概述

本策略名称为“双均线叠加RSI指标的量化交易策略”。该策略通过计算股票的双均线指标与RSI指标的叠加来识别股票的超买超卖情况,在股票被低估时建立多头头寸,被高估时建立空头头寸,实现对冲套利。

策略原理

双均线叠加RSI指标的量化交易策略通过计算%K线与%D线的交叉情况判断超买超卖。其中,%K线计算为该股票收盘价的K天简单移动平均值,%D线则计算%K线的D天简单移动平均值。当%K线从下方上穿%D线时,认为股票被低估,应建立多头头寸;当%K线从上方下穿%D线时,认为股票被高估,应建立空头头寸。

同时,该策略还结合RSI指标判断股票的超买超卖情况。RSI指标反映该股票的涨跌速度变化,当RSI低于50%时表示股票被低估,高于60%时表示股票被高估。

综合双均线指标与RSI指标,当%K线从下方上穿%D线且RSI低于50%时,判定股票被严重低估,应建立多头头寸;当%K线从上方下穿%D线且RSI高于60%时,判定股票被严重高估,应建立空头头寸。

策略优势

- 结合双均线指标与RSI指标判断超买超卖,避免单一指标判断的错误率

- 可灵活配置均线参数与RSI参数,适应不同股票的特征

- 实时监控股票涨跌速度变化,及时调整仓位

- 可配置仅做多或仅做空,降低操作风险

策略风险

- 双均线与RSI指标存在一定滞后,可能错过最佳开仓时机

- 需要对股票特征有深入研究,参数设置不当可能导致交易频繁或无法开仓

- 需配置止损策略,防止亏损扩大

风险解决方法:

- 结合其他指标避免价格跳空造成的损失

- 增加回测周期和样本量,测试参数设置的稳定性

- 设定止损位,加大仓位等方法控制风险

策略优化

- 结合交易量指标避免虚假突破

- 增加开仓条件,避免频繁交易造成交易费用过高

- 优化仓位控制模型,在高确信度下加大仓位

需要增加交易量指标与其他指标结合判断,确保突破信号的可靠性,避免虚假信号带来损失。同时,优化仓位控制模型,在高确信度下适当加大仓位可以获得更高收益。

总结

双均线叠加RSI指标的量化交易策略通过双均线指标和RSI指标的叠加使用判断股票的超买超卖情况,在股票被低估时做多,被高估时做空,实现对冲套利。该策略充分利用了双均线指标的价格捕捉能力与RSI指标的超买超卖判断能力,避免了单一指标判断的限制。通过灵活参数配置,可以适用于不同股票;并可进一步优化,在控制风险的前提下获得更高收益。

策略源码

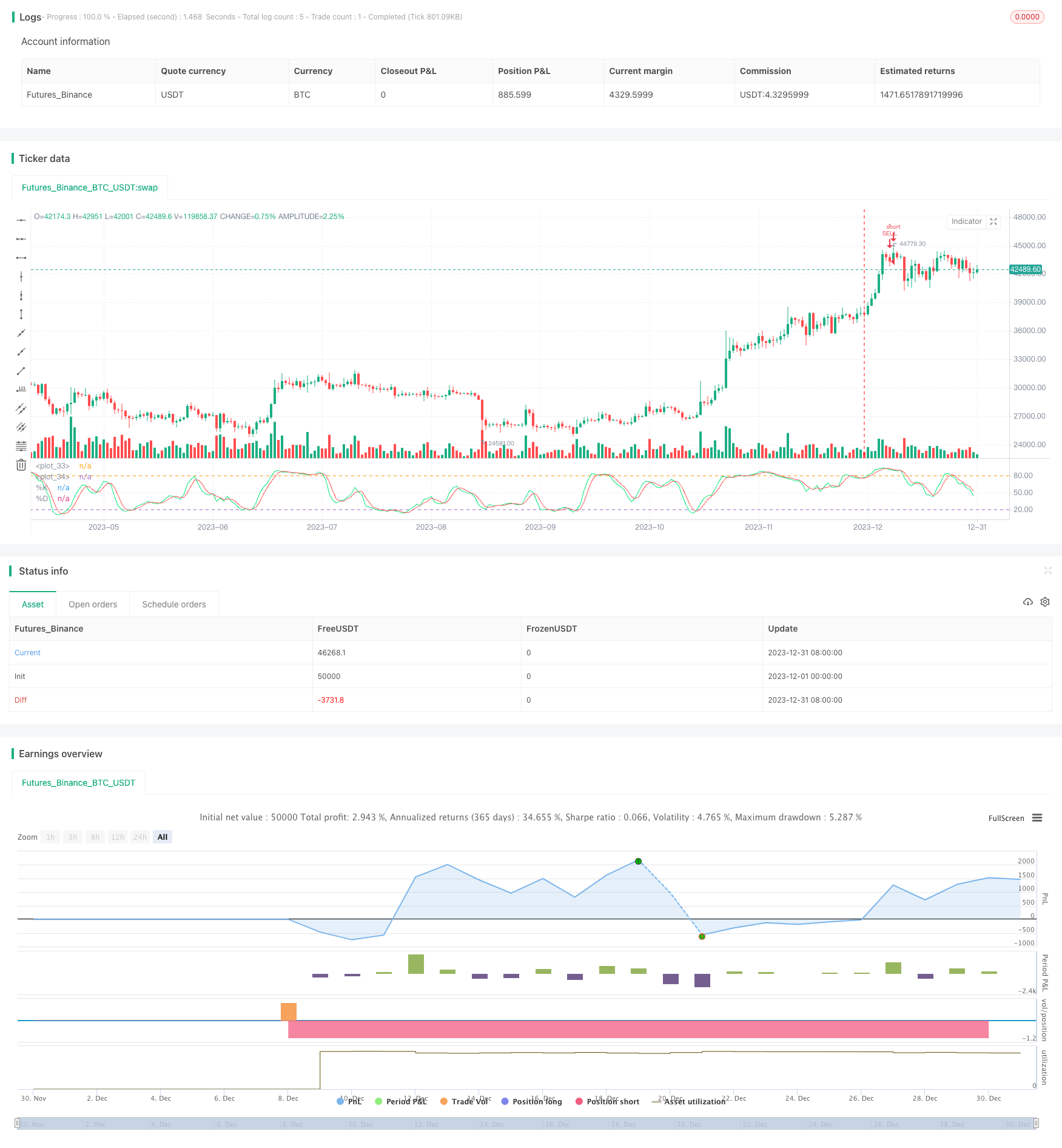

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="Easy to Use Stochastic + RSI Strategy", overlay=false)

//// Only Enter Long Positions /////

// strategy.risk.allow_entry_in(strategy.direction.long)

///// Backtest Start Date /////

startDate = input(title="Start Date", defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", defval=2014, minval=1800, maxval=2100)

afterStartDate = true

///// Create inputs /////

// Stochastics //

periodK = input(14, title="K", minval=1)

periodD = input(3, title="D", minval=1)

smoothK = input(3, title="Smooth", minval=1)

k = sma(stoch(close, high, low, periodK), smoothK)

d = sma(k, periodD)

// RSI Values //

rsivalue = rsi(close, 14)

///// Plot Stochastic Values and Lines /////

plot(k, title="%K", color=lime)

plot(d, title="%D", color=red)

h0 = hline(80)

h1 = hline(20)

fill(h0, h1, color=purple, transp=80)

///// Submit orders /////

if (afterStartDate and crossover(k, d) and k<20 and rsivalue<50)

strategy.entry(id="BUY", long=true)

if (afterStartDate and crossunder(k, d) and k>80 and rsivalue>60)

strategy.entry(id="SELL", long=false)