概述

本策略基于MACD指标以及长线和平仓线,实现了货币对的长线交易。当MACD指标线穿过长线时进行开仓,当MACD指标线穿过平仓线时进行平仓。同时设置了止损策略。

策略原理

该策略使用MACD指标的快线和慢线。快线参数为12日EMA,慢线参数为26日EMA。两条均线之间差值为MACD柱状图。另外计算9日EMA作为讯号线。当MACD柱状图上穿0.04时做多,下穿0.015时平多单。同时设置了5%的止损。

具体来说,策略首先计算MACD指标的快线、慢线和信号线。然后设置长线为-0.04,平仓线为0.015。如果当前MACD柱状图大于长线,进行做多;如果当前MACD柱状图小于平仓线,进行平多仓。此外,设置止损线为开仓价格的95%。

优势分析

该策略具有以下优势:

- 使用MACD指标判断行情趋势,准确率较高

- 同时使用长线和平仓线双重过滤,避免错误信号

- 设置止损策略,有效控制风险

- 简单明了,逻辑清晰,易于理解与实施

- 仅需和MACD指标,资源占用低

风险分析

该策略也存在一定风险:

- MACD指标具有一定滞后性,可能错过短线机会

- 止损设置可能过于保守,无法持续跟踪长线趋势

- 参数设置需要反复测试优化,否则可能过拟合

- 仅适用于,其他货币对效果存疑

可以通过适当调整参数、组合其他指标等方法来优化和改进。

优化方向

该策略可以从以下几个方面进行优化:

- 测试不同的MACD参数组合,寻找更优参数

可以尝试不同长度的快线、慢线、信号线,找到更合适的组合

- 更换其他指标试探

例如RSI,KD等指标可能带来截然不同的效果

- 优化长线和平仓线参数

可以通过反复回测数据,寻找更合适的长平仓参数

- 调整止损策略

可以考虑trailing stop等方法,让止损更加动态跟踪

- 测试多种货币对

将策略运用到其他货币对,考察效果

总结

本策略overall是一个非常简单直观的长线交易策略。利用MACD指标判断行情,并设置双重过滤条件减少误交易。同时配置了止损来控制风险。该策略逻辑清晰,资源占用低,易于理解和实施,值得推荐。当然,通过参数优化、指标调整等手段,该策略还有很大的改进空间,可以使效果更加出色。

策略源码

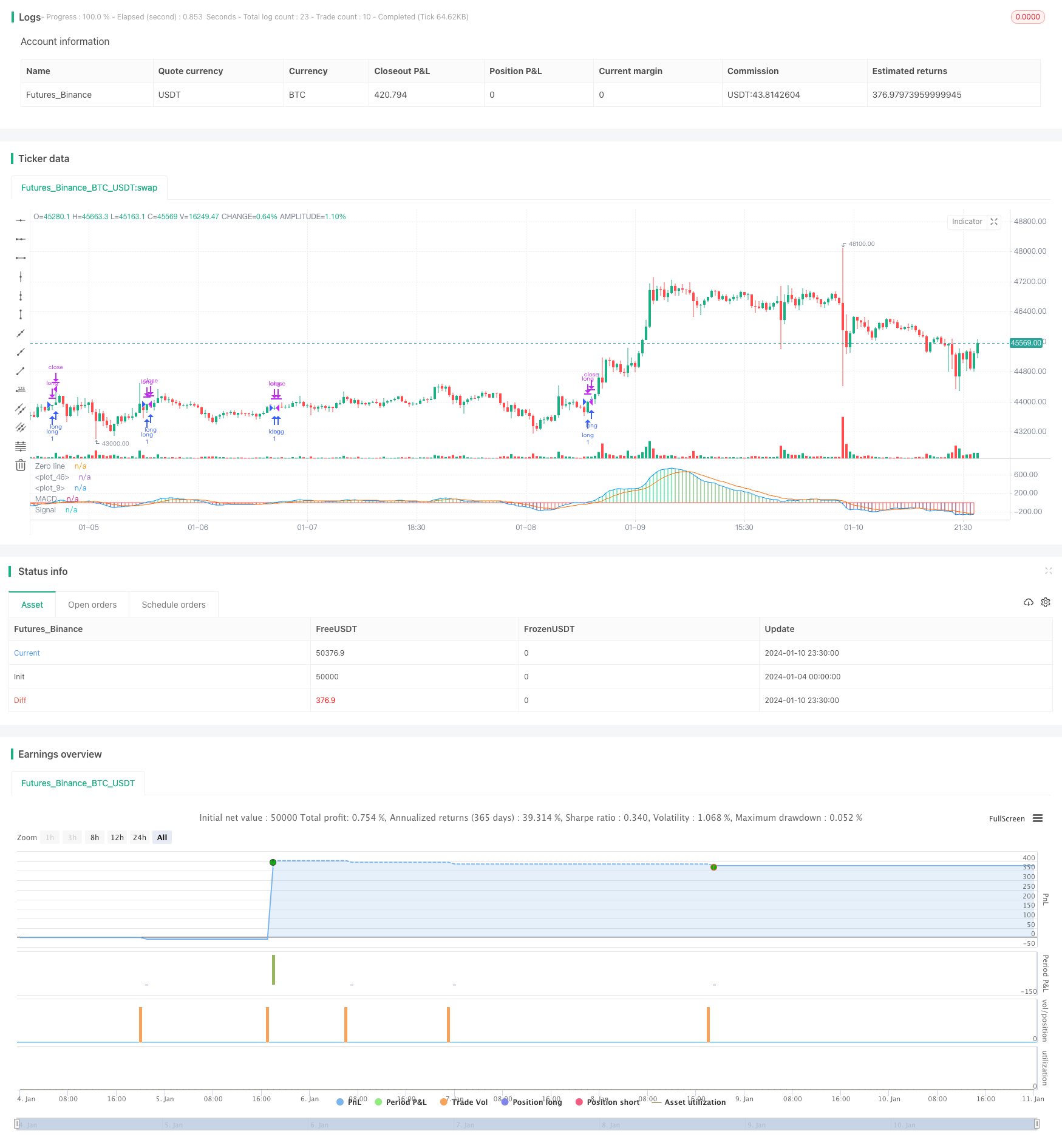

/*backtest

start: 2024-01-04 00:00:00

end: 2024-01-11 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(shorttitle = "GBPJPY MACD", title = "GBPJPY MACD")

fastMA = input(title="Fast moving average", defval = 12, minval = 7)

slowMA = input(title="Slow moving average", defval = 26, minval = 7)

lastColor = yellow

[currMacd,_,_] = macd(close[0], fastMA, slowMA, 9)

[prevMacd,_,_] = macd(close[1], fastMA, slowMA, 9)

plotColor = currMacd > 0 ? currMacd > prevMacd ? lime : green : currMacd < prevMacd ? maroon : red

plot(currMacd, style = histogram, color = plotColor, linewidth = 3)

plot(0, title = "Zero line", linewidth = 1, color = gray)

//MACD

// Getting inputs

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

src = input(title="Source", defval=close)

signal_length = input(title="Signal Smoothing", minval = 1, maxval = 50, defval =9)

sma_source = input(title="Simple MA(Oscillator)", type=bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

//plot(hist, title="Histogram", style=columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

///END OF MACD

//Long and Close Long Lines

linebuy = input(title="Enter Long", type=float, defval=-0.04)

linesell = input(title="Close Long", type=float, defval=0.015)

//Plot Long and Close Long Lines

plot(linebuy,color=green),plot(linesell,color=red)

//Stop Loss Input

sl_inp = input(0.05, title='Stop Loss %', type=float)/100

//Order Conditions

longCond = crossover(currMacd, linebuy)

exitLong = crossover(currMacd, linesell)

stop_level = strategy.position_avg_price * (1 - sl_inp)

//Order Entries

strategy.entry("long", strategy.long, when=longCond==true)

strategy.close("long", when=exitLong==true)

strategy.exit("Stop Loss", stop=stop_level)