概述

该策略是一个简单的突破策略,它使用两个不同的零时滞后EMA的差值来跟踪标的物的上涨或下跌势头。当差值超过一定倍数的布林带时,根据基础EMA的方向生成做多或做空信号。

策略原理

该策略使用两个特殊类型的EMA指标来计算波动率差值。这两个EMA指标的计算公式为:

hJumper = math.max(src,ta.ema(src,lx))

lJumper = math.min(src,ta.ema(src,lx))

dif = (hJumper / lJumper) - 1

该指标立即响应价格的大幅波动,没有滞后。

当dif超过布林带上轨时,产生入场信号;当dif低于布林带中轨时,产生出场信号。基础EMA方向决定做多或做空方向。

优势分析

该策略最大的优势是捕捉突破信号的速度快,没有滞后。这是通过计算两个特殊的零时滞后EMA实现的。这使得策略可以即时响应价格突破事件,从而在趋势形成初期捕捉更高的效率。

另一个优势是该策略仅仅使用一个参数lx。参数少使得策略容易调优,也减少了过度优化的风险。

风险分析

该策略的主要风险在于突破信号可能出现假突破。当价格出现震荡时,可能会连续产生假突破。为了减少这样的风险,可以适当调大布林带倍数,使信号更加稳定。

另一个风险是在震荡行情中会出现频繁的小损益。这可以通过调整出场机制来缓解。比如设定止损或止盈价格。

优化方向

该策略可以从以下几个方面进行优化:

结合其他指标过滤入场信号,减少假突破的概率

增加止损止盈机制,管理持仓风险

引入交易量的确认,避免出现无量突破的假信号

使用自适应布林带参数,根据市场波动率调整参数

基于机器学习方法动态优化策略参数

总结

该即时突破波动率EMA策略通过计算零时滞后的EMA捕捉价格趋势的势头,具有响应迅速、参数简单等优点。下一步可以从过滤信号、止损止盈、交易量确认等方面进行优化,使策略在不同市场环境中都能稳定运行。

策略源码

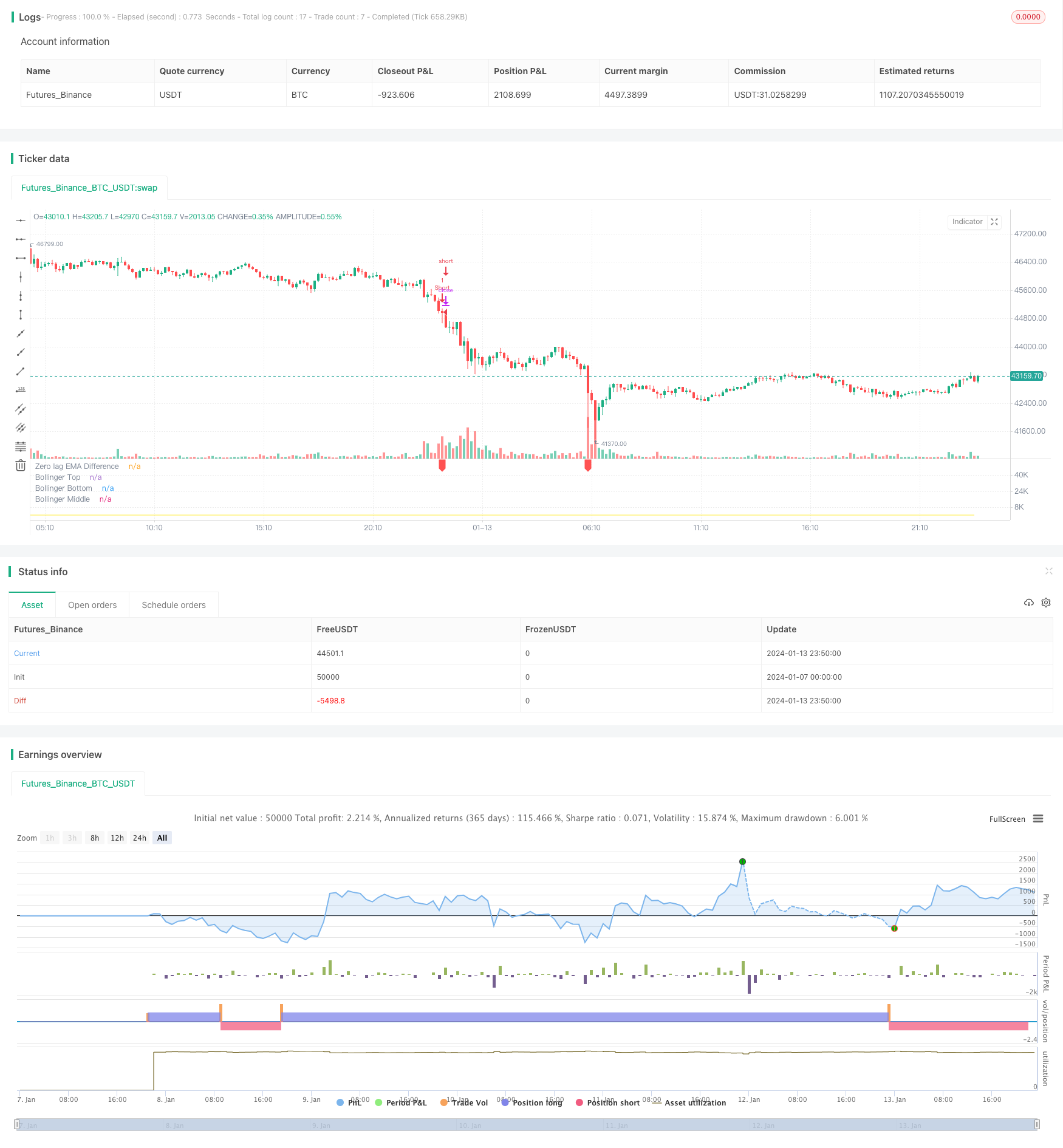

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © wbburgin

//@version=5

strategy("Zero-lag Volatility-Breakout EMA Trend Strategy",overlay=false)

tt1 = "If selected, the strategy will not close long or short positions until the opposite signal is received. This"+

" exposes you to more risk but potentially could generate larger returns."

src = input.source(close,"Source")

lx = input.int(200,"EMA Difference Length")

bbmult = input.float(2.0,"Standard Deviation Multiple")

useBinaryStrategy = input.bool(true,"Use Binary Strategy",tooltip = tt1)

hJumper = math.max(src,ta.ema(src,lx))

lJumper = math.min(src,ta.ema(src,lx))

dif = (hJumper / lJumper) - 1

[bbm,bbu,bbl] = ta.bb(dif,lx,bbmult)

plot(dif,color=color.white,title="Zero lag EMA Difference")

plot(bbu,color=color.lime,title="Bollinger Top")

plot(bbl,color=color.red,title="Bollinger Bottom")

plot(bbm,color=color.yellow,title="Bollinger Middle")

sigEnter = ta.crossover(dif,bbu)

sigExit = ta.crossunder(dif,bbm)

emaBase = ta.ema(src,lx)

enterLong = sigEnter and emaBase > emaBase[1]

enterShort = sigEnter and emaBase < emaBase[1]

plotshape(enterLong,style=shape.labelup,location=location.bottom,color=color.green,size=size.tiny)

plotshape(enterShort,style=shape.labeldown,location=location.top,color=color.red,size=size.tiny)

if enterLong

strategy.entry("Long",strategy.long)

if enterShort

strategy.entry("Short",strategy.short)

if not useBinaryStrategy and sigExit

strategy.close("Long")

strategy.close("Short")