概述

该策略主要基于RSI指标和布林带指标设计交易规则,实现在趋势市场中获利。当RSI低于超买线而价格接近布林带下轨时做多;当RSI高于超卖线而价格接近布林带上轨时做空,这是该策略的基本交易逻辑。

策略原理

该策略使用RSI指标判断超买超卖区域。RSI低于设定的超买线则为超卖信号,高于超卖线则为超买信号。同时使用布林带指标判断价格突破。当价格由下至上突破布林带下轨时为做多信号,由上至下突破上轨时为做空信号。

该策略综合运用了RSI指标判断市场意愿和布林带判断价格突破两个因素,形成交易决策依据。只有两者同时符合条件时才发出交易信号,可以有效过滤掉一些假信号,提高策略效果。

优势分析

该策略结合RSI和布林带两个指标,可以更准确判断市场走势和捕捉趋势。相比单一指标策略,可以过滤更多假信号,信号质量更高。而RSI指标可以判断超买超卖现象,布林带指标判断价格突破则可以捕捉突破开始的趋势。两者结合使用效果更好。

该策略只在RSI和布林带指标同时发出信号时才开仓,可以有效避免假信号的干扰。同时结合停损来控制风险,即使行情转变也可以及时止损。

风险分析

该策略虽然可以过滤掉一定假信号,但在震荡行情中,RSI和布林带指标可能同时发出错误信号,导致不必要的亏损。此外,参数设置不当也会导致策略效果不佳。

建议通过回测优化参数,寻找最佳参数组合。同时适当调整策略规则,在震荡行情中暂停交易,避免不必要的损失。此外,合理使用止损来控制单笔损失。

优化方向

该策略可以从以下几个方面进行优化:

优化RSI参数和布林带参数,寻找最佳参数组合

增加其他指标作为过滤信号,如MACD、KD等

增加突破验证机制,避免假突破

根据不同行情类型调整参数或停止交易

优化止损策略,实现动态止损

总结

该策略结合RSI指标和布林带指标设计交易规则,只在两者发出同步信号时才开仓,可以有效过滤假信号。通过参数优化、增加信号过滤、止损策略优化等手段,可以不断优化和改进该策略,实现更稳定的盈利。

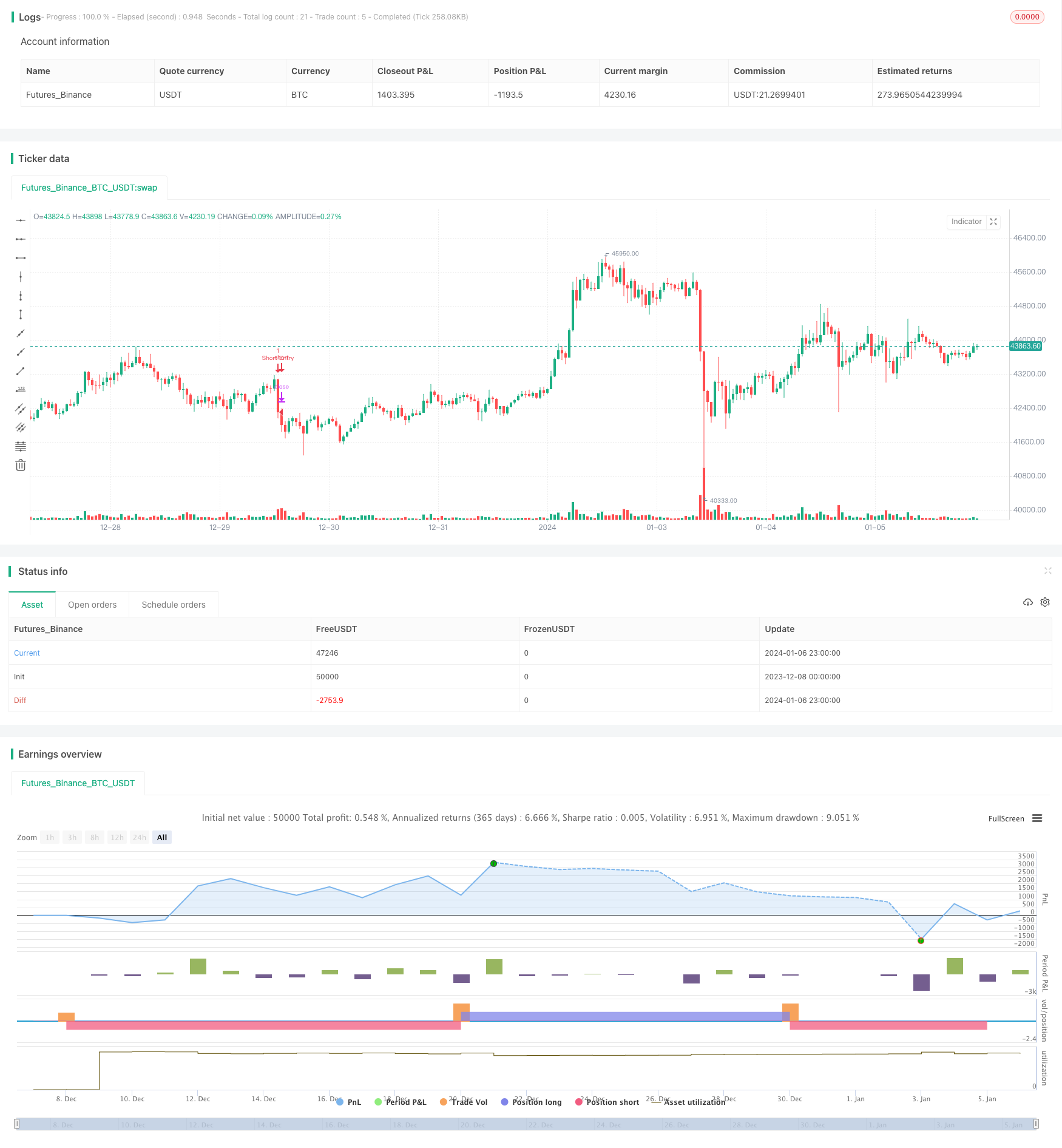

/*backtest

start: 2023-12-08 00:00:00

end: 2024-01-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Get Funded Easily by mjanusic", shorttitle="FTMO Crusher by mjanusic", overlay=true)

///////////// RSI

RSIlength = input(16, title="RSI Period Length")

RSIvalue = input(45, title="RSI Value Range")

RSIoverSold = 0 + RSIvalue

RSIoverBought = 100 - RSIvalue

price = close

vrsi = ta.rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(20, title="Bollinger Bands SMA Period Length")

BBmult = input(2.0, title="Bollinger Bands Standard Deviation")

BBbasis = ta.sma(price, BBlength)

BBdev = BBmult * ta.stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyCondition = ta.crossover(vrsi, RSIoverSold) and ta.crossover(source, BBlower)

sellCondition = ta.crossunder(vrsi, RSIoverBought) and ta.crossunder(source, BBupper)

///////////// RSI + Bollinger Bands Strategy

if (not na(vrsi))

if (buyCondition)

strategy.entry("Long Entry", strategy.long, stop=BBlower, comment="Long Entry")

else

strategy.cancel(id="Long Entry")

if (sellCondition)

strategy.entry("Short Entry", strategy.short, stop=BBupper, comment="Short Entry")

else

strategy.cancel(id="Short Entry")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_area)