概述

本策略是一个利用ADX指标来过滤突破信号的短线交易策略。当价格突破 Bollinger 布林带上轨,且 ADX 在下降时,做空;当价格突破 Bollinger 布林带下轨,且 ADX 在上升时,做多。该策略同时设置止损和止盈,全自动交易。

策略原理

本策略使用 Bollinger 布林带作为主要的突破信号。布林带上下轨代表了价格的两倍标准差,价格突破布林带通常代表价格进入强趋势阶段。另外,为了避免虚假突破,本策略新增了 ADX 指标作为过滤条件。只有当 ADX 下降时才考虑布林带上轨突破;只有当 ADX 上升时才考虑布林带下轨突破。这样可以过滤掉部分震荡行情中的假突破。

具体来说,本策略使用长度为 33 周期的收盘价计算布林带。布林带中轨线为收盘价的 33 周期简单移动平均线,上下轨分别是中轨上下两个标准差。指标参数设置为当收盘价跌破上轨,且 8 周期 ADX 小于 15 周期 ADX 时做空;当收盘价突破下轨,且 8 周期 ADX 大于 15 周期 ADX 时做多。平仓设置为止盈 800 个点,止损 400 个点。

优势分析

这是一个结合趋势和次数指标过滤信号的突破策略,有以下几个优势:

- 使用布林带判断趋势突破点,比较符合大部分交易者的习惯。

- 增加 ADX 条件过滤,可以减少趋势震荡期间的虚假突破带来的损失。

- 策略操作简单,容易理解和优化。

- 自动设置止损止盈,无需人工干预,适合算法交易。

风险分析

本策略也存在一些风险:

- 布林带参数设置不当可能导致信号过于频繁,交易成本增加。

- ADX 设置不当也可能过滤掉部分有效信号。

- 止损距离可能过大,单笔损失扩大。

为了降低这些风险,我们可以调整布林带参数,缩小布林带范围;调整 ADX 周期参数,避免过度过滤信号;适当缩小止损距离,控制单笔损失。当然,这些优化都需要经过回测验证,避免过拟合。

优化方向

本策略还有进一步优化的空间:

- 可以测试不同市场的数据,寻找最优参数组合。

- 可以结合其他指标进一步过滤信号,例如交易量,Moving Average 等。

- 可以采用机器学习的方法自动优化参数。

- 可以考虑动态止损和止盈。

总结

本策略整体来说是一个简单实用的突破过滤策略。通过布林带判断趋势,ADX 过滤信号,可以在一定程度上规避震荡市的噪音,抓住趋势机会。优化空间还很大,值得进一步测试和改进。

策略源码

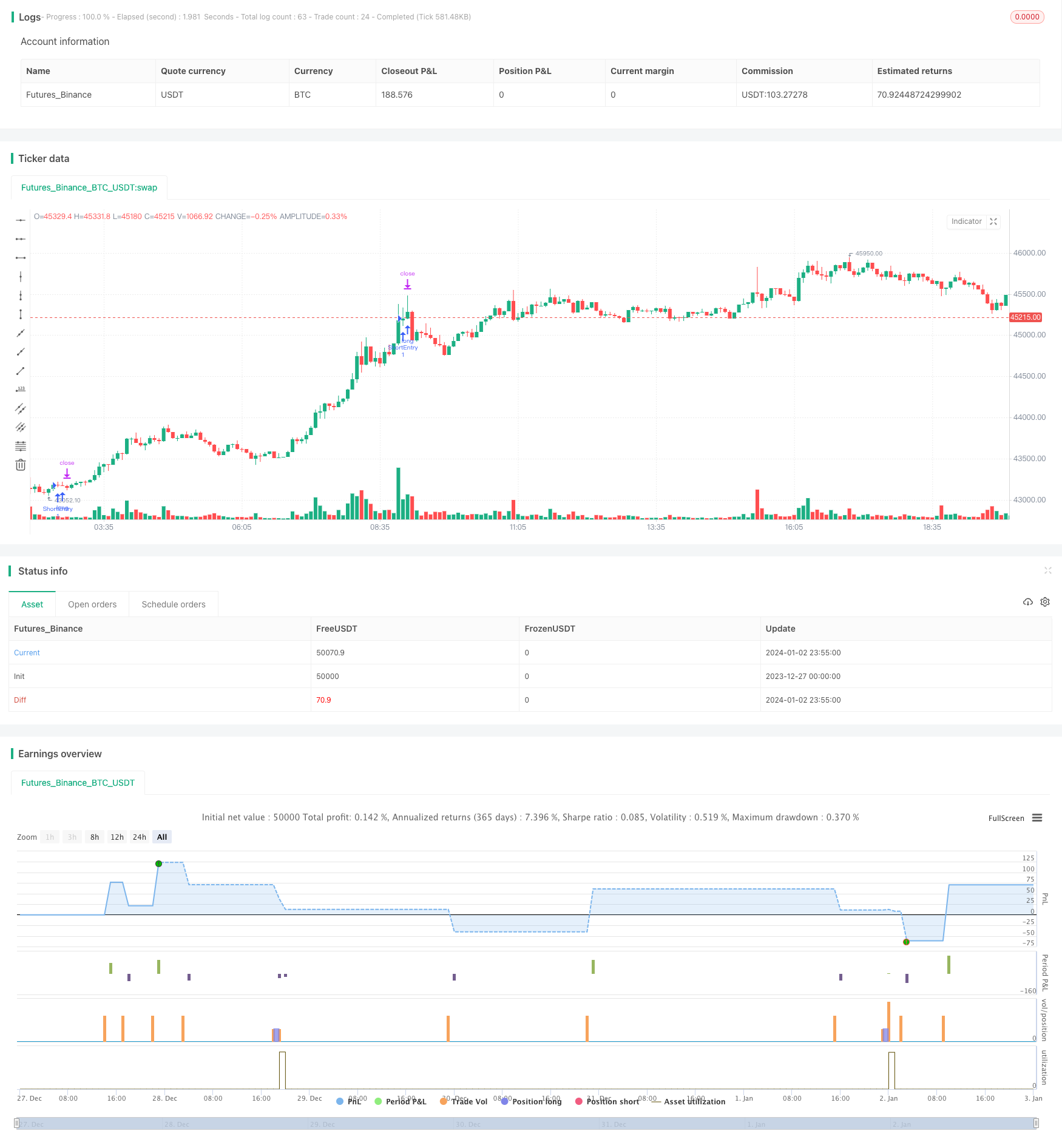

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hizbullah XAUUSD Sniper", overlay=true)

Price = close

Length = input(33)

Mult = input(2)

Basis = sma(Price, Length)

StdDev = Mult * stdev(Price, Length)

Upper = Basis + StdDev

Lower = Basis - StdDev

ADX_Length = input(4)

TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

SmoothedTrueRange = sma(TrueRange, ADX_Length)

DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

SmoothedDirectionalMovementPlus = sma(DirectionalMovementPlus, ADX_Length)

SmoothedDirectionalMovementMinus = sma(DirectionalMovementMinus, ADX_Length)

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIPlus - DIMinus) / (DIPlus + DIMinus)*100

SmoothedADX1 = ema(DX, input(8))

SmoothedADX2 = ema(DX, input(15))

Condition1 = crossunder(Price, Upper) and SmoothedADX1 < SmoothedADX2

Take_Profit = input(800)

Stop_Loss = input(400)

strategy.entry("ShortEntry", true, when = Condition1)

strategy.exit("ShortExit", "ShortEntry", profit = Take_Profit, loss = Stop_Loss)