概述

该策略通过结合123反转策略和CMO均线策略,形成买卖信号的组合。123反转策略通过股票连续两天收盘价形成新的高点或低点,结合随机指标判断市场买卖力度,产生交易信号。CMO均线策略则利用CMO指标判断价格动量,产生交易信号。两种策略信号结合,可形成更可靠的组合信号。

策略原理

123反转策略运用以下原理产生交易信号:

- 当收盘价连续两天上涨,且9日随机指标低于50时,做多

- 当收盘价连续两天下跌,且9日随机指标高于50时,做空

该策略通过判断价格在短期内是否形成新的高点或低点,结合随机指标的多空指标,产生交易信号。

CMO均线策略运用以下原理产生交易信号:

- 计算5日、10日和20日的CMO值

- 求出其平均值

- 当平均CMO高于70时,做多

- 当平均CMO低于-70时,做空

该策略通过对不同周期CMO值的集合运算,判断价格动量指标的多空,产生交易信号。

组合策略对两个策略的信号进行AND运算,即两个策略的信号同时做多或同时做空时,该组合策略才产生实际的交易信号。

策略优势

该策略具有以下优势:

- 组合信号更加可靠,可减少虚假信号

- 123反转策略适合捕捉短期调整后的趋势

- CMO均线策略判断大级别价格动量

- 可适应不同市场环境

风险分析

该策略也存在以下风险:

- 123反转策略对价格的形态依赖较高,可能出现失效

- CMO指标对市场震荡敏感,可能产生错误信号

- 组合策略的信号可能过于保守,漏失交易机会

- 需要适当调整参数,使之适应不同周期和市场环境

对策有:

- 优化反转策略的形态判断规则

- 在CMO均线策略中加入其他辅助指标

- 评估最近一段时间的策略效果,动态调整参数

优化方向

该策略可从以下方面进行优化:

- 使用机器学习算法自动优化组合权重

- 增加自适应调参模块,使策略参数动态优化

- 增加止损模块,有效控制风险

- 评估策略健壮性,改进形态识别算法

- 结合行业选择、基本面等因素

总结

该策略通过123反转和CMO均线两种互补性强的策略,形成有效的组合交易策略。在控制风险的前提下,可产生稳定的超额收益。随着算法和模型的不断优化,期待该策略的收益率和稳定性获得进一步提高。

策略源码

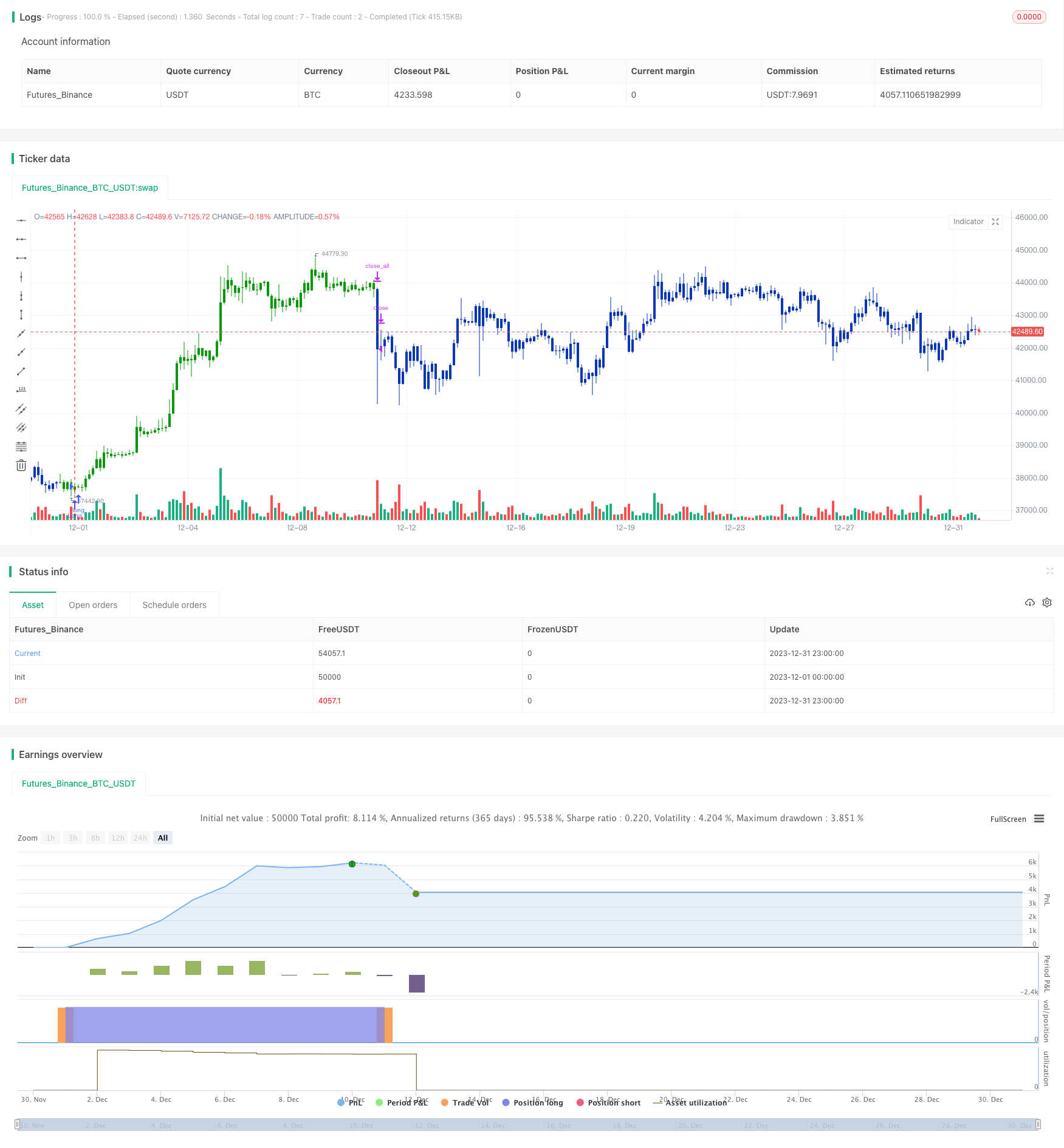

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/09/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator plots average of three different length CMO's. This indicator

// was developed by Tushar Chande. A scientist, an inventor, and a respected

// trading system developer, Mr. Chande developed the CMO to capture what he

// calls "pure momentum". For more definitive information on the CMO and other

// indicators we recommend the book The New Technical Trader by Tushar Chande

// and Stanley Kroll.

// The CMO is closely related to, yet unique from, other momentum oriented

// indicators such as Relative Strength Index, Stochastic, Rate-of-Change, etc.

// It is most closely related to Welles Wilder?s RSI, yet it differs in several ways:

// - It uses data for both up days and down days in the numerator, thereby directly

// measuring momentum;

// - The calculations are applied on unsmoothed data. Therefore, short-term extreme

// movements in price are not hidden. Once calculated, smoothing can be applied to

// the CMO, if desired;

// - The scale is bounded between +100 and -100, thereby allowing you to clearly see

// changes in net momentum using the 0 level. The bounded scale also allows you to

// conveniently compare values across different securities.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

CMOav(Length1,Length2,Length3, TopBand, LowBand) =>

pos = 0

xMom = close - close[1]

xMomabs = abs(close - close[1])

nSum1 = sum(xMom, Length1)

nSumAbs1 = sum(xMomabs, Length1)

nSum2 = sum(xMom, Length2)

nSumAbs2 = sum(xMomabs, Length2)

nSum3 = sum(xMom, Length3)

nSumAbs3 = sum(xMomabs, Length3)

nRes = 100 * (nSum1 / nSumAbs1 + nSum2 / nSumAbs2 + nSum3 / nSumAbs3 ) / 3

pos := iff(nRes > TopBand, 1,

iff(nRes < LowBand, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & CMOav", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Length1 = input(5, minval=1)

Length2 = input(10, minval=1)

Length3 = input(20, minval=1)

TopBand = input(70, minval=1)

LowBand = input(-70, maxval=-1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posCMOav = CMOav(Length1,Length2,Length3, TopBand, LowBand)

pos = iff(posReversal123 == 1 and posCMOav == 1 , 1,

iff(posReversal123 == -1 and posCMOav == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )