概述

本策略通过计算超级趋势指标判断价格趋势,并在趋势变化时建立做多或做空头寸。同时设置止损位和止盈位来控制风险。

策略原理

本策略使用ta.supertrend()函数计算超级趋势指标。超级趋势指标结合平均真实波幅和平均价格,可以判断价格是否处于上升趋势或下降趋势。当价格从下降趋势转为上升趋势时,通过ta.change()判断方向变化,建立做多头寸。当价格从上升趋势转为下降趋势时,建立做空头寸。

设置止损位stop_loss和止盈位profit,在建仓后设置止损单和止盈单,控制风险。

具体来说,策略通过以下步骤实现:

- 计算超级趋势指标方向

- 判断价格是否从下降趋势转为上升趋势,如果是,建立做多单

- 判断价格是否从上升趋势转为下降趋势,如果是,建立做空单

- 建仓后,为做多单设置止损价格和止盈价格

- 建仓后,为做空单设置止损价格和止盈价格

以上步骤可以有效捕捉价格趋势的变化,在合适时机建立仓位,并设置止损止盈来控制风险,是一种较为稳定的趋势跟踪策略。

策略优势分析

本策略最大的优势在于可以自动跟踪价格趋势的变化,无需人工判断。超级趋势指标对价格波动具有一定的滤波效果,可以有效识别价格趋势,避免在震荡行情中频繁开仓。

同时,策略设置了止损位和止盈位,可以自动止损止盈,有效控制单笔损失,锁定盈利。这对于量化交易而言非常重要。

相比于简单的移动平均线策略,本策略判断价格趋势的效果更佳,也更适合跟踪趋势性行情。

风险分析

本策略最大的风险在于超级趋势指标的参数设置。如果参数设置不当,则会导致策略运算效果不佳,识别趋势变化的效果差。如果ATR周期参数设置过大或因子参数设置过小,都会导致超级趋势指标对价格波动响应迟钝,错过最佳开仓时机。

此外,止盈位和止损位的设置也会对策略收益产生很大影响。如果止损距离过小,容易被突破;如果止盈距离过大,可能错过理想退出点。这些参数的最优设置需要根据不同市场行情和交易品种进行优化。

最后,与所有趋势跟踪策略一样,当价格突然反转或进入震荡区间时,也会给本策略带来损失。这需要通过严格的资金管理来控制。

优化方向

本策略可以从以下几个方面进行优化:

优化超级趋势指标的参数,包括ATR周期和因子参数。可以通过遍历回测获得最优参数组合。

增加仓位管理机制。可以根据收益率、回撤指标动态调整仓位。

增加机器学习模型判断趋势。可以训练模型辅助判断价格趋势,提高开仓准确性。

结合其他指标过滤交易信号。比如结合均线、波动率指标等避免错误开仓。

动态优化止盈止损距离。可以根据市场波动程度、仓位大小等调整止盈止损参数。

以上几个方向都可以进一步提高策略收益率和稳定性。

总结

本策略总体来说是一个非常实用的趋势跟踪策略。它可以自动跟踪价格趋势变化,合理设置止损止盈来控制风险。与简单的移动平均线策略相比,判断价格趋势的效果更佳,更适合趋势性行情。通过一定程度的参数优化与机器学习模型辅助,本策略可以进一步增强稳定性与收益表现。值得进一步研究与应用。

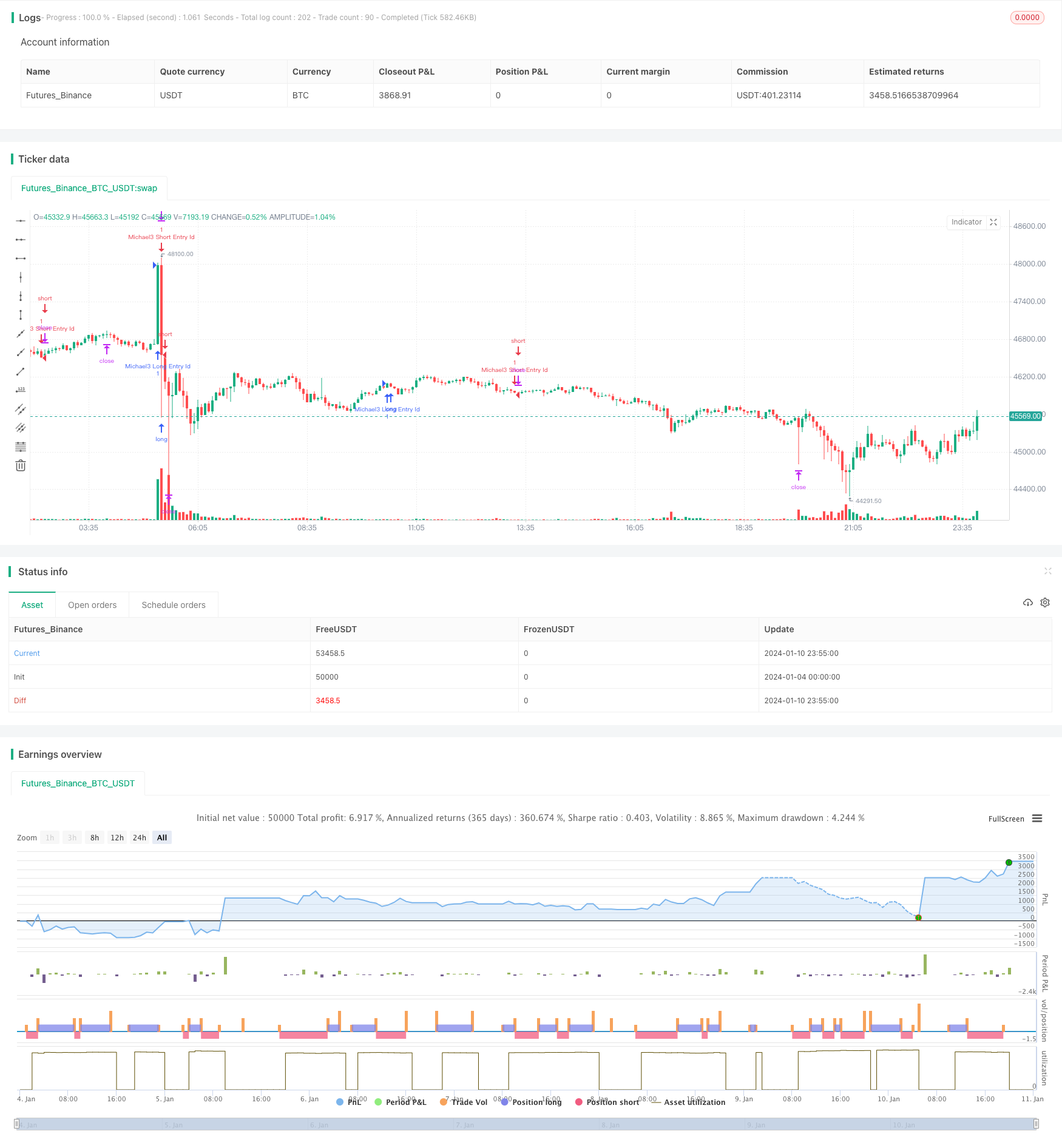

/*backtest

start: 2024-01-04 00:00:00

end: 2024-01-11 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supertrend Strategy", overlay=true, default_qty_type=strategy.percent_of_equity)

// Stop loss and profit amount

stop_loss = input(300, title="Stop Loss Amount")

profit = input (800, title="Profit Amount")

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[_, direction] = ta.supertrend(factor, atrPeriod)

long_condition = ta.change(direction) <0

short_condition = ta.change(direction) >0

long_condition_1= (long_condition)?1:0

short_condition_2 = (short_condition)?1:0

stop_price_long = ta.valuewhen(long_condition, low[0]-stop_loss,0)

profit_price_long = ta.valuewhen(long_condition, high[0]+profit,0)

stop_price_short = ta.valuewhen(short_condition, high[0]+stop_loss,0)

profit_price_short = ta.valuewhen(short_condition, low[0]-profit,0)

if (long_condition)

strategy.entry("Michael3 Long Entry Id", strategy.long)

if (short_condition)

strategy.entry("Michael3 Short Entry Id", strategy.short)

if (strategy.position_size>0)

strategy.exit("exit_long",from_entry="Michael3 Long Entry Id",limit=profit_price_long,stop=stop_price_long)

if (strategy.position_size<0)

strategy.exit("exit_short",from_entry="Michael3 Short Entry Id",limit=profit_price_short,stop=stop_price_short)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)