概述

本策略通过计算不同周期的SMA均线,实现均线的金叉和死叉形态,进而产生买入和卖出信号,属于一种典型的趋势跟踪策略。

策略原理

- 计算5日线(sma5)、20日线(sma20)、200日线(sma200)三条不同周期的SMA均线

- 当短周期均线从下方向上突破长周期均线时,产生买入信号

- 当短周期从上方向下跌破长周期均线时,产生卖出信号

- 根据买入和卖出信号进行交易

以5日线和200日线的交叉为例,当5日线上穿200日线时,表示市场步入短线看涨,产生买入信号;当5日线下破200日线时,表示市场步入短线看跌,产生卖出信号。通过捕捉不同周期均线的交叉形态,可以顺势捕捉市场趋势。

策略优势

- 操作简单,容易实施。仅需要计算几条不同周期的SMA均线,通过简单的均线交叉形态来判断入市和出场。

- 对市场大趋势比较敏感,能利用趋势效应获利。例如5日线上穿200日线时,市场正处于中长线看涨状态,这时买入股票,可乘势而上。

- 回撤和亏损风险较小。当市场出现较大调整时,均线交叉策略会及时发出卖出信号,可以有效控制回撤。

风险及对策

- 容易产生错失信号。当市场震荡行情时,均线可能出现多次的错误交叉,带来不必要的交易频率和成本。可以适当调整持仓周期,过滤掉一些短线噪音。

- 调整周期选择很关键。如果均线参数选择不当,产生信号的效果可能不理想。应根据不同品种确定适合的均线周期组合。

- 无法对付特大震荡。遇到重大黑天鹅事件,均线交叉策略可能会损失惨重。这时应暂停策略,转为人工操作。

策略优化方向

1.加入其他指标过滤。可以在均线交叉信号出现时,再参考MACD、KDJ等其他技术指标,避免在震荡行情中产生错误信号。

结合趋势判断指标。例如实例中用5日线和200日线构建买卖点。可再结合例如ADX指标判断趋势强弱,仅在趋势 sufficient 时执行信号。

使用自适应均线。根据市场情况和波动率,实时调整均线参数,使交易信号更实用。

多品种组合。将策略套用在不同类型的股票和外汇品种,进行策略组合,可以提高策略效果。

总结

本策略通过简单的SMA均线交叉形态来判断市场走势,实现了一种典型的趋势跟踪策略。优点是简单易操作,可以有效捕捉大趋势;而缺点在于容易产生错误信号,对市场大震荡无法应对。未来可从过滤信号、优化参数等方面进行策略改进与优化。

策略源码

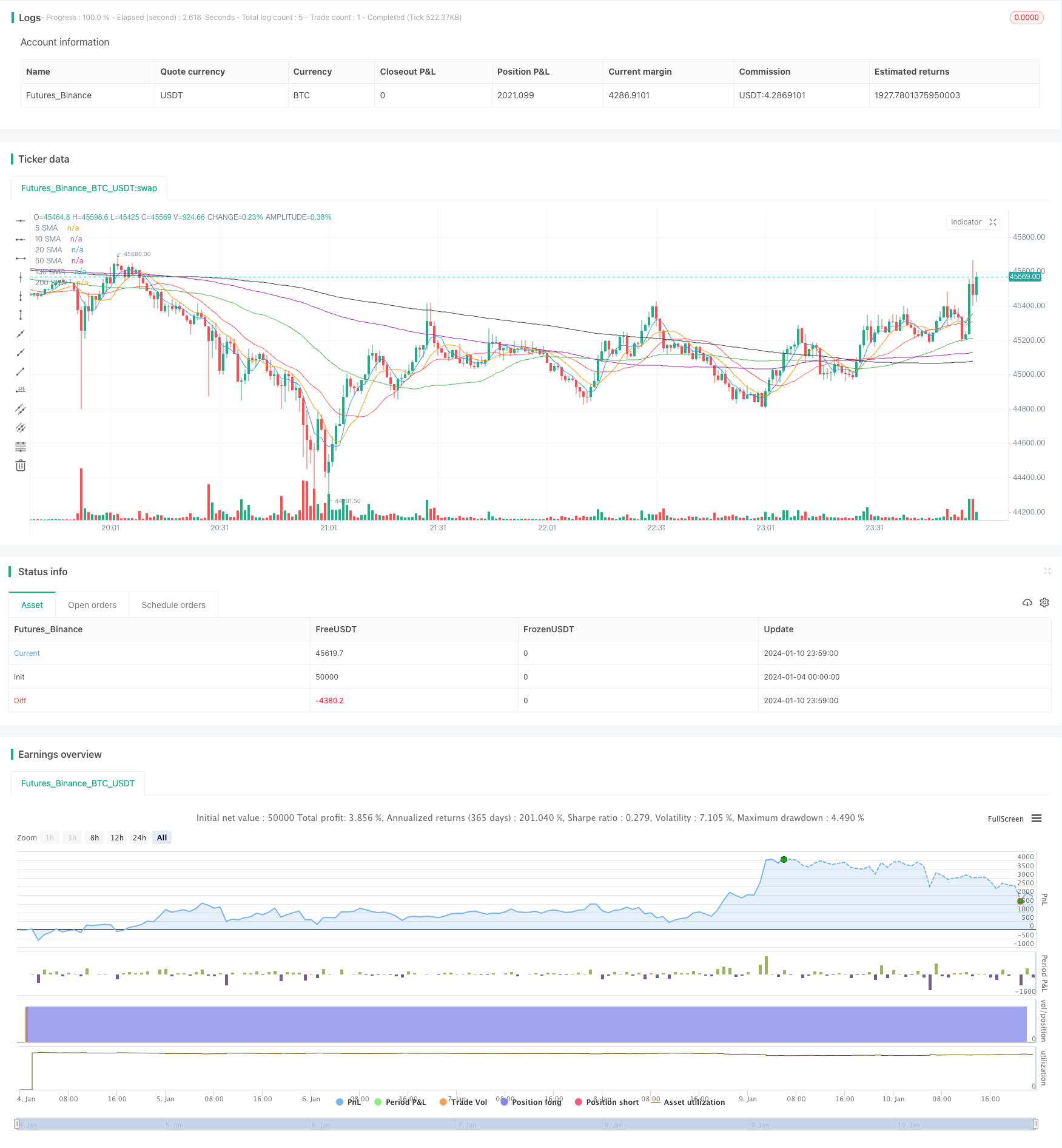

/*backtest

start: 2024-01-04 00:00:00

end: 2024-01-11 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SMA Crossover Strategy", overlay=true)

// Define SMAs

sma5 = sma(close, 5)

sma10 = sma(close, 10)

sma20 = sma(close, 20)

sma50 = sma(close, 50)

sma130 = sma(close, 130)

sma200 = sma(close, 200)

// Plot SMAs on the chart

plot(sma5, color=color.blue, title="5 SMA")

plot(sma10, color=color.orange, title="10 SMA")

plot(sma20, color=color.red, title="20 SMA")

plot(sma50, color=color.green, title="50 SMA")

plot(sma130, color=color.purple, title="130 SMA")

plot(sma200, color=color.black, title="200 SMA")

// Generating the buy and sell signals

buySignal = crossover(sma5, sma200)

sellSignal = crossunder(sma5, sma200)

// Execute trades based on signals

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Sell")