概述

本策略named“ATR趋势跟踪策略”,是一种基于平均真实波动幅度(ATR)设置止损,并利用标准差通道判断入市时机的趋势跟踪交易策略。该策略适用于股指、外汇、商品等具有明显趋势的金融产品。

策略原理

该策略使用ATR指标来设置止损价格。ATR指标反映市场波动程度,可以动态设置止损距离。策略通过输入ATR周期和倍数,来计算ATR值,然后乘以倍数作为止损距离。具体来说,ATR止损线的计算公式为:

ATR线 = 前一日ATR线 ± nLoss(nLoss = nATRMultip * ATR值)

若收盘价 > ATR线,ATR线上调至收盘价 - nLoss

若收盘价 < ATR线,ATR线下调至收盘价 + nLoss

这样ATR线就可以根据价格波动来动态调整,从而实现趋势跟踪止损。

除了ATR止损以外,策略还使用标准差通道判断入市时机。标准差通道的计算公式为:

中线 = ATR止损线

上轨 = 中线 + n倍标准差

下轨 = 中线 - n倍标准差

当价格由下向上突破中线时,做多;当价格由上向下突破中线时,做空。

策略优势

该策略最大的优势在于,利用ATR指标作为止损工具,可以根据市场波动程度来动态调整止损距离,实现趋势跟踪止损,有效控制风险。

另外,结合标准差通道判断入市时机,可以避免因价格小幅震荡而频繁开仓。

风险及解决方案

该策略主要风险在于,止损距离过大时无法有效控制风险;止损距离过小时则容易被市场噪音止损。针对此风险,可以调整ATR周期及ATR倍数,寻找最佳参数组合。

另一个风险在于,标准差通道参数设置不当,会导致开仓频率过高或过低。可以通过参数优化找到最优参数。

优化方向

该策略可从以下几个方面进行优化:

ATR周期和倍数优化。调整这两个参数可以获得更好的止损效果。

标准差通道参数优化。优化通道参数,获得更好的入市效果。

增加其他指标过滤。可以增加移动平均线、K线形态等指标,辅助判断趋势方向,提高获利率。

优化开仓和平仓逻辑。可以设定价格触及标准差通道时,再次确认K线形态后才开仓。

总结

本策略基于ATR指标实现趋势跟踪止损,并用标准差通道辅助判断入市时机。策略优势在于止损风险控制效果好,适合趋势交易。风险和优化方向也得到明确分析。该策略值得进一步测试优化,具有实盘交易价值。

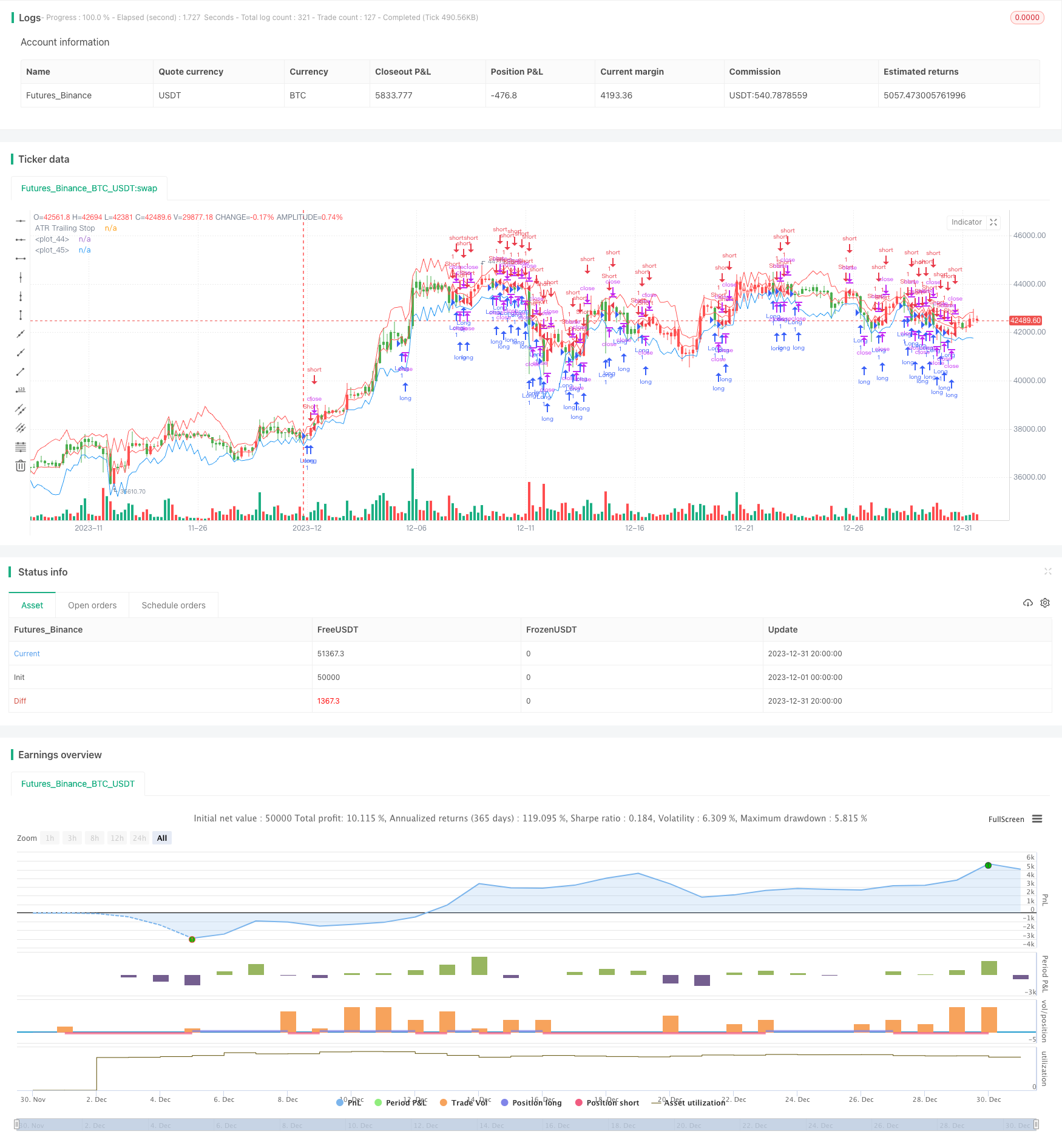

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 2

strategy(title="Average True Range Strategy", overlay = true)

nATRPeriod = input(11) //Hur många perioder ATR är på

nATRMultip = input(0.5) //Hur många gånger nuvarande ATR multipliceras med

xATR = atr(nATRPeriod)

nLoss = nATRMultip * xATR

xATRTrailingStop = iff(close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), close - nLoss),

iff(close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), close + nLoss),

iff(close > nz(xATRTrailingStop[1], 0), close - nLoss, close + nLoss)))

pos = iff(close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0), -1,

iff(close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0), 1, nz(pos[1], 0)))

stdev3 = 14*stdev(xATR, nATRPeriod)

band1 = xATRTrailingStop+stdev3 //Översta stdev bandet

band2 = xATRTrailingStop-stdev3 //Nedersta stdev bandet

// Datum och tid

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 18, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2013, title = "From Year", minval = 2013)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2020, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest slut

startTimeOk() => true

initial_capital = 100000

take = close > xATRTrailingStop

if( startTimeOk() ) and (pos == 1)

//if (pos == 1)

strategy.entry("Long", strategy.long, comment = "KOP")

strategy.exit("Long", when = take)

if( startTimeOk() ) and (pos == -1)

//if (pos == -1)

strategy.entry("Short", strategy.short, comment = "SALJ")

barcolor(pos == -1 ? red: pos == 1 ? green : blue )

plot(xATRTrailingStop, color=red, title="ATR Trailing Stop") //Mittersta linjen som är triggerlinjen för köp/sälj

plot(band1, color=red)

plot(band2, color=blue)