概述

这个策略名为“BollingerBands趋势跟踪策略”,它使用BollingerBands指标判断价格趋势,并在价格突破BollingerBands通道时入场做多做空。它结合均线过滤器,在突破发生时判断趋势方向,从而决定做多做空。

策略原理

该策略主要依赖BollingerBands指标判断价格趋势和定位入场点。BollingerBands包含三条线:

- 中间线:n天的移动平均线

- 上线:往上移动n天标准差的距离

- 下线:往下移动n天标准差的距离

当价格从下线突破上线时,认为正在形成看涨趋势;当价格从上线突破下线时,认为正在形成看跌趋势。策略在这两种突破发生时入场做多做空。

具体来说,策略逻辑是:

- 当收盘价从Bands下线突破上线时,做多入场

- 当收盘价从Bands上线突破下线时,做空入场

为了过滤假突破,策略加入均线判断。只有当收盘价突破Bands的同时,也突破均线时,才会触发入场。

这里使用Exponential Moving Average作为均线指标。

总之,该策略判断趋势突破的方式是:

- 做多信号:收盘价突破Bands上线 && 收盘价突破均线

- 做空信号:收盘价突破Bands下线 && 收盘价突破均线

入场后,止损方式为追踪中线。当价格重新触及中线时,退出止损。

优势分析

该策略主要具有以下优势:

- 能捕捉中间线突破形成的新趋势。Bands通道具有容纳价格波动的空间,突破通道代表价格开始形成新的方向。

- 结合均线过滤,避免了假突破的问题,确保真正出现趋势转折时才入场。

- 具有内在的止损机制,当价格重新回到Bands中线时主动止损,有效控制了风险。

- 策略逻辑简单清晰,容易理解和实现,适合量化交易的算法策略。

- 利用Bands通道和均线指标,无需预测价格,根据事后证据判断趋势,回测效果较好。

风险分析

尽管该策略有一定优势,但也存在以下风险:

- Bands参数设置不当可能导致增大交易频率和交易风险。如果参数过于敏感,会产生大量假突破造成系统频繁开仓。

- 均线参数选择不当也可能导致错过真正趋势或者产生假信号。参数设置需要反复测试和优化。

- 止损依赖中线,可能会过早离场或者给予价格过多回调空间。这可能会导致错过大部分利润或者增加亏损风险。

为控制上述风险,可以从以下方面进行优化:

- 适当调整Bands参数,增加通道宽度,减少假突破概率

- 测试不同类型和长度的均线,找出最佳组合

- 尝试其他止损方式,例如趋势跟踪止损或逐步移动止损

优化方向

根据上面的风险分析,该策略可以从以下方面进行进一步优化:

参数优化:通过更系统的方法,如遗传算法等,寻找Bands和均线参数的最佳组合,使策略更稳定和profitable。

止损优化:测试不同的止损方式,如ATR止损,跟踪止损等,确定最佳止损机制。

过滤器优化:尝试加入其他指标,如RSI,KD等作为额外过滤条件,降低假信号概率,提高盈利率。

入场条件优化:加入例如趋势判断、异动VOLUME等其他考量因素,严格筛选入场时机,减少不必要开仓。

机器学习:收集更多历史数据,使用LSTM, RNN等深度学习模型进行建模,利用AI判断最佳入场出场点。

风险与获利动态管理:加入固定比例止盈止损、盈利目标后加大止盈幅度等方式,动态管理风险与收益。

通过上述几个方面的优化,可以使该策略的稳定性、收益率、风险调节能力等指标得到全面提高,成为可供实盘交易的算法策略。

总结

总体来说,该“BollingerBands趋势跟踪策略”利用Bands指标和均线判断价格趋势,在关键点位突破时入场,属于趋势跟踪类型策略。它具有判断明确,逻辑简洁,容易实现等优势,也存在一些参数优化、止损方式等可优化空间。通过进一步调整参数设置、优化止损机制、加入机器学习模型等,可以将其打造成稳定可靠的量化策略。

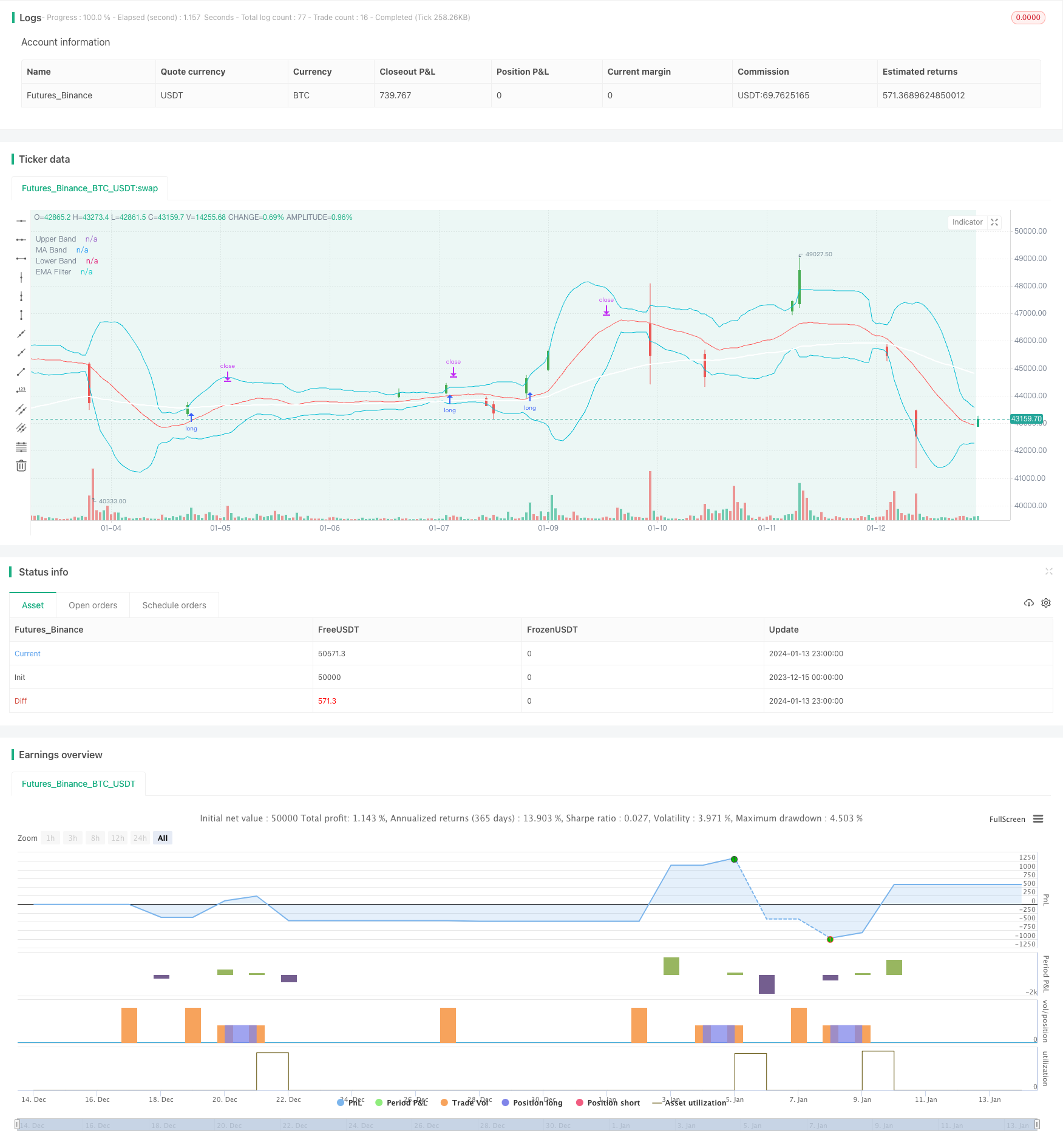

/*backtest

start: 2023-12-15 00:00:00

end: 2024-01-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//VERSION =================================================================================================================

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This strategy is intended to study.

// It can also be used to signal a bot to open a deal by providing the Bot ID, email token and trading pair in the strategy settings screen.

// As currently written, this strategy uses a Bollinger Bands for trend folling, you can use a EMA as a filter.

//Autor Credsonb (M4TR1X_BR)

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//STRATEGY ================================================================================================================

strategy(title = 'BT-Bollinger Bands - Trend Following',

shorttitle = 'BBTF',

overlay = true )

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// CONFIG =================================================================================================================

// TIME INPUTS

usefromDate = input.bool(defval = true, title = 'Start date', inline = '0', group = "Time Filters")

initialDate = input(defval = timestamp('01 Jan 2022 00:00 UTC'), title = '', inline = "0",group = 'Time Filters',tooltip="This start date is in the time zone of the exchange ")

usetoDate = input.bool(defval = true, title = 'End date', inline = '1', group = "Time Filters")

finalDate = input(defval = timestamp('31 Dec 2029 23:59 UTC'), title = '', inline = "1",group = 'Time Filters',tooltip="This end date is in the time zone of the exchange")

// TIME LOGIC

inTradeWindow = true

// ENABLE LONG SHORT OPTIONS

string entrygroup ='Long/Short Options ==================================='

checkboxLong = input.bool(defval=true, title="Enable Long Entrys",group=entrygroup)

checkboxShort = input.bool(defval=true, title="Enable Short Entrys",group=entrygroup)

// BOLLINGER BANDS INPUTS ==================================================================================================

string bbgroup ='Bollinger Bands ======================================'

bbLength = input.int(defval=20,title='BB Length', minval=1, step=5, group=bbgroup)

bbStddev = input.float(defval=2, title='BB StdDev', minval=0.5, group=bbgroup)

//BOLLINGER BANDS LOGIC

[bbMiddle, bbUpper, bbLower] = ta.bb(close, bbLength, bbStddev)

// MOVING AVERAGES INPUTS ================================================================================================

string magroup = 'Moving Average ======================================='

useEma = input.bool(defval = true, title = 'Moving Average Filter',inline='', group= magroup,tooltip='This will enable or disable Exponential Moving Average Filter on Strategy')

emaType=input.string (defval='Ema',title='Type',options=['Ema','Sma'],inline='', group= magroup)

emaSource = input.source(defval=close,title=" Source",inline="", group= magroup)

emaLength = input.int(defval=100,title="Length",minval=0,inline='', group= magroup)

// MOVING AVERAGE LOGIC

float ema = emaType=='Ema'? ta.ema(emaSource,emaLength): ta.sma(emaSource,emaLength)

// BOT MESSAGES

string msgroup='Alert Message For Bot ================================'

messageEntry = input.string("", title="Strategy Entry Message",group=msgroup)

messageExit =input.string("",title="Strategy Exit Message",group=msgroup)

messageClose = input.string("", title="Strategy Close Message",group=msgroup)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITIONS =============================================================================================================

//VERIFY IF THE BUY FILTERS ARE ON OR OFF

bool emaFilterBuy = useEma? (close > ema):(close >= ema) or (close <= ema)

//LONG / SHORT POSITIONS LOGIC

bool openLongPosition = (close[1] < bbUpper) and (close > bbUpper) and (emaFilterBuy)

bool openShortPosition = (close[1] > bbLower) and (close < bbLower) and (emaFilterBuy)

//bool closeLongPosition = (close > bbMiddle)

//bool closeShortPosition= (close < bbLower)

// CHEK OPEN POSITONS =====================================================================================================

// open signal when not already into a position

bool validOpenLongPosition = openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool longIsActive = validOpenLongPosition or strategy.opentrades.size(strategy.opentrades - 1) > 0

bool validOpenShortPosition = openShortPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool shortIsActive = validOpenShortPosition or strategy.opentrades.size(strategy.opentrades - 1) < 0

longEntryPoint = high

if (openLongPosition) and (inTradeWindow) and (checkboxLong)

strategy.entry(id = 'Long Entry', direction = strategy.long, stop = longEntryPoint, alert_message=messageEntry)

if not (openLongPosition)

strategy.cancel('Long Entry')

//submit exit orders for trailing take profit price

if (longIsActive) and (inTradeWindow)

strategy.exit(id = 'Long Exit', stop=bbMiddle, alert_message=messageExit)

//if (closeLongPosition)

// strategy.close(id = 'Long Entry', alert_message=messageClose)

shortEntryPoint = low

if (openShortPosition) and (inTradeWindow) and (checkboxShort)

strategy.entry(id = 'Short Entry', direction = strategy.short, stop = shortEntryPoint, alert_message=messageEntry)

if not(openShortPosition)

strategy.cancel('Short Entry')

if (shortIsActive)

strategy.exit(id = 'Short Exit', stop = bbMiddle, alert_message=messageExit)

//if (closeShortPosition)

//strategy.close(id = 'Short Close', alert_message=messageClose)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOTS ===============================================================================================================

// TRADE WINDOW ========================================================================================================

bgcolor(color = inTradeWindow ? color.new(#089981,90):na, title = 'Time Window')

// EMA/SMA

var emafilterColor = color.new(color.white, 0)

plot(series=useEma? ema:na, title = 'EMA Filter', color = emafilterColor, linewidth = 2, style = plot.style_line)

// BOLLINGER BANDS

plot(series=bbUpper, title = "Upper Band", color = color.aqua)//, display = display.none)

plot(series=bbMiddle, title = "MA Band", color = color.red)//, display = display.none)

plot(series=bbLower, title = "Lower Band", color = color.aqua)//, display = display.none)

// PAINT BARS COLORS

bool bulls = (close[1] < bbUpper[1]) and (close > bbUpper)

bool bears = (close[1] > bbLower [1]) and (close < bbLower)

neutral_color = color.new(color.black, 100)

barcolors = bulls ? color.green : bears ? color.red : neutral_color

barcolor(barcolors)

// ======================================================================================================================