概述

该策略结合使用了单指数平滑移动平均线(SESMA)和附带尾随止损的唐奇阶梯围绕机制,形成一个非常稳定和高效的趋势跟踪策略。SESMA作为主线,用于识别价格趋势方向。尾随止损机制则可有效降低策略风险,同时保护策略利润。

策略原理

该策略由两个核心指标组成:

单指数平滑移动平均线(SESMA):SESMA借鉴了EMA的思想,同时改进了参数,使得曲线更加光滑,延迟降低。通过SESMA的方向和价位关系来判断价格趋势。

尾随止损机制:结合最高价、最低价以及ATR指标,实时计算出多头和空头的止损线。这是一个动态调整的止损机制,可根据市场波动性和趋势调整止损幅度。止损线同价位的关系用于判断平仓退出的时机。

该策略的入场依据是价格突破SESMA。而出场信号则由止损线来触发。可设定是否显示标记。

策略优势

- SESMA计算方法改进,可有效减少延迟,提高顺势捕获能力。

- 尾随止损机制可根据实时波动调整止损幅度,避免止损过于宽松或过于紧挨。

- 附带视觉辅助判断 Entry 和 Exit 时机的标记。

- 可自定义参数,适用于不同品种和参数优化。

风险及优化方向

- 在趋势反转时,可能出现止损被触发导致过早退出。可适当放宽止损幅度。

- SESMA 参数可进行优化,找到最佳长度。

- ATR 参数也可测试不同的周期长度。

- 测试是否显示标记的效果。

总结

该策略整合了趋势判断与风险控制指标,形成一个较为稳健的趋势跟踪策略。相比于简单的移动平均线策略,该策略可更加灵活地捕捉趋势,同时可减少回撤。通过参数优化,可使策略在不同市场中达到更好的效果。

策略源码

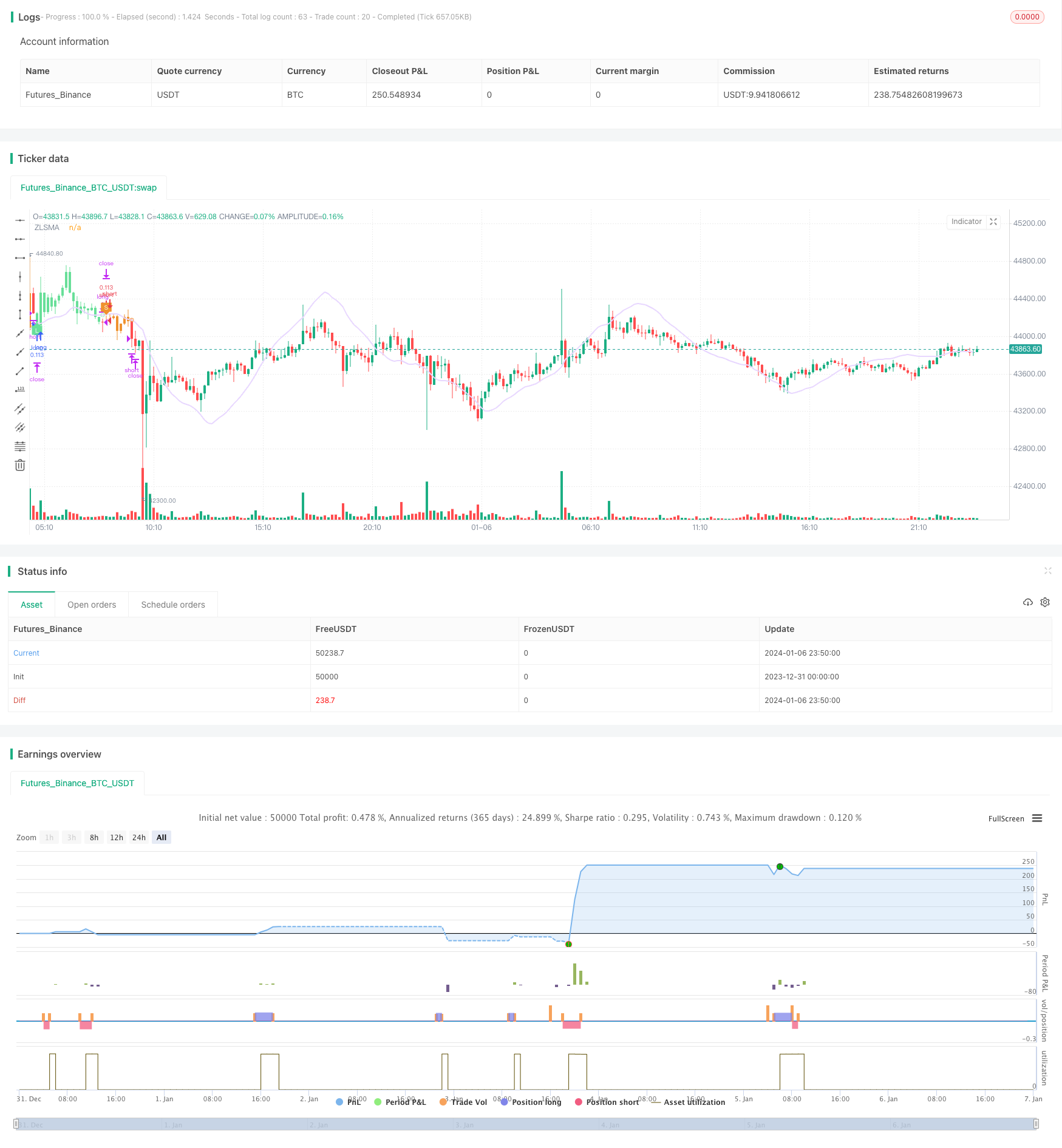

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © simwai

strategy('Chandelier Exit ZLSMA Strategy', shorttitle='CE_ZLSMA', overlay = true, initial_capital = 1000, default_qty_value = 10, default_qty_type = strategy.percent_of_equity, calc_on_every_tick = false, process_orders_on_close = true, commission_value = 0.075)

// -- Colors --

color maximumYellowRed = color.rgb(255, 203, 98) // yellow

color rajah = color.rgb(242, 166, 84) // orange

color magicMint = color.rgb(171, 237, 198)

color languidLavender = color.rgb(232, 215, 255)

color maximumBluePurple = color.rgb(181, 161, 226)

color skyBlue = color.rgb(144, 226, 244)

color lightGray = color.rgb(214, 214, 214)

color quickSilver = color.rgb(163, 163, 163)

color mediumAquamarine = color.rgb(104, 223, 153)

color carrotOrange = color.rgb(239, 146, 46)

// -- Inputs --

length = input(title='ATR Period', defval=1)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2)

showLabels = input(title='Show Buy/Sell Labels ?', tooltip='Created by Chandelier Exit (CE)', defval=false)

isSignalLabelEnabled = input(title='Show Signal Labels ?', defval=true)

useClose = input(title='Use Close Price for Extrema ?', defval=true)

zcolorchange = input(title='Enable Rising/Decreasing Highlightning', defval=false)

zlsmaLength = input(title='ZLSMA Length', defval=50)

offset = input(title='Offset', defval=0)

// -- CE - Credits to @everget --

float haClose = float(1) / 4 * (open[1] + high[1] + low[1] + close[1])

atr = mult * ta.atr(length)[1]

longStop = (useClose ? ta.highest(haClose, length) : ta.highest(haClose, length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := haClose > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(haClose, length) : ta.lowest(haClose, length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := haClose < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := haClose > shortStopPrev ? 1 : haClose < longStopPrev ? -1 : dir

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=mediumAquamarine, textcolor=color.white)

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=carrotOrange, textcolor=color.white)

changeCond = dir != dir[1]

// -- ZLSMA - Credits to @netweaver2011 --

lsma = ta.linreg(haClose, zlsmaLength, offset)

lsma2 = ta.linreg(lsma, zlsmaLength, offset)

eq = lsma - lsma2

zlsma = lsma + eq

zColor = zcolorchange ? zlsma > zlsma[1] ? magicMint : rajah : languidLavender

plot(zlsma, title='ZLSMA', linewidth=2, color=zColor)

// -- Signals --

var string isTradeOpen = ''

var string signalCache = ''

bool enterLong = buySignal and ta.crossover(haClose, zlsma)

bool exitLong = ta.crossunder(haClose, zlsma)

bool enterShort = sellSignal and ta.crossunder(haClose, zlsma)

bool exitShort = ta.crossover(haClose, zlsma)

if (signalCache == 'long entry')

signalCache := ''

enterLong := true

else if (signalCache == 'short entry')

signalCache := ''

enterShort := true

if (isTradeOpen == '')

if (exitShort and (not enterLong))

exitShort := false

if (exitLong and (not enterShort))

exitLong := false

if (enterLong and exitShort)

isTradeOpen := 'long'

exitShort := false

else if (enterShort and exitLong)

isTradeOpen := 'short'

exitLong := false

else if (enterLong)

isTradeOpen := 'long'

else if (enterShort)

isTradeOpen := 'short'

else if (isTradeOpen == 'long')

if (exitShort)

exitShort := false

if (enterLong)

enterLong := false

if (enterShort and exitLong)

enterShort := false

signalCache := 'short entry'

if (exitLong)

isTradeOpen := ''

else if (isTradeOpen == 'short')

if (exitLong)

exitLong := false

if (enterShort)

enterShort := false

if (enterLong and exitShort)

enterLong := false

signalCache := 'long entry'

if (exitShort)

isTradeOpen := ''

plotshape((isSignalLabelEnabled and enterLong) ? zlsma : na, title='LONG', text='L', style=shape.labelup, color=mediumAquamarine, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and enterShort) ? zlsma : na, title='SHORT', text='S', style=shape.labeldown, color=carrotOrange, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitLong) ? zlsma : na, title='LONG EXIT', style=shape.circle, color=magicMint, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitShort) ? zlsma : na, title='SHORT EXIT', style=shape.circle, color=rajah, size=size.tiny, location=location.absolute)

barcolor(color=isTradeOpen == 'long' ? mediumAquamarine : isTradeOpen == 'short' ? carrotOrange : na)

// -- Long Exits --

if (exitLong and strategy.position_size > 0)

strategy.close('long', comment='EXIT_LONG')

// -- Short Exits --

if (exitShort and strategy.position_size < 0)

strategy.close('short', comment='EXIT_SHORT')

// -- Long Entries --

if (enterLong)

strategy.entry('long', strategy.long, comment='ENTER_LONG')

// -- Short Entries --

if (enterShort)

strategy.entry('short', strategy.short, comment='ENTER_SHORT')