概述

黄金分割与相对强弱指标(RSI)策略是一种Intraday(盘内)交易策略。它结合了Fibonacci黄金分割法则与RSI指标,在价格接近黄金分割关键点时,判断RSI是否过度买入或卖出,以发出买入或卖出信号。

策略原理

根据一定长度的K线计算出价格的中轴线。

根据中轴线和标准差计算出黄金分割关键点,包括0.618级别和1级别。

当价格接近黄金分割关键点时,检查RSI指标是否进入超买或超卖区域。

如果同时满足黄金分割法则和RSI条件,则发出买入或卖出信号。

设置止损和止盈以控制风险。

优势分析

结合多个指标,可以提高信号质量,降低假信号。

利用黄金分割法则的支持/阻力特性,提高入场质量。

RSI指标可以判断市场心理面,避免极端情况的反转。

适合高频Intraday交易,收益可以通过多次较小交易累积。

风险分析

黄金分割法则并不能百分之百确保价格会反转。

RSI指标可能发出误导信号,需要结合价格行情判断。

止损点设定过小可能被价格震荡止损。

高频交易需要更多交易成本和更严格的风险控制。

解决方法:

严格遵守止损规则,控制单笔损失。

适当放宽RSI参数,避免误导。

优化止损点,在保证止损的同时尽量减少被止损概率。

优化方向

测试不同长度周期的参数优化结果。

尝试结合其他指标如MACD、布林带等提高信号质量。

研究不同的止损策略,寻找最优配置。

评估确定最佳的持仓时间,以平衡收益和成本。

总结

黄金分割与RSI策略通过双重确认,能过滤掉一些噪声交易。与使用单一指标相比,它可以产生更高质量的交易信号。通过参数优化和规则严格遵守,该策略可以成为有效的Intraday交易工具。

策略源码

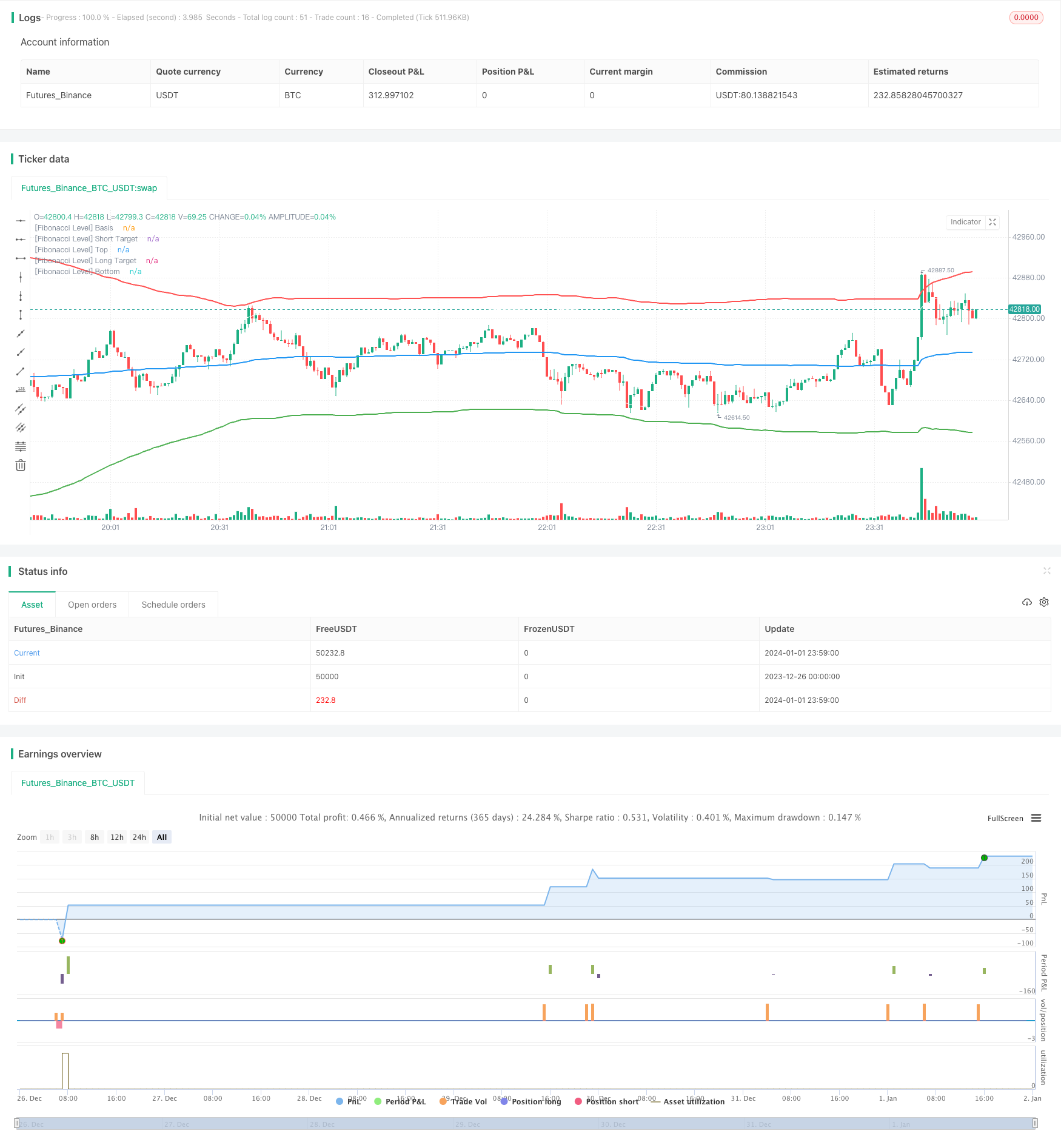

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-02 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MohamedYAbdelaziz

// Intraday Trading

// Best used for Short Timeframes [1-30 Minutes]

// If you have any modifications please tell me to update it

//@version=4

strategy(title="Fibonacci + RSI - Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=10000, currency=currency.USD)

// Inputs

timeFilter = year >= 2000

// Stop Loss %

loss_percent = input(title="Stop Loss (%)", minval=0.0, step=0.1, defval=2) * 0.001

// RSI Inputs

len = input(title="[RSI] Length", minval=0, step=1, defval=14)

overSold = input(title="[RSI] Over Sold %", defval=30)

overBought = input(title="[RSI] Over Bought %", defval=70)

// Fibonacci Levels

length = input(title="[Fibonacci] Length", defval=200, minval=1)

src = input(hlc3, title="[Fibonacci] Source")

mult = input(title="[Fibonacci] Multiplier", defval=3.0, minval=0.001, maxval=50)

level = input(title="[Fibonacci] Level", defval=764)

// Calculate Fibonacci

basis = vwma(src, length)

dev = mult * stdev(src, length)

fu764= basis + (0.001*level*dev)

fu1= basis + (1*dev)

fd764= basis - (0.001*level*dev)

fd1= basis - (1*dev)

// Calculate RSI

vrsi = rsi(close, len)

// Calculate the Targets

targetUp = fd764

targetDown = fu764

// Actual Targets

bought = strategy.position_size[0] > strategy.position_size[1]

exit_long = valuewhen(bought, targetUp, 0)

sold = strategy.position_size[0] < strategy.position_size[1]

exit_short = valuewhen(sold, targetDown, 0)

// Calculate Stop Losses

stop_long = strategy.position_avg_price * (1 - loss_percent)

stop_short = strategy.position_avg_price * (1 + loss_percent)

// Conditions to Open Trades

openLong = low < fd1 and crossover(vrsi[1], overSold)

openShort = high > fu1 and crossunder(vrsi[1], overBought)

// Conditions to Close Trades

closeLong = high > exit_long

closeShort = low < exit_short

// Plots

plot(basis, color=color.blue, linewidth=2, title="[Fibonacci Level] Basis")

plot(fu764, color=color.white, linewidth=1, title="[Fibonacci Level] Short Target")

plot(fu1, color=color.red, linewidth=2, title="1", title="[Fibonacci Level] Top")

plot(fd764, color=color.white, linewidth=1, title="[Fibonacci Level] Long Target")

plot(fd1, color=color.green, linewidth=2, title="1", title="[Fibonacci Level] Bottom")

// Strategy Orders

if timeFilter

// Entry Orders

strategy.entry(id="Long", long=true, when=openLong and high < targetUp, limit=close)

strategy.entry(id="Short", long=false, when=openShort and low > targetDown, limit=close)

// Exit Orders

strategy.exit(id="Long", when=closeLong and strategy.position_size > 0, limit=exit_long, stop=stop_long)

strategy.exit(id="Short", when=closeShort and strategy.position_size < 0, limit=exit_short, stop=stop_short)