概述

该策略基于PIVOT高低点和突破来判断加密货币的趋势反转,属于突破反转类策略。策略首先计算标的物最近一段时间的最高价和最低价PIVOT点,然后判断价格是否突破这些关键点位后发生反转,以捕捉大的趋势变化。

策略原理

- 计算PIVOT高低点

使用ta.pivothigh()和ta.pivotlow()函数计算最近一定bar数的最高价点和最低价点作为关键PIVOT点。

- 判断突破

如果价格突破PIVOT低点向上,或者突破PIVOT高点向下,则判断趋势发生反转。

- 设置过滤条件

需要价格较PIVOT点有一定幅度突破,并且突破150bar的收盘价,避免被套。

- 入场和出场

触发买入条件后做多入场,触发卖出条件后平掉多单。类似判断空单入场和出场。

优势分析

- 使用PIVOT点判断,对大的趋势变化比较敏感

- 有效过滤加入震荡趋势中,确保趋势反转后入场

- 由于判断高低PIVOT点突破,能及时捕捉反转机会

风险分析

- 大周期震荡容易使策略被套

- 需要调整PIVOT点长度和过滤条件来适应不同标的物

- 需要确保交易所手续费接近于零,否则盈亏受影响较大

优化方向

- 可以测试不同的PIVOT参数组合

- 可以添加移动止损来控制单笔损失

- 可以结合其他指标判断过滤信号

总结

该策略整体较为稳健,适合捕捉大幅反转。但需要注意控制风险,调整参数适应不同币种。相信在参数优化和风控的基础上,该策略可以取得较好的效果。

策略源码

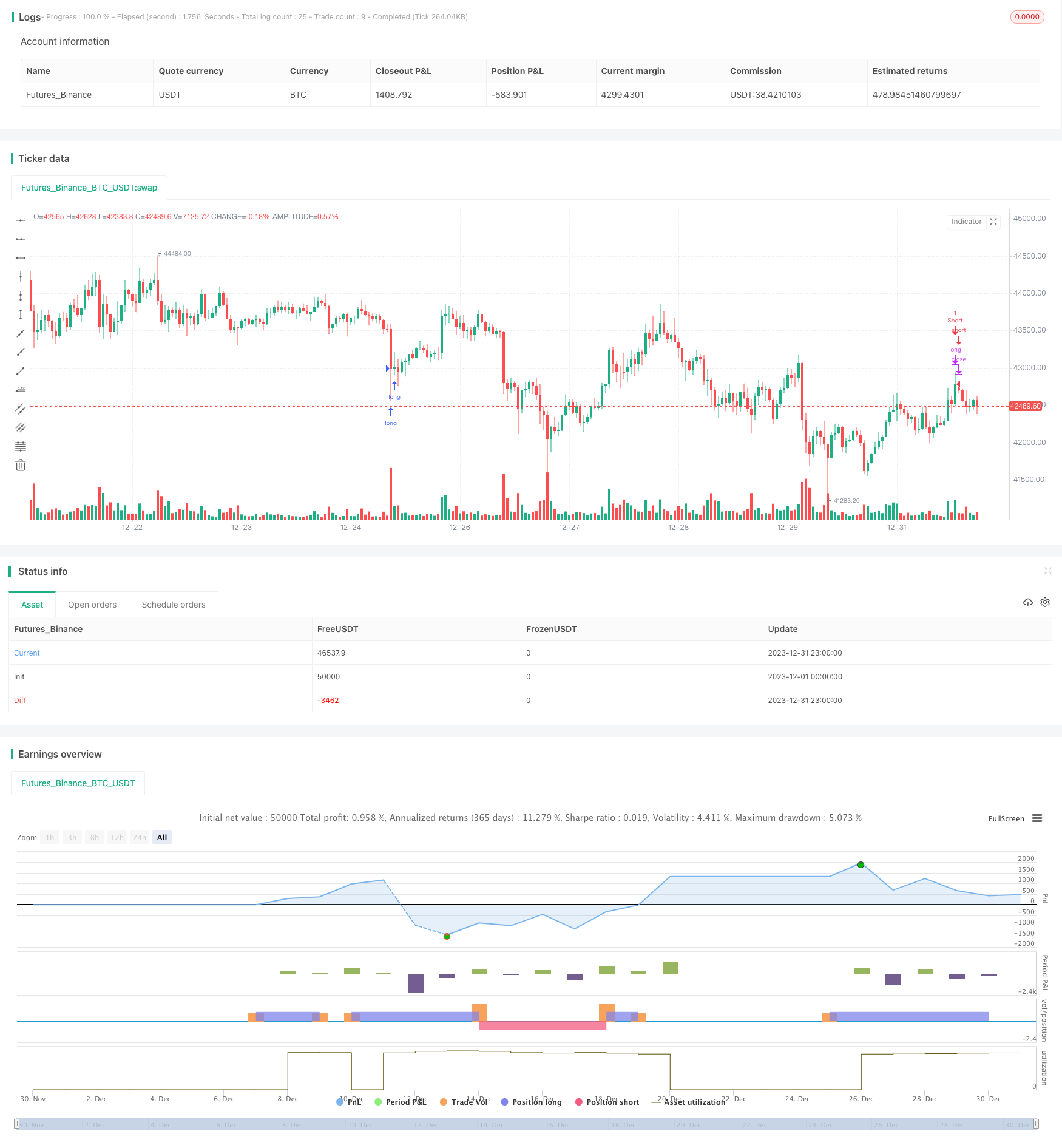

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nkrastins95

//@version=5

strategy("Swing Hi Lo", overlay=true, margin_long=100, margin_short=100)

//-----------------------------------------------------------------------------------------------------------------------//

tf = input.timeframe(title="Timeframe", defval="")

gr="LENGTH LEFT / RIGHT"

leftLenH = input.int(title="Pivot High", defval=10, minval=1, inline="Pivot High",group=gr)

rightLenH = input.int(title="/", defval=10, minval=1, inline="Pivot High",group=gr)

colorH = input(title="", defval=color.red, inline="Pivot High",group=gr)

leftLenL = input.int(title="Pivot Low", defval=10, minval=1, inline="Pivot Low", group=gr)

rightLenL = input.int(title="/", defval=10, minval=1, inline="Pivot Low",group=gr)

colorL = input(title="", defval=color.blue, inline="Pivot Low",group=gr)

//-----------------------------------------------------------------------------------------------------------------------//

pivotHigh(ll, rl) =>

maxLen = 1000

float ph = ta.pivothigh(ll, rl)

int offset = 0

while offset < maxLen

if not na(ph[offset])

break

offset := offset + 1

ph[offset]

pivotLow(ll, rl) =>

maxLen = 1000

float pl = ta.pivotlow(ll, rl)

int offset = 0

while offset < maxLen

if not na(pl[offset])

break

offset := offset + 1

pl[offset]

//-----------------------------------------------------------------------------------------------------------------------//

ph = request.security(syminfo.tickerid, tf, pivotHigh(leftLenH, rightLenH), barmerge.gaps_off, barmerge.lookahead_on)

pl = request.security(syminfo.tickerid, tf, pivotLow(leftLenL, rightLenL), barmerge.gaps_off, barmerge.lookahead_on)

drawLabel(_offset, _pivot, _style, _color) =>

if not na(_pivot)

label.new(bar_index[_offset], _pivot, str.tostring(_pivot, format.mintick), style=_style, color=_color, textcolor=#131722)

//-----------------------------------------------------------------------------------------------------------------------//

VWAP = ta.vwap(ohlc4)

longcondition = ta.crossunder(close,pl) and close > close[150]

exitcondition = close > ph

shortcondition = ta.crossover(close,ph) and close < close[150]

covercondition = close < pl

strategy.entry("long", strategy.long, when = longcondition)

strategy.close("long", when = exitcondition)

strategy.entry("Short", strategy.short, when = shortcondition)

strategy.close("Short", when = covercondition)