概述

极化分形效率(Polarized Fractal Efficiency,PFE)交易策略通过应用分形几何和混沌理论的概念,测量价格运动的效率。价格运动越线性和高效,两个点之间的距离就越短,价格运动的效率也就越高。

策略原理

PFE交易策略的核心指标是极化分形效率(PFE)。该指标基于下述公式计算:

PFE = sqrt(pow(close - close[Length], 2) + 100)

其中,Length为回看窗口期,该参数通过输入设置。PFE实际上是衡量价格在Length期间内运动的“长度”,它使用欧几里得距离(直线距离)来近似衡量。

为了评估价格运动的效率,我们需要一个用于对比的基准。这个基准是价格在Length期间内按照实际顺序连接而成路径的长度,称为C2C(Close to Close),计算公式如下:

C2C = sum(sqrt(pow((close - close[1]), 2) + 1), Length)

这样,我们就可以计算出价格运动的分形效率xFracEff:

xFracEff = iff(close - close[Length] > 0, round((PFE / C2C) * 100) , round(-(PFE / C2C) * 100))

如果价格上涨,分数为正值,如果下跌,则为负值。绝对值越大,表示运动越不效率。

为了产生交易信号,我们计算xEMA,即xFracEff的指数移动平均。并设定买入和卖出通道:

xEMA = ema(xFracEff, LengthEMA)

BuyBand = input(50)

SellBand = input(-50)

当xEMA上穿BuyBand generate买入信号;当xEMA下穿SellBand generate卖出信号。

优势分析

PFE交易策略具有以下优势:

- 应用独特的分形几何和混沌理论方法,从另一个角度衡量价格运动效率

- 回避常规技术指标的一些问题,如曲线拟合

- 可以通过调整参数找到适合不同市场环境的设置

- 交易规则简单清晰,容易实施

风险分析

PFE交易策略也存在以下风险:

- 和所有指标策略一样,参数优化困难,容易过度优化

- 在市场剧烈波动时,买卖信号可能不可靠

- 需谨慎处理极值,如价格突然出现间隙

- 需承受一定的时间滞后,产生信号时可能已经错过最佳入场点

优化方向

PFE交易策略可以从以下几个方面进行优化:

- 尝试不同的Length参数组合,找到最佳平衡点

- 优化买卖通道参数,降低错误交易概率

- 加入止损机制,控制单笔损失

- 结合其它指标,提高信号质量

- 动态调整参数,适应市场环境变化

总结

PFE交易策略立足于分形几何和混沌理论的角度,提出了一个新颖的方法来衡量价格运动的效率。相比常规技术指标,这种方法有其独特优势,但也面临一定程度的时间滞后,参数优化,信号质量方面的问题。通过不断测试与优化,PFE策略有望成为一个可靠的量化交易策略选择。

策略源码

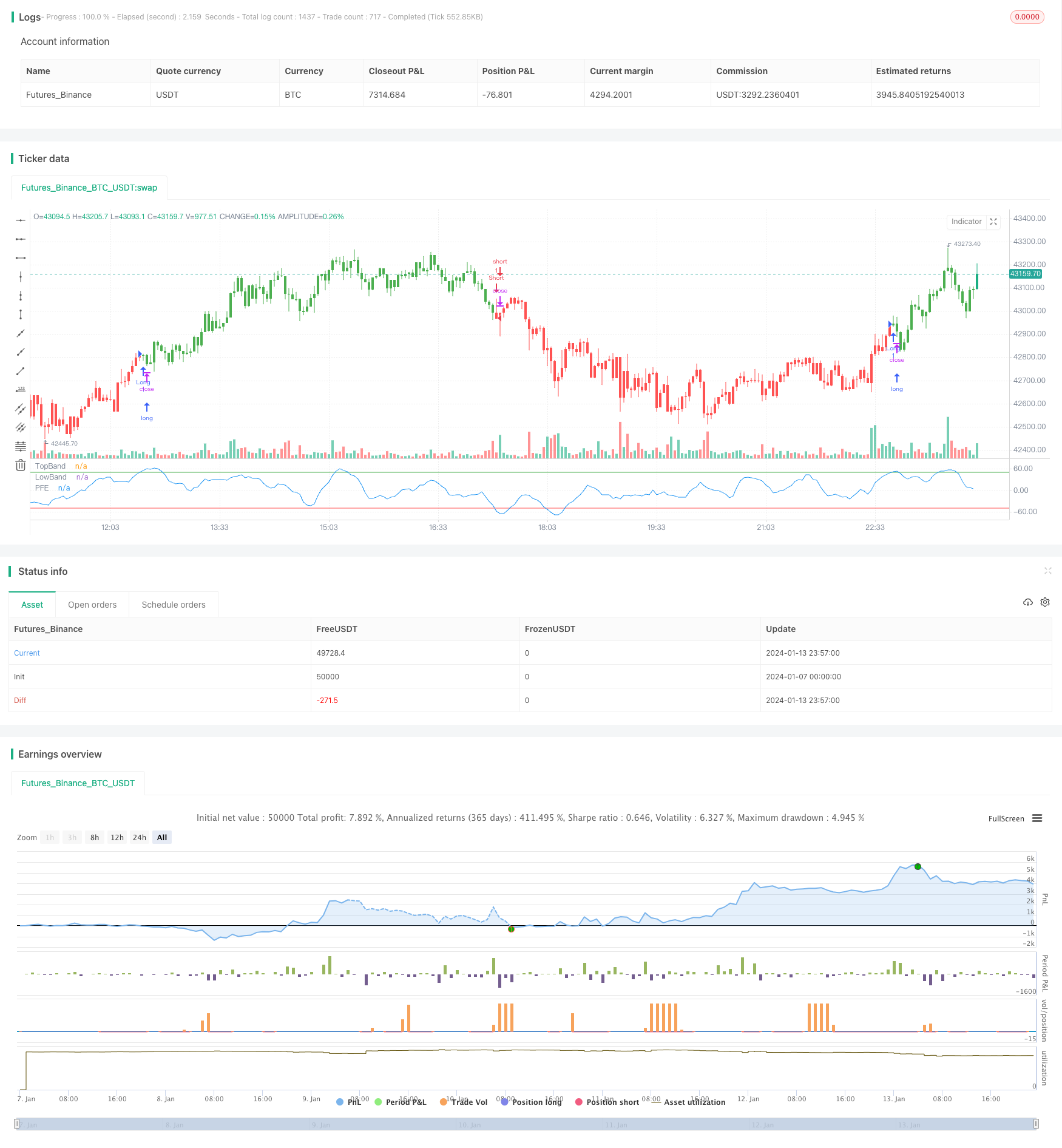

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 29/09/2017

// The Polarized Fractal Efficiency (PFE) indicator measures the efficiency

// of price movements by drawing on concepts from fractal geometry and chaos

// theory. The more linear and efficient the price movement, the shorter the

// distance the prices must travel between two points and thus the more efficient

// the price movement.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="PFE (Polarized Fractal Efficiency)", shorttitle="PFE (Polarized Fractal Efficiency)")

Length = input(9, minval=1)

LengthEMA = input(5, minval=1)

BuyBand = input(50, step = 0.1)

SellBand = input(-50, step = 0.1)

reverse = input(false, title="Trade reverse")

hline(BuyBand, color=green, linestyle=line, title = "TopBand")

hline(SellBand, color=red, linestyle=line, title = "LowBand")

PFE = sqrt(pow(close - close[Length], 2) + 100)

C2C = sum(sqrt(pow((close - close[1]), 2) + 1), Length)

xFracEff = iff(close - close[Length] > 0, round((PFE / C2C) * 100) , round(-(PFE / C2C) * 100))

xEMA = ema(xFracEff, LengthEMA)

pos = iff(xEMA < SellBand, -1,

iff(xEMA > BuyBand, 1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xEMA, color=blue, title="PFE")