概述

该策略是一个基于K线中的熊转形态来判断市场反转信号的策略。当出现熊转形态时做空,目标获利后平仓。

策略原理

该策略的核心判断逻辑在于识别K线中是否出现了熊转形态。熊转形态是指一个向上涨升的K线后,紧接着一个收盘价格低于前一日收盘价格的阴线,并且该阴线的实体部分完全包裹住前一日的阳线实体。根据技术分析理论,这种形态通常预示着当前上涨趋势即将反转。

因此,该策略的具体交易逻辑是:

- 监测到熊转形态出现时(前一日为阳线并且实体满足大小要求,当前为阴线并且实体完全包住前一日阳线实体),做空头入场

- 若亏损超过设定的止损点则止损退出仓位

- 若盈利超过设定的止盈点则止盈退出仓位

通过这种方式,可以在 judged出现熊转信号时捕捉到价格反转机会。

优势分析

该策略最大的优势在于能较早地判断市场趋势反转,采用的是熊转形态这一比较有效的反转信号,成功率较高。且策略思路简单清晰易于理解,容易实施。

另外,策略加入了止损止盈机制来控制风险和锁定利润,可以有效防止过度亏损的情况发生。

风险分析

该策略的主要风险在于熊转形态发出的反转信号不一定总是可靠的。虽然大多情况下是准确的,但也会出现误判的情况。这会导致在实际交易中无法完全避免亏损的发生。

此外,设置固定的止损止盈点也具有一定的盲目性,不够灵活。可能会在行情剧烈波动时被套住导致损失或错过更大利润。

优化方向

该策略可以通过以下几个方面进行进一步优化:

- 增加对交易时段的选择。只在活跃交易的时段运作策略,可以减少误判概率

- 增加对突破力度的判断。结合交易量或者平均真实波幅来确定熊转信号的可靠性

- 采用动态止损止盈方式,并结合波动率指标来更加灵活地设置止损止盈点

- 增加整体市场趋势判断,避免在盘整时造成不必要的亏损

总结

该熊转魔法蜡烛反转策略通过识别熊转形态来判断市场反转时机。策略思路清晰易操作,成功率较高。但也存在一定误判风险。可以通过进一步优化来改善策略效果,降低风险。

策略源码

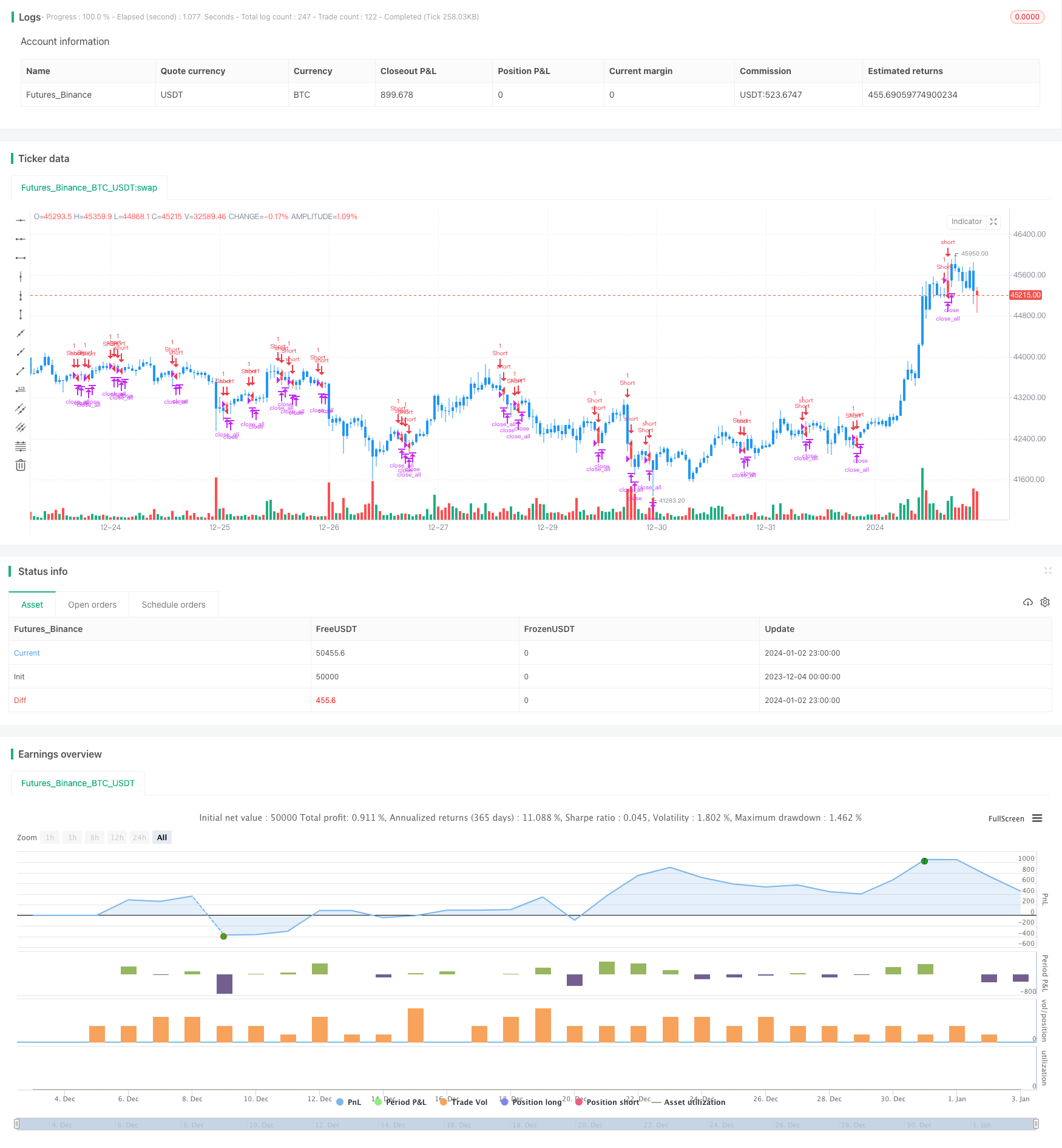

/*backtest

start: 2023-12-04 00:00:00

end: 2024-01-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 30/10/2018

//

// This is a bearish candlestick reversal pattern formed by two candlesticks.

// Following an uptrend, the first candlestick is a up candlestick which is

// followed by a down candlestick which has a long real body that engulfs or

// contains the real body of the prior bar. The Engulfing pattern is the reverse

// of the Harami pattern.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title = "Bearish Engulfing Backtest", overlay = true)

input_takeprofit = input(40, title="Take Profit pip")

input_stoploss = input(20, title="Stop Loss pip")

input_minsizebody = input(2, title="Min. Size Body pip")

barcolor(abs(close[1] - open[1]) >= input_minsizebody? close[1] > open[1] ? open > close ? open >= close[1] ? open[1] >= close ? open - close > close[1] - open[1] ? yellow :na :na : na : na : na: na)

pos = 0.0

barcolor(nz(pos[1], 0) == -1 ? red: nz(pos[1], 0) == 1 ? green : blue )

posprice = 0.0

posprice := abs( close[1] - open[1]) >= input_minsizebody? close[1] > open[1] ? open > close ? open >= close[1] ? open[1] >= close ? open - close > close[1] - open[1] ? close :nz(posprice[1], 0) :nz(posprice[1], 0) : nz(posprice[1], 0) : nz(posprice[1], 0) : nz(posprice[1], 0): nz(posprice[1], 0)

pos := iff(posprice > 0, -1, 0)

if (pos == 0)

strategy.close_all()

if (pos == -1)

strategy.entry("Short", strategy.short)

posprice := iff(low <= posprice - input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_stoploss and posprice > 0, 0 , nz(posprice, 0))