概述

本策略名称为“基于RSI指标的双轨突破策略”。该策略利用RSI指标的双轨配合进行判断,实现低买高卖的目的。当RSI指标低于设置的低轨(默认40)时视为买入信号,此时若RSI10小于RSI14则进一步确认买入;当RSI指标高于设置的高轨(默认70)时视为卖出信号,此时若RSI10高于RSI14则进一步确认卖出。该策略同时设置了移动止损和止盈退出机制。

策略原理

本策略的核心逻辑是利用RSI指标的双轨进行判断。RSI指标一般设置为14周期,代表了近14天的股票强弱情况。本策略则添加了RSI10作为辅助判断指标。

当RSI14下破40轨时,认为股价跌破弱势面,有可能形成支撑反弹的机会。此时若RSI10小于RSI14,说明短期趋势依然向下,可以进一步确认看跌信号。所以满足“RSI14 <= 40且RSI10 < RSI14”时则产生买入信号。

当RSI14上破70轨时,认为股价进入短期的强势区域,有可能出现回落调整的机会。此时若RSI10大于RSI14,说明短期趋势继续向上,可以进一步确认看涨信号。所以满足“RSI14 >= 70且RSI10 > RSI14”时则产生卖出信号。

这样,RSI14和RSI10的配合判断,构成了双轨策略的核心逻辑。

策略优势

- 使用双RSI指标组合判断,可以更准确捕捉买卖点位

- 采用移动止损机制,可以及时止损,控制最大亏损

- 设置止盈退出机制,可以在达到目标利润后退出,避免盈利回吐

策略风险

- RSI指标容易产生虚假信号,无法完全避免亏损的发生

- 止损点设置过于接近可能会被秒出,设置过大又难以控制风险

- 如果行情异常,如快速跳空,也会招致相应损失

要充分利用该策略,可以适当调整RSI参数,严格控制止损位置,避免操作过于密集,追求稳定持久的盈利能力。

策略优化方向

- 可以考虑结合其他指标进行组合,如KDJ、MACD等,实现多指标验证

- 可以针对不同品种分别设置RSI参数,使参数更贴近该品种特点

- 可以设置动态止损,根据ATR等指标实时调整止损位

- 可以通过机器学习技术自动优化RSI参数

总结

本策略基于RSI的双轨思路进行判断,在一定程度上过滤了部分噪音信号。但任何单一指标策略都无法完美,RSI指标容易产生误导,应谨慎看待。本策略中加入了移动止损和止盈机制来控制风险,这是非常必要的。未来可继续优化,使策略参数和止损方式更加智能化、动态化。

策略源码

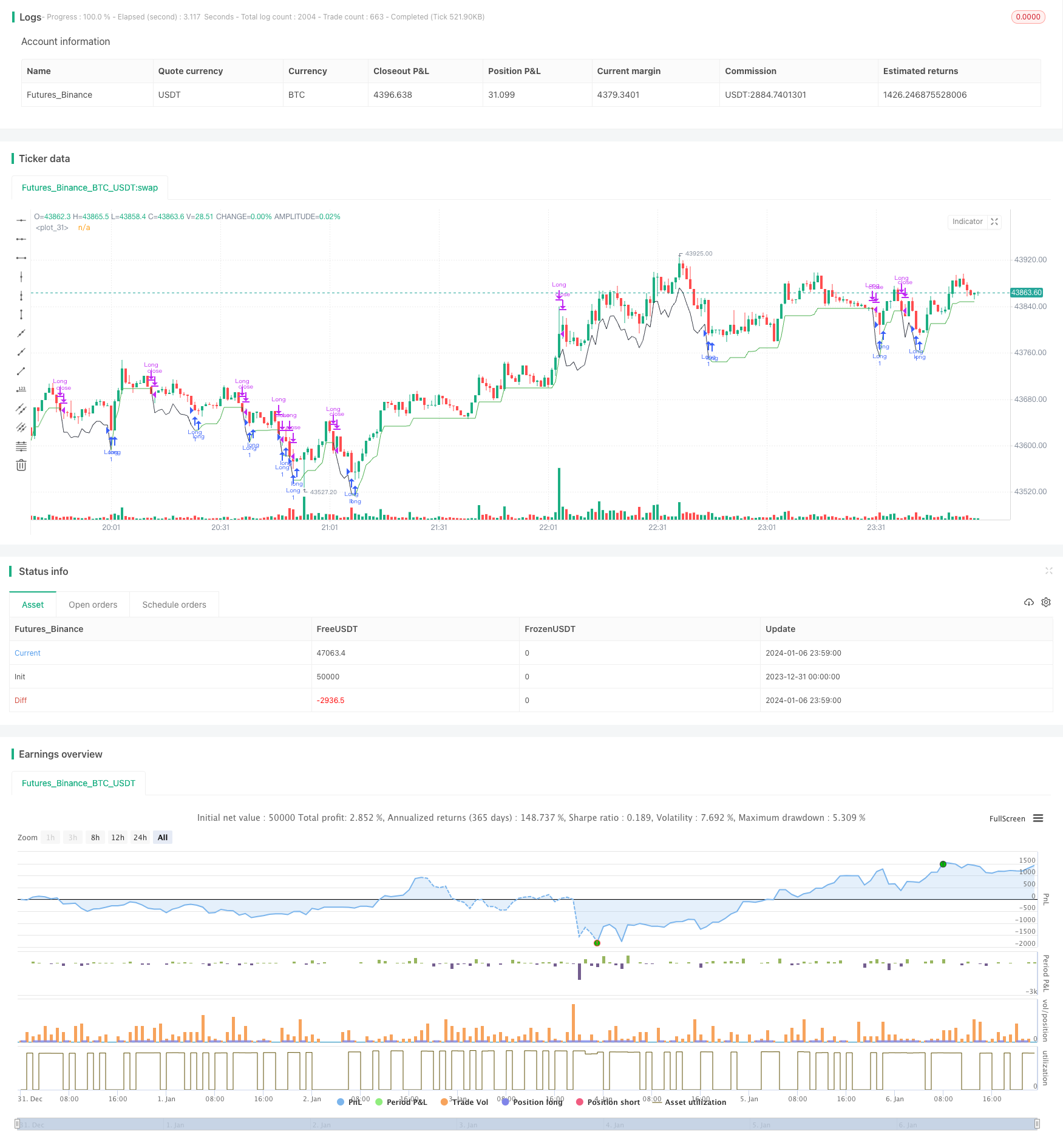

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//@version=4

strategy("[KL] RSI 14 + 10 Strategy",overlay=true)

backtest_timeframe_start = input(defval = timestamp("01 Jan 2015 13:30 +0000"), title = "Backtest Start Time", type = input.time)

//backtest_timeframe_end = input(defval = timestamp("19 Mar 2021 19:30 +0000"), title = "Backtest End Time", type = input.time)

TARGET_PROFIT_MODE = input(false,title="Exit when Risk:Reward met")

REWARD_RATIO = input(3,title="Risk:[Reward] (i.e. 3) for exit")

// Trailing stop loss {

TSL_ON = input(true,title="Use trailing stop loss")

var entry_price = float(0)

ATR_multi_len = 26

ATR_multi = input(2, "ATR multiplier for stop loss")

ATR_buffer = atr(ATR_multi_len) * ATR_multi

plotchar(ATR_buffer, "ATR Buffer", "", location = location.top)

risk_reward_buffer = (atr(ATR_multi_len) * ATR_multi) * REWARD_RATIO

take_profit_long = low > entry_price + risk_reward_buffer

take_profit_short = low < entry_price - risk_reward_buffer

var bar_count = 0 //number of bars since entry

var trailing_SL_buffer = float(0)

var stop_loss_price = float(0)

stop_loss_price := max(stop_loss_price, close - trailing_SL_buffer)

// plot TSL line

trail_profit_line_color = color.green

showLine = strategy.position_size == 0

if showLine

trail_profit_line_color := color.black

stop_loss_price := close - trailing_SL_buffer

plot(stop_loss_price,color=trail_profit_line_color)

// }

// RSI

RSI_LOW = input(40,title="RSI entry")

RSI_HIGH = input(70,title="RSI exit")

rsi14 = rsi(close, 14)

rsi10 = rsi(close, 10)

if true// and time <= backtest_timeframe_end

buy_condition = rsi14 <= RSI_LOW and rsi10 < rsi14

exit_condition = rsi14 >= RSI_HIGH and rsi10 > rsi14

//ENTRY:

if strategy.position_size == 0 and buy_condition

entry_price := close

trailing_SL_buffer := ATR_buffer

stop_loss_price := close - ATR_buffer

strategy.entry("Long",strategy.long, comment="buy")

bar_count := 0

else if strategy.position_size > 0

bar_count := bar_count + 1

//EXIT:

// Case (A) hits trailing stop

if TSL_ON and strategy.position_size > 0 and close <= stop_loss_price

if close > entry_price

strategy.close("Long", comment="take profit [trailing]")

stop_loss_price := 0

else if close <= entry_price and bar_count

strategy.close("Long", comment="stop loss")

stop_loss_price := 0

bar_count := 0

// Case (B) take targeted profit relative to risk

if strategy.position_size > 0 and TARGET_PROFIT_MODE

if take_profit_long

strategy.close("Long", comment="take profits [risk:reward]")

stop_loss_price := 0

bar_count := 0

// Case (C)

if strategy.position_size > 0 and exit_condition

if take_profit_long

strategy.close("Long", comment="exit[rsi]")

stop_loss_price := 0

bar_count := 0