一、策略概述

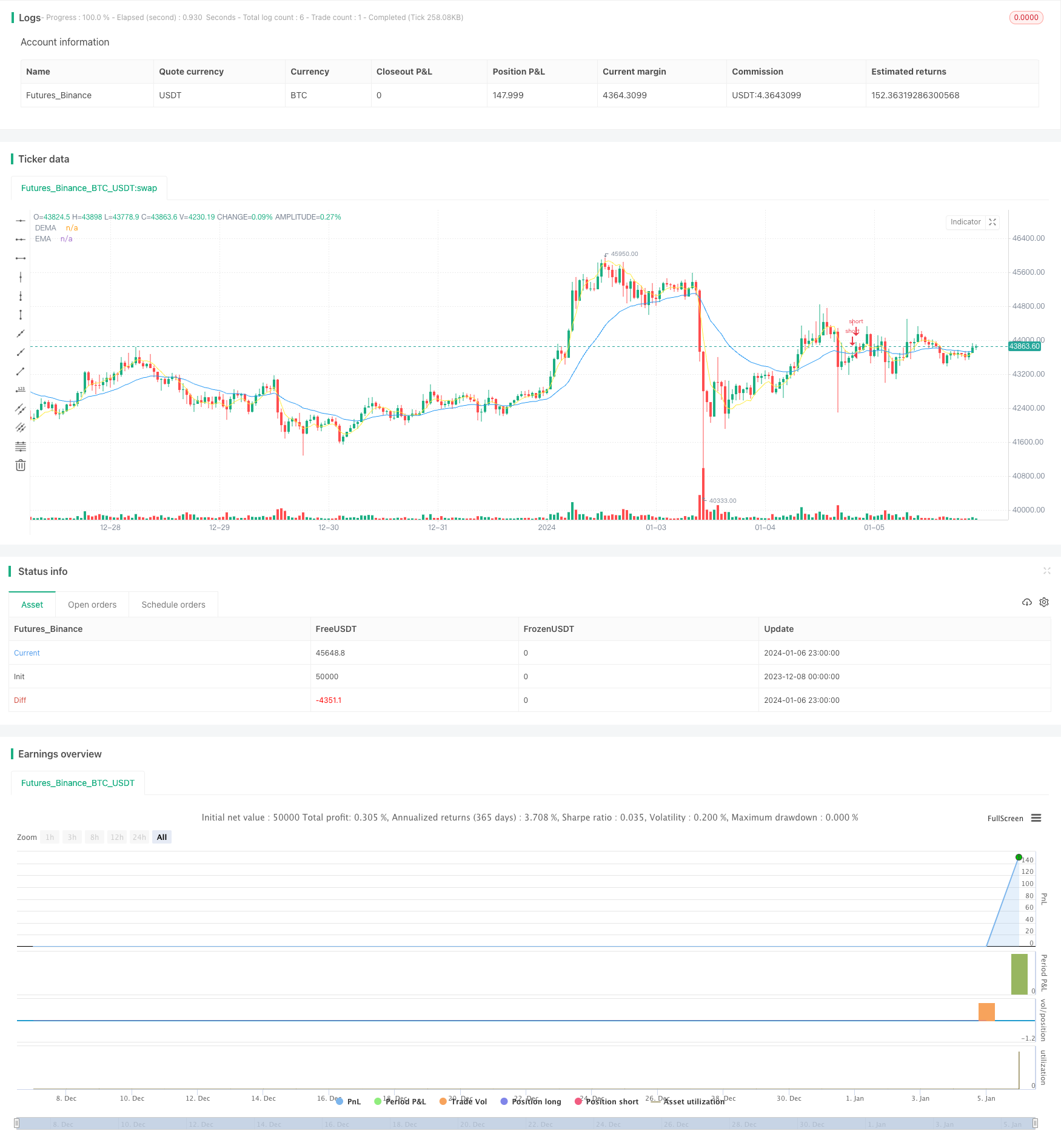

本策略名称为“DEMA与EMA短期交叉结合ATR波动率策略”。该策略通过计算DEMA与EMA的交叉信号,结合ATR波动率指标,实现高效的短线交易策略。当DEMA下穿EMA,并且ATR波动率上升时,做空;当DEMA重新上穿EMA时,平仓。

二、策略原理

计算DEMA指标。DEMA为双EMA移动平均线,通过计算一定周期内的双EMA,可以有效过滤短期市场噪音,提高信号准确率。

计算EMA指标。EMA为指数移动平均线,可以更快地反应价格变化。

计算ATR波动率。ATR为真实波动幅度指标,可以反映市场波动性和风险水平。当ATR上升时,代表市场波动加大,容易形成短线调整。

当DEMA下穿EMA,并且ATR波动率大于设置的参数时,表明股价开始下跌,市场 risk off,此时做空。

当DEMA重新上穿EMA时,表明价格形成支撑,开始反弹上涨,此时平仓。

三、策略优势

双EMA结合EMA,可以有效提高信号的准确性。

ATR波动率指标可以排除低风险的whipsaw信号。

短期操作,适合短线追踪,可以避免长时间对冲。

交易逻辑简单清晰,容易理解和实现。

四、策略风险

ATR参数设置不当可能错过交易机会。

需同时关注多空两侧信号,操作难度较大。

ffected by short-term market volatility.

解决方法:参数优化测试,调整参数;简化交易逻辑,只关注单边信号;适当放宽止损范围。

五、策略优化方向

优化DEMA和EMA的参数,寻找最佳参数组合。

优化ATR的周期参数,确定最佳市场波动性衡量指标。

添加其他辅助指标,如BOLL通道,提高信号准确率。

增加止损和止盈规则,锁定更稳定的收益。

六、总结

本策略通过DEMA、EMA交叉和ATR波动率指标,构建了一个简单高效的短期交易策略。策略交易逻辑清晰,容易操作,可适应高频短线交易。下一步通过参数优化和规则优化,可望获得更稳定的超额收益。

/*backtest

start: 2023-12-08 00:00:00

end: 2024-01-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Qorbanjf

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Qorbanjf

//@version=4

strategy("Qorban: DEMA/EMA & VOL Short ONLY", shorttitle="DEMA/EMA & VOL SHORT", overlay=true)

// DEMA

length = input(10, minval=1, title="DEMA LENGTH")

src = input(close, title="Source")

e1 = ema(src, length)

e2 = ema(e1, length)

dema1 = 2 * e1 - e2

plot(dema1, "DEMA", color=color.yellow)

//EMA

len = input(25, minval=1, title="EMA Length")

srb = input(close, title="Source")

offset = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

ema1 = ema(srb, len)

plot(ema1, title="EMA", color=color.blue, offset=offset)

// get ATR VALUE

atr = atr(14)

//ATRP (Average True Price in precentage)

// Inputs

atrTimeFrame = input("D", title="ATR Timeframe", type=input.resolution)

atrLookback = input(defval=14,title="ATR Lookback Period",type=input.integer)

useMA = input(title = "Show Moving Average?", type = input.bool, defval = true)

maType = input(defval="EMA", options=["EMA", "SMA"], title = "Moving Average Type")

maLength = input(defval = 20, title = "Moving Average Period", minval = 1)

slType = input(title="Stop Loss ATR / %", type=input.float, defval=5.0, step=0.1)

slMulti = input(title="SL Multiplier", type=input.float, defval=1.0, step=0.1)

minimumProfitPercent = input(title="Minimum profit %", type=input.float, defval=20.00)

// ATR Logic

// atrValue = atr(atrLookback)

// atrp = (atrValue/close)*100

// plot(atrp, color=color.white, linewidth=2, transp = 30)

atrValue = security(syminfo.tickerid, atrTimeFrame, atr(atrLookback))

atrp = (atrValue/close)*100

// Moving Average Logic

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

maFilter = security(syminfo.tickerid, atrTimeFrame, ma(maType, atrp, maLength))

// Determine percentage of open profit

var entry = 0.0

distanceProfit = low - entry

distanceProfitPercent = distanceProfit / entry

//Determin if we have a long entry signal OR a sell position signal

profitSignal = minimumProfitPercent == 0.0 or distanceProfitPercent >= minimumProfitPercent

shortSignal = crossunder(dema1, ema1) and atrp > maFilter and strategy.position_size == 0 and not na(atr)

exitSignal = profitSignal and strategy.position_size !=0 and crossover(dema1, ema1)

// === INPUT BACKTEST RANGE ===

//FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

//FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

//FromYear = input(defval = 2017, title = "From Year", minval = 2000)

//ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

//ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

//ToYear = input(defval = 9999, title = "To Year", minval = 2017)

//Invert trade direction & flipping

//tradInvert = input(defval = false, title = "invert trade direction")

//MOM_MR = input(defval=1, title = "MOM = 1 / MR = -1", minval=-1, maxval=1)

//plots=input(false, title="Show plots?")

// Get stop loss (in pips AND percentage distance)

shortStop = highest(high, 4) - (atr * slMulti)

shortStopPercent = close - (close * slMulti)

// Save long stop & target prices (used for drawing data to the chart & deetermining profit)

var shortStopSaved = 0.0

var shortTargetSaved = 0.0

enterShort = false

if shortSignal

shortStopSaved := slType ? shortStop : shortStopPercent

enterShort:= true

entry := close

// long conditions

//enterLong = crossover(dema1, ema1) and atrp < maFilter

//exitSignal => crossunder(dema1, ema1)

//Enter trades when conditions are met

strategy.entry("short", strategy.short, when=enterShort, comment="SHORT")

//place exit orders (only executed after trades are active)

strategy.exit(id="Short exit",

from_entry="short",

limit=exitSignal ? close : na,

stop=shortStopSaved,

when=strategy.position_size > 0,

comment="end short")

//short strategy

//goShort() => crossunder(dema1, ema1) and atrp > maFilter

//KillShort() => crossover(dema1, ema1)

//strategy.entry("SHORT", strategy.short, when = goShort())

//strategy.close("COVER", when = KillShort())