概述

该策略组合使用了11种不同类型的移动平均线的交叉来进行做多和做空。使用的11种移动平均线包括:简单移动平均线(SMA)、指数移动平均线(EMA)、加权移动平均线(WMA)、成交量加权移动平均线(VWMA)、平滑移动平均线(SMMA)、双指数移动平均线(DEMA)、三次指数移动平均线(TEMA)、赫尔移动平均线(HMA)、零滞后指数移动平均线(ZEMA)、三角移动平均线(TMA)和超平滑过滤器(SSMA)。

该策略允许配置两个移动平均线——一个较快的和一个较慢的,都从11种选择中选择。当较快的MA交叉超过较慢的MA时,会生成做多信号。当较快的MA交叉低于较慢的MA时,会生成做空信号。

附加功能包括梯形设置、止盈和止损水平。

策略逻辑

核心策略逻辑依赖于两个移动平均线之间的交叉来确定进入和退出。

进入条件是:

做多入场:快速MA > 慢速MA

做空入場:快速MA < 慢速MA

退出由以下三个标准中的一个确定:

- 止盈水平达到

- 止损水平达到

- 生成相反信号(移动平均线以相反方向交叉)

该策略允许配置关键参数,如MA类型和长度、梯形设置、止盈和止损百分比。这为根据不同的市场条件和风险偏好优化策略提供了灵活性。

优势

- 结合11种不同的MA类型以产生强大信号

- 主要参数配置灵活

- 止盈和止损功能保护利润、限制损失

- 梯形允许强势趋势中增加仓位

风险

- 和任何技术指标一样,MA交叉可能会生成错误信号

- 过度优化当前市场条件可能降低未来表现

- 硬止损过早退出了波动大的正确交易

可以通过为入场信号使用价位确认、使用追踪止损而不是硬止损以及避免过度优化来加强风险管理。

优化空间

可以通过几种方式改进该策略:

- 在入场前加入额外过滤器,如成交量和价位检查

- 系统地测试不同MA类型的表现,选择最佳的1-2种

- 针对特定交易品种和时间段优化MA长度

- 使用追踪止损替代硬止损

- 随着趋势加长添加分阶段止盈

总结

十一条移动平均线交叉策略提供了一种系统化交易交叉的方法。通过结合跨多种MA指标的信号并允许配置关键参数,它提供了一个强大且灵活的交易框架。优化和风险管理将发挥关键作用,以优化表现。该策略在动量交易中具有很强的潜力,但应根据不同的市场环境进行调整。

策略源码

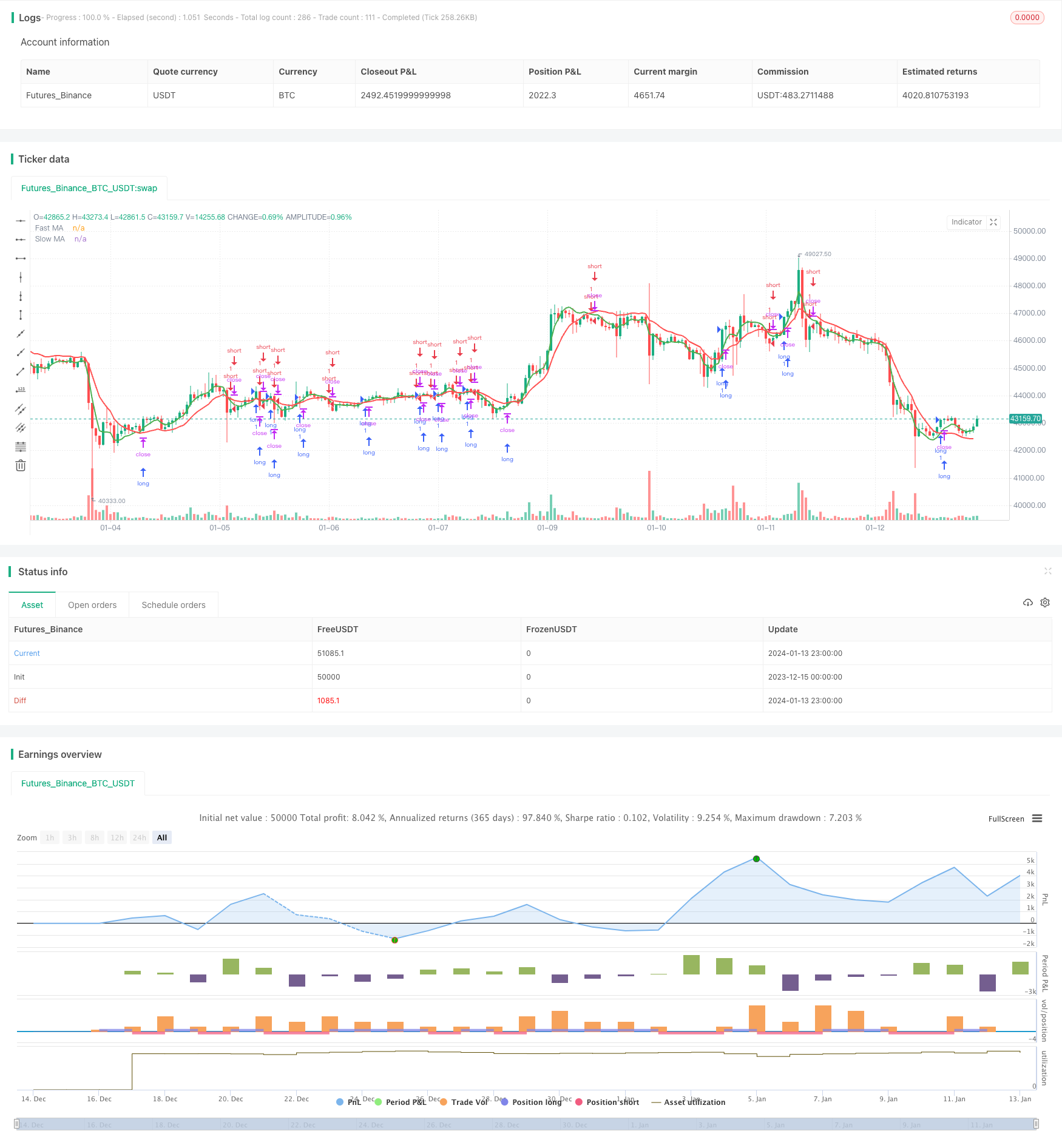

/*backtest

start: 2023-12-15 00:00:00

end: 2024-01-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "[STRATEGY] MA Cross Eleven", overlay = true)

// MA - type, source, length

// MA - type, source, length

// SMA --> Simple

// EMA --> Exponential

// WMA --> Weighted

// VWMA --> Volume Weighted

// SMMA --> Smoothed

// DEMA --> Double Exponential

// TEMA --> Triple Exponential

// HMA --> Hull

// TMA --> Triangular

// SSMA --> SuperSmoother filter

// ZEMA --> Zero Lag Exponential

type = input(defval="ZEMA", title="MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=8, title="Fast MA Length", minval=1)

srcclose1 = input(close, "Fast MA Source")

len2 = input(defval=21, title="Slow MA Length", minval=1)

srcclose2 = input(close, "Slow MA Source")

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = wma(src, len) // Weighted

v4 = vwma(src, len) // Volume Weighted

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v6 = 2 * v2 - ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v11 = sma(sma(src,len),len) // Triangular

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

// Zero Lag Exponential

e = ema(v2, len)

v10 = v2+(v2-e)

// return variant, defaults to SMA if input invalid.

type=="EMA"?v2 : type=="WMA"?v3 : type=="VWMA"?v4 : type=="SMMA"?v5 : type=="DEMA"?v6 : type=="TEMA"?v7 : type=="HullMA"?v8 : type=="SSMA"?v9 : type=="ZEMA"?v10 : type=="TMA"? v11: v1

ma_1 = variant(type, srcclose1, len1)

ma_2 = variant(type, srcclose2, len2)

plot(ma_1, title="Fast MA", color = green, linewidth=2, transp=0)

plot(ma_2, title="Slow MA", color = red, linewidth=2, transp=0)

longCond = na

shortCond = na

longCond := crossover(ma_1, ma_2)

shortCond := crossunder(ma_1, ma_2)

// Count your long short conditions for more control with Pyramiding

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if longCond

sectionLongs := sectionLongs + 1

sectionShorts := 0

if shortCond

sectionLongs := 0

sectionShorts := sectionShorts + 1

// Pyramiding Inputs

pyrl = input(1, "Pyramiding")

// These check to see your signal and cross references it against the pyramiding settings above

longCondition = longCond and sectionLongs <= pyrl

shortCondition = shortCond and sectionShorts <= pyrl

// Get the price of the last opened long or short

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? high[1] : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? low[1] : nz(last_open_shortCondition[1])

// Check if your last postion was a long or a short

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

// Take profit

isTPl = input(false, "Take Profit Long")

isTPs = input(false, "Take Profit Short")

tpl = input(3, "Take Profit Long %", type=float)

tps = input(30, "Take Profit Short %", type=float)

long_tp = isTPl and crossover(high, (1+(tpl/100))*last_open_longCondition) and in_longCondition == 1

short_tp = isTPs and crossunder(low, (1-(tps/100))*last_open_shortCondition) and in_shortCondition == 1

// Stop Loss

isSLl = input(false, "Stop Loss Long")

isSLs = input(false, "Stop Loss Short")

sl= 0.0

sl := input(3, "Stop Loss %", type=float)

long_sl = isSLl and crossunder(low, (1-(sl/100))*last_open_longCondition) and longCondition == 0 and in_longCondition == 1

short_sl = isSLs and crossover(high, (1+(sl/100))*last_open_shortCondition) and shortCondition == 0 and in_shortCondition == 1

// Create a single close for all the different closing conditions.

long_close = long_tp or long_sl ? 1 : 0

short_close = short_tp or short_sl ? 1 : 0

// Get the time of the last close

last_long_close = na

last_short_close = na

last_long_close := long_close ? time : nz(last_long_close[1])

last_short_close := short_close ? time : nz(last_short_close[1])

// Strategy entries

strategy.entry("long", strategy.long, when=longCondition == true, stop = open[1])

strategy.entry("short", strategy.short, when=shortCondition == true)

strategy.close("long", when = long_sl or long_tp)

strategy.close("short", when = short_sl or short_tp)