概述

本策略基于双EMA指标和AC加速振荡指标设计。其中,双EMA指标用于判断价格趋势方向,而AC指标则用于确认趋势信号,实现过滤效果。该策略结合了趋势跟踪和信号过滤两大功能,旨在提高信号质量,在趋势中获利。

策略原理

该策略由两大模块组成:

双EMA模块

使用2日EMA和20日EMA构建双EMA指标。当价格上穿2日EMA时视为买入信号;当价格下破20日EMA时视为卖出信号。

该模块判断价格的短期和中期趋势方向,实现基本的趋势跟踪。

AC模块

使用AC加速振荡指标的正负值来确认趋势信号。只有当双EMA和AC指标同方向时,才产生交易信号。

该模块通过过滤假信号,提高了信号的可靠性。

综上,该策略整合双EMA判断大趋势,以及AC指标过滤假突破,形成系统性的趋势跟踪体系。

策略优势分析

本策略具有如下优势:

双EMA跟踪中长线趋势,AC滤除短期噪音,组合效果好。

信号过滤效果佳,可避免多头获利后盲目做空,或空头获利后盲目做多的情况。

调参数灵活,可配合不同品种和市场环境调整参数,适用面广。

策略思路清晰,容易理解,便于量化交易者优化和改进。

可在趋势型品种中获得不错的跟踪获利。

策略风险分析

本策略也存在一些风险:

双EMA参数设置不当可能错过较短的趋势或者产生多余交易。

AC参数设置不当可能过滤掉较弱的有效信号或者无法过滤足够的噪音。

无法应对急速变化的市场,如快速断崖式下跌。

无法在震荡市中获得足够盈利,应作为趋势跟踪策略使用。

策略优化方向

本策略可从以下维度进行优化:

测试更多参数组合,寻找更匹配不同品种特点的最优参数。

增加止损模块,在亏损过大时止损退出。

结合更多指标进行信号过滤优化。

开发长短线组合策略,在趋势中跟踪中长线,利用短线针对性交易为长线减仓加仓。

总结

本策略结合双EMA判趋势和AC滤噪的思路值得学习借鉴。该策略优势在于信号质量好,可靠性高,适合跟踪趋势型品种。如果参数调整合适,在趋势行情中可获得丰厚收益。

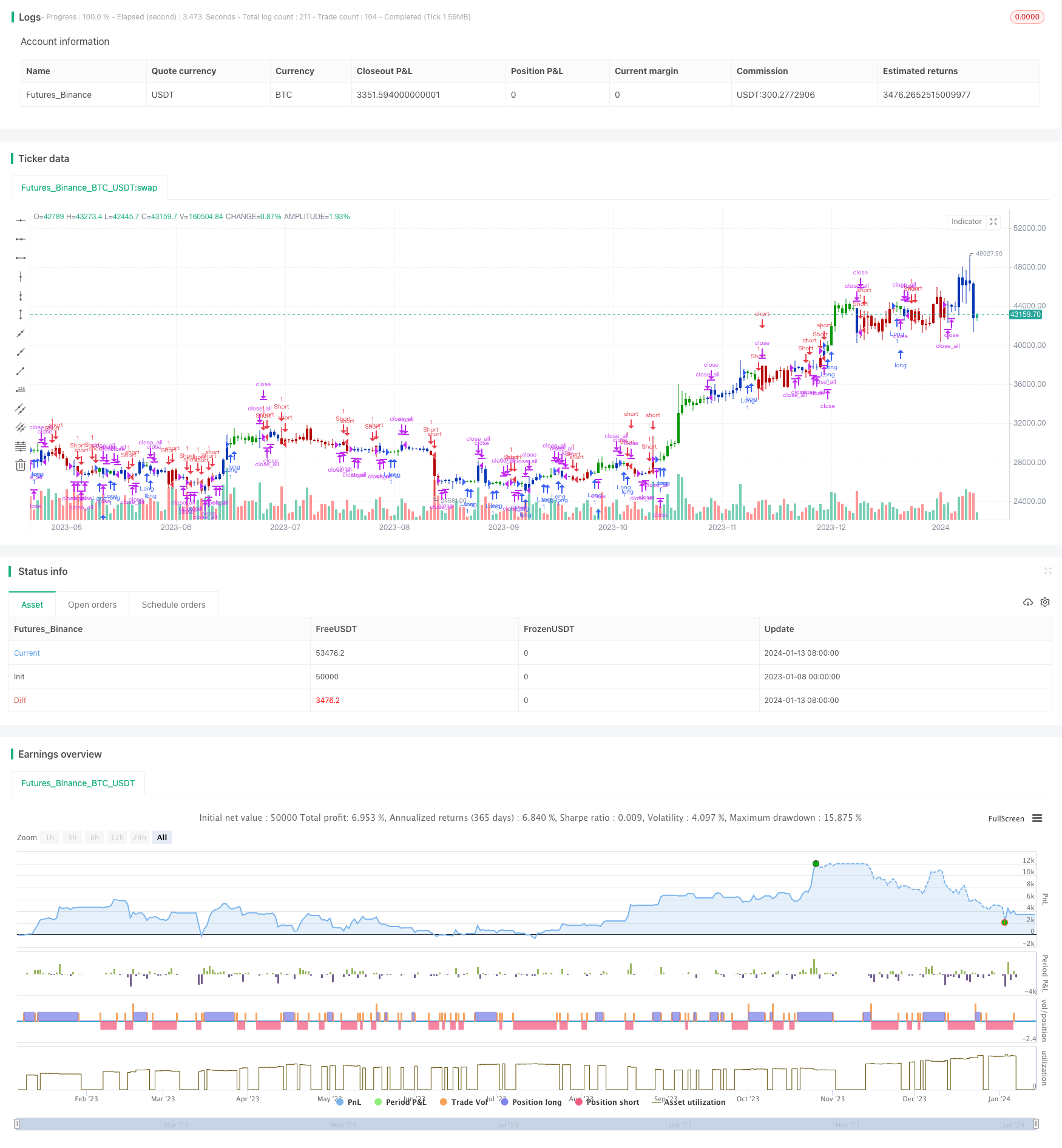

/*backtest

start: 2023-01-08 00:00:00

end: 2024-01-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/01/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// The Accelerator Oscillator has been developed by Bill Williams

// as the development of the Awesome Oscillator. It represents the

// difference between the Awesome Oscillator and the 5-period moving

// average, and as such it shows the speed of change of the Awesome

// Oscillator, which can be useful to find trend reversals before the

// Awesome Oscillator does.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

AC(nLengthSlow,nLengthFast) =>

pos = 0.0

xSMA1_hl2 = ta.sma(hl2, nLengthFast)

xSMA2_hl2 = ta.sma(hl2, nLengthSlow)

xSMA1_SMA2 = xSMA1_hl2 - xSMA2_hl2

xSMA_hl2 = ta.sma(xSMA1_SMA2, nLengthFast)

nRes = xSMA1_SMA2 - xSMA_hl2

cClr = nRes > nRes[1] ? color.blue : color.red

iff_1 = nRes > 0 ? 1 : nz(pos[1], 0)

pos := nRes < 0 ? -1 : iff_1

pos

strategy(title='Combo 2/20 EMA & Accelerator Oscillator (AC)', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Accelerator Oscillator ═════●'

nLengthSlow = input(33, title="Length Slow", group=I2)

nLengthFast = input(6, title="Length Fast", group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosAC = AC(nLengthSlow,nLengthFast)

iff_1 = posEMA20 == -1 and prePosAC == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosAC == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)