概述

双均线交叉交易策略是一种趋势跟踪策略。它利用快速移动平均线(MACD)和慢速移动平均线的交叉作为买入和卖出信号。当快速移动平均线从下方上扫慢速移动平均线时,产生买入信号;当快速移动平均线从上方下扫慢速移动平均线时,产生卖出信号。

策略原理

该策略基于MACD指标。MACD指标是两条不同参数的移动平均线的差值,反映价格的动量变化。具体来说,是快速移动平均线(默认参数为12日线)减去慢速移动平均线(默认参数为26日线)得到的差值,称为MACD柱。为了消除震荡,MACD指标中又引入了DEA线或称信号线,一般为MACD的9日加权移动平均线。

当MACD柱从下向上突破DEA线而进入正值区域时,说明短期平均线上扫长期平均线,表明股价趋势转为上升,产生买入信号。当MACD从上向下跌破DEA线而进入负值区域时,表明短期平均线下扫长期平均线,股价趋势转为下降,产生卖出信号。

该策略就是利用MACD柱和DEA线的交叉来判断买入和卖出时机。当MACD柱上扫DEA线时买入,下扫时卖出。

优势分析

该策略具有以下优势:

- captured 能够顺势而为,及时抓住价格趋势的变化。

- 简单明了,容易理解和实现。

- 参数较为固定,不需要经常调整。

- 可适用于不同时间周期。

风险分析

该策略也存在一些风险:

- whipsaws 可能产生多次错误信号,即在横盘中反复触发买入卖出。

- lagging 存在一定的滞后性,可能错过价格变化的最佳时机。

- over optimization 参数容易过度优化,实际效果可能不佳。

为了降低风险,可以适当调整参数,或与其它指标结合使用,如量价指标、波动率指标等。此外,合理的止损和止盈策略也很重要。

优化方向

该策略可从以下几个方面进行优化:

参数优化。可以测试不同的参数组合,找到最佳的参数。但要注意避免过度优化。

与其它指标组合。可以引入量价指标、波动率指标等,形成更强大的组合策略。

止损止盈策略。设定合理的止损止盈点,可以有效控制风险。

适配性优化。该策略可以适用于不同市场和时间周期,可以根据实际情况调整。

总结

双均线交叉策略通过捕捉价格趋势的变化,实现低成本的趋势跟踪交易。它简单实用,易于实现,是一种适合新手的入门策略。但该策略也存在一定缺陷,需要注意防范风险。通过不断优化和改进,可以使该策略的实际效果更好,值得推荐。

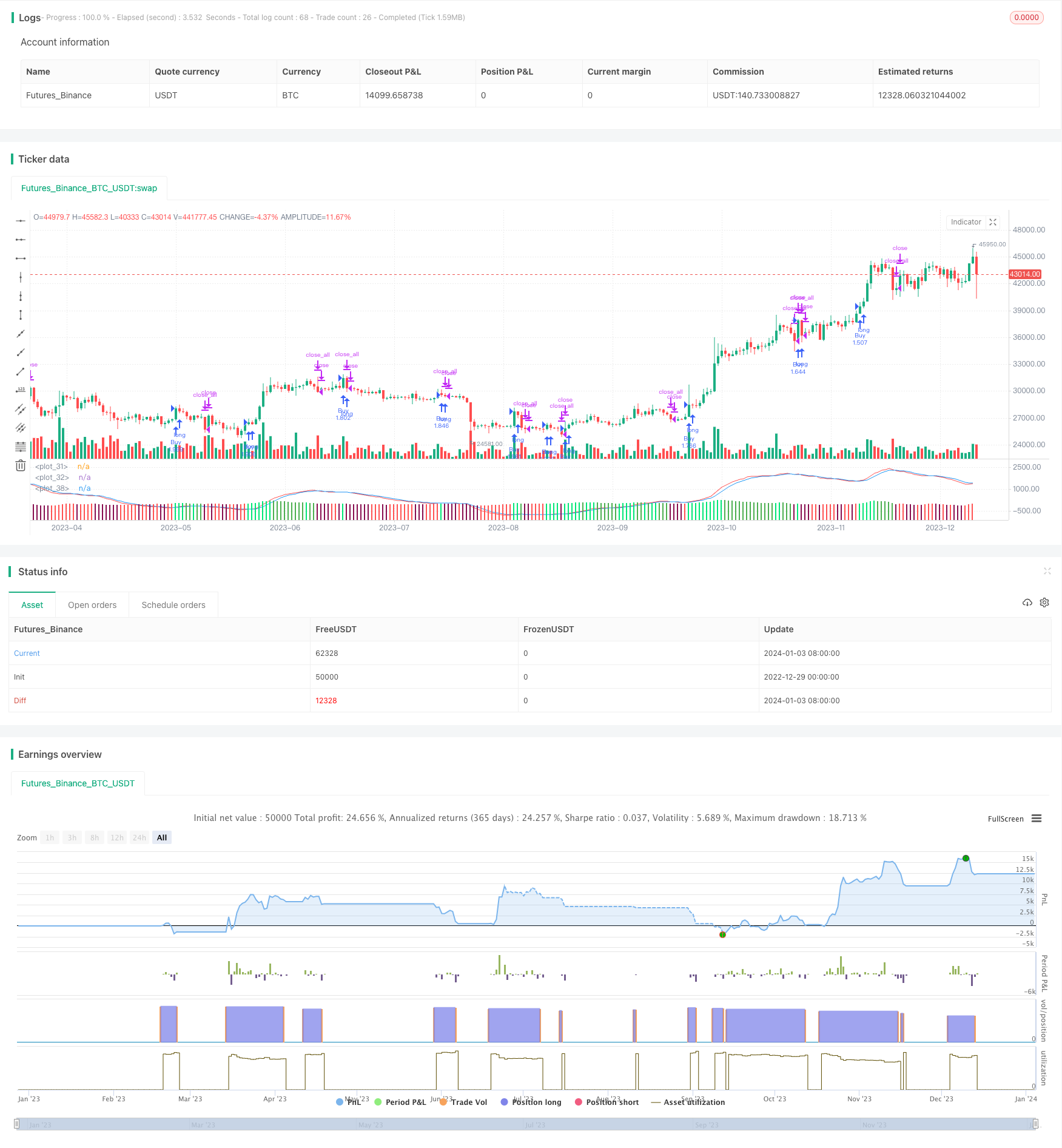

/*backtest

start: 2022-12-29 00:00:00

end: 2024-01-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("MACD Strategy by Forbes",default_qty_type=strategy.percent_of_equity, default_qty_value=100, overlay=false)

fastLength = input(20)

slowlength = input(40)

MACDLength = input(4)

// === INPUT BACKTEST RANGE ===

FromYear = input(defval = 2011, title = "From Year", minval = 2009)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2009)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

f1 = plot(MACD,color=red)

s1 = plot(aMACD,color=blue)

plotColor = if delta > 0

delta > delta[1] ? lime : green

else

delta < delta[1] ? maroon : red

plot(delta, color=plotColor, style=columns)

if (crossover(delta, 0))

strategy.entry("Buy", true, when=window(), comment="Buy")

if (crossunder(delta, 0))

strategy.close_all(when=window())

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)