA能清晰判断总体趋势方向,避免在震荡行情频繁交易。MACD指标能较好地捕捉短期价格态势的变化,产生买卖信号。两者配合使用,能在保证捕捉趋势的同时获得较多买卖机会。此外,运用ATR指标动态跟踪止损止盈,能有效控制单笔交易的风险。

风险及解决方法

该策略主要存在两方面风险:第一是在无明显趋势时,MTF EMA可能会产生错误信号, 导致亏损;第二是MACD指标常在价格变化较大时产生误导信号,可能造成过度交易。针对第一种风险,可以适当调整MTF EMA参数,使其更能匹配价格趋势变化;第二种风险可以通过设定MACD指标的交叉限制来减轻。

优化方向

该策略可以从以下几个方面进行优化:

调整MTF EMA的周期参数,使其更能匹配不同交易品种的价格特征

优化MACD指标的快慢均线和Signal均线参数,以获得更好信号

测试不同的ATR周期参数和止盈止损倍数,获得最佳回报

添加其他辅助指标过滤信号

总结

该长空开仓策略综合运用MTF EMA判断趋势、MACD产生交易信号以及ATR动态止损止盈的方法,在有明显趋势的市场中能获得较好收益。该策略优化空间较大,通过参数调整和优化可以获得更好的表现。但需注意控制风险,避免在震荡行情中盲目交易。

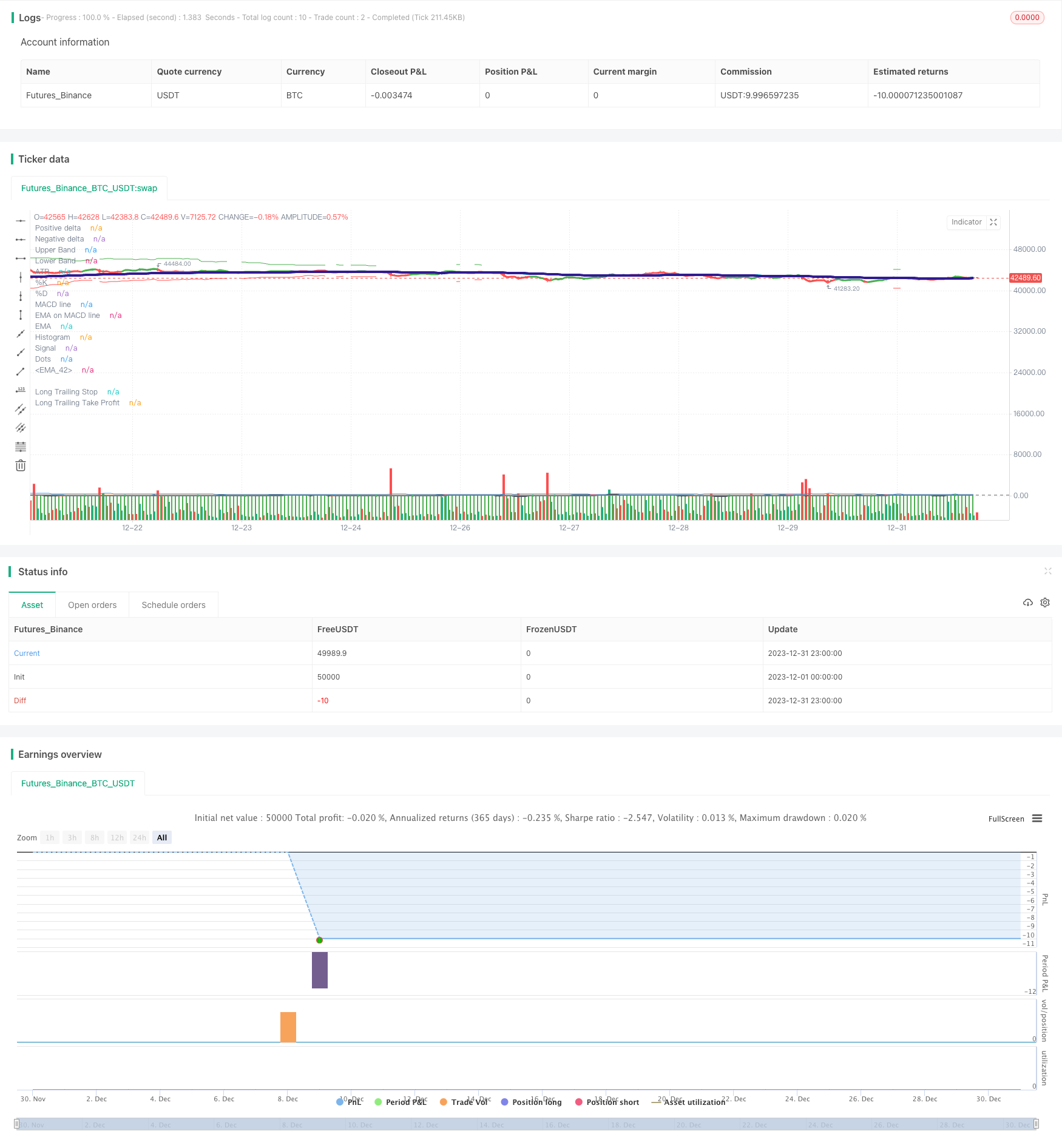

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Steven A. Zmuda Burke / stevenz17

//@version=4

// From Date Inputs

fromDay = input(defval = 01, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 04, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2022, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 01, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 05, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2022, title = "To Year", minval = 1970)

// Calculate start/end date and time condition

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

// Input

strategy("LONG", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, slippage=1, commission_type=strategy.commission.percent,

commission_value=0.015)

SOURCE = input(title = "═════════════════════ SOURCE ═════════════════════", defval = false, type = input.bool)

sourcehl2 = input(title="Source hl2 or (open+close)/2 ?",type=input.bool,defval=true)

source = sourcehl2 ? hl2 : ((open+close)/2)

//MTF EMA

MTFEMA = input(title = "════════════════════ MTF EMA ════════════════════", defval = false, type = input.bool)

res1=input(title="MTF EMA 1", type=input.resolution, defval="60")

len1 = input(title = "EMA Period 1", type=input.integer, defval=70, minval=1)

ema1 = ema(source, len1)

emaStep1 = security (syminfo.tickerid, res1, ema1, barmerge.gaps_off, barmerge.lookahead_off)

mtf1 = emaStep1

res2=input(title="MTF EMA 2", type=input.resolution, defval="15")

len2 = input(title = "EMA Period 2", type=input.integer, defval=68, minval=1)

ema2 = ema(source, len2)

emaStep2 = security (syminfo.tickerid, res2, ema2, barmerge.gaps_off, barmerge.lookahead_off)

mtf2 = emaStep2

t1 = plot(mtf1, linewidth=4, color= color.aqua, title="EMA")

t2 = plot(mtf2, linewidth=4, color= color.navy, title="EMA")

fill(t1, t2, transp = 70, color = mtf1 > mtf2 ? color.red : color.green)

///MACD

MACD= input(title = "═════════════════════ MACD ══════════════════════", defval = false, type = input.bool)

MACDsource=close

fastLength = input(13, minval=1, title="MACD fast moving average")

slowLength=input(18,minval=1, title="MACD slow moving average")

signalLength=input(24,minval=1, title="MACD signal line moving average")

MacdEmaLength =input(9, title="MACD EMA period", minval=1)

useEma = input(true, title="Use EMA (otherwise SMA)")

useOldAlgo = input(false, title="Use normal MACD")

Lmacsig=input(title="LONG MACD and signal crossover limit",type=input.integer,defval=180)

// Fast line

ma1= useEma ? ema(MACDsource, fastLength) : sma(MACDsource, fastLength)

ma2 = useEma ? ema(ma1,fastLength) : sma(ma1,fastLength)

fastMA = ((2 * ma1) - ma2)

// Slow line

mas1= useEma ? ema(MACDsource , slowLength) : sma(MACDsource , slowLength)

mas2 = useEma ? ema(mas1 , slowLength): sma(mas1 , slowLength)

slowMA = ((2 * mas1) - mas2)

// MACD line

macd = fastMA - slowMA

// Signal line

emasig1 = ema(macd, signalLength)

emasig2 = ema(emasig1, signalLength)

signal = useOldAlgo ? sma(macd, signalLength) : (2 * emasig1) - emasig2

hist = macd - signal

histline = hist > 0 ? color.green : color.red

//MACD ribbon

macdribbon=input(title="Show MACD ribbon?",type=input.bool,defval=false)

macdx=input(title="MACD ribbon multiplier", type=input.integer, defval=3, minval=1)

leadLine1 = macdribbon ? macd*macdx + source : na

leadLine2 = macdribbon ? signal*macdx + source : na

leadLine3 = hist + source

//MACD plot

p3 = plot(leadLine1, color= color.green, title="MACD", transp = 100, linewidth = 8)

p4 = plot(leadLine2, color= color.red, title="Signal", transp = 100, linewidth = 8)

fill(p3, p4, transp = 20, color = leadLine1 > leadLine2 ? #53b987 : #eb4d5c)

plot((leadLine3), color = histline, title="Histogram", linewidth = 3)

l="TEst"

upHist = (hist > 0) ? hist : 0

downHist = (hist <= 0) ? hist : 0

p1 = plot(upHist, color=color.green, transp=40, style=plot.style_columns, title='Positive delta')

p2 = plot(downHist, color=color.green, transp=40, style=plot.style_columns, title='Negative delta')

zeroLine = plot(macd, color=color.black, transp=0, linewidth=2, title='MACD line')

signalLine = plot(signal, color=color.gray, transp=0, linewidth=2, title='Signal')

ribbonDiff = color.green

fill(zeroLine, signalLine, color=ribbonDiff)

circleYPosition = signal

plot(ema(macd,MacdEmaLength) , color=color.red, transp=0, linewidth=2, title='EMA on MACD line')

ribbonDiff2 = hist > 0 ? color.green : color.red

plot(crossunder(signal,macd) ? circleYPosition : na,style=plot.style_circles, linewidth=4, color=ribbonDiff, title='Dots')

//STOCHASTIC

stochchch= input(title = "═══════════════════ STOCHASTIC ════════════════════", defval = false, type = input.bool)

StochOn = input(title="Stochastic On?",type=input.bool,defval=true)

periodK = input(10, title="K", minval=1)

periodD = input(1, title="D", minval=1)

smoothK = input(3, title="Smooth", minval=1)

stochlimit = input(30, title="Stoch value crossover", minval=1)

k = sma(stoch(close, high, low, periodK), smoothK)

d = sma(k, periodD)

stochSignal = StochOn ? (d < stochlimit ? true : false) : true

pp= input(1, title="avg price length", minval=1)

p = ema (source, pp)

K = k + p

plot(k, title="%K", color=#0094FF)

plot(d, title="%D", color=#FF6A00)

h0 = hline(72, "Upper Band", color=#606060)

h1 = hline(20, "Lower Band", color=#606060)

fill(h0, h1, color=#9915FF, transp=80, title="Background")

//Long

LS= "════════════════════════════════ LONG CONDITIONS ═══════════════════════════"

uptrend = close > mtf1 and mtf1 < mtf2

downtrend = close < mtf1 and mtf1 > mtf2

crossMACD = crossunder(macd,signal)

LongBuy = uptrend and stochSignal? crossMACD and signal < Lmacsig and macd < Lmacsig : na

LONG = strategy.position_size > 0

SHORT = strategy.position_size < 0

FLAT = strategy.position_size == 0

plotshape(LongBuy, style=shape.xcross, text="LONG", color=color.green)

//ATR & TP/SL

ATRTPSLX= input(title = "═════════════════ LONG SL ═════════════════", defval = false, type = input.bool)

maxIdLossPcnt = input(5, "Max Intraday Loss(%)", type=input.float, minval=0.0, step=0.1)

// strategy.risk.max_intraday_loss(maxIdLossPcnt, strategy.percent_of_equity)

SSL2=input(title="Long Stop Loss when MTF EMA cross?",type=input.bool,defval=false)

SSLOP = LONG and crossunder(source, mtf1)

SlossPercOn = input(title="Long Stop Loss (%) on?",type=input.bool,defval=false)

SlossPerc = input(title="Long Stop Loss (%)", type=input.float, minval=0.0, step=0.1, defval=4.7) * 0.01

SSpricePerc = LONG and SlossPercOn? strategy.position_avg_price * (-1 - SlossPerc) : na

plot(series = SSpricePerc, linewidth=2, color= color.maroon,style=plot.style_linebr, title="Long Stop Loss %")

SSLX = LONG and crossunder(source, SSpricePerc)

SSLatr= input(title="Long Stop Loss ATR?",type=input.bool,defval=true)

useStructure=input(title="Look back for High/Lows?",type=input.bool,defval=true)

Slookback=input(title="How far to look back for High/Lows:",type=input.integer,defval=18,minval=1)

SatrLenghth=input(title="Long ATR Lenghth",type=input.integer,defval=9,minval=1)

SatrStopMultiplier=input(title="Long ATR Stop x ?", type=input.float,defval=4.3, minval=0.1,step=0.1)

Satr = atr(SatrLenghth)

LongStop = SSLatr ? ((useStructure ? lowest(low, Slookback) : source) - Satr * SatrStopMultiplier) : na

SStop = crossunder(source,LongStop)

plot(Satr, color=color.blue, title="ATR", transp=100)

plot(series = uptrend ? LongStop : na, color=color.red, style=plot.style_linebr, title="Long Trailing Stop", transp=0)

ATRTPSLXX= input(title = "═════════════════ LONG TP ═════════════════", defval = false, type = input.bool)

TpPercOn = input(title="Long Take Profit (%) on?",type=input.bool,defval=true)

TpPerc = input(title="Long Take Profit (%)", type=input.float, minval=0.0, step=0.1, defval=5.3) * 0.01

TppricePerc = LONG and TpPercOn? strategy.position_avg_price * (-1 + TpPerc) : na

plot(series = TppricePerc, linewidth=2, color= color.lime,style=plot.style_linebr, title="Long Take Profit %")

TPLX = LONG and crossunder(source, TppricePerc)

TP1=input(title="1 Long Take Profit On?",type=input.bool,defval=true)

useStructure1=input(title="Look back for High/Lows?",type=input.bool,defval=true)

STplookback=input(title="How far to look back for High/Lows for 1 TP",type=input.integer,defval=12,minval=1)

STpatrLenghth=input(title="Long ATR Lenghth 1 TP",type=input.integer,defval=24,minval=1)

SatrProfitMultiplier = input(title="First Long ATR Take Profit x ?", type=input.float,defval=5.5, minval=0.1,step=0.1)

STpatr = atr(STpatrLenghth)

LongTakeProfit = (useStructure1 ? highest(high, STplookback) : source) + STpatr * SatrProfitMultiplier

LongTP = TP1 ? crossover(source, LongTakeProfit): false

plot(series = uptrend ? LongTakeProfit: na , color=color.green, style=plot.style_linebr, title="Long Trailing Take Profit", transp=0)

// Bar color

barcolor(cross(macd, signal) ? (macd - signal > 0 ? (uptrend and macd < 0 and signal < 0 ? color.yellow : na) : (downtrend and macd > 0 and signal > 0 ? color.blue : na)) : na)

// Strategy ATR

GOLONG = LongBuy and SSLatr and FLAT

if GOLONG and TP1

strategy.entry(id="Entry LONG 1TP", long=true,comment="Entry Long")

strategy.exit("Long Profit or Loss 1TP","Entry LONG 1TP", limit=LongTakeProfit, stop=LongStop)

if SSLX

strategy.close(id="Entry LONG 1TP", comment="% Long SL EXIT")

if TPLX

strategy.close(id="Entry LONG 1TP", comment="% Long TP EXIT")

if SSLOP and SSL2

strategy.close(id="Entry LONG 1TP", comment="MTF EMA cross EXIT")

if (not time_cond)

strategy.close_all()

strategy.cancel_all()

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

//@version=4