概述

双重确认量化交易策略通过结合123反转策略和百分比成交量震荡指标(PVO)两个子策略,实现对交易信号的双重确认,降低交易风险。该策略主要适用于中长线持仓交易。

策略原理

123反转策略

123反转策略基于随机指标K线形态实现。具体来说,当收盘价连续2天低于前一日收盘价,并且9日慢速随机指标低于50时做多;当收盘价连续2天高于前一日收盘价,并且9日快速随机指标高于50时做空。

百分比成交量震荡指标(PVO)

PVO是基于成交量的动量震荡指标。它测量两个不同周期成交量指数移动平均线的差值与较长周期平均线的比值,以百分比的形式表示。当短周期平均线高于长周期平均线时为正,反之为负。该指标反映成交量的涨跌态势。

优势分析

该策略结合价格指标和成交量指标,能够有效过滤假突破。同时通过双重确认机制,可以减少交易频率,降低交易风险。

风险分析

该策略依赖较长的持仓周期,存在回撤风险。此外,参数设置不当也会导致交易频率过高或信号错失。

优化方向

可以通过调整随机指标和PVO的参数,优化子策略的表现。也可以引入止损机制来控制风险。此外,结合其他指标过滤信号可以进一步提高策略稳定性。

总结

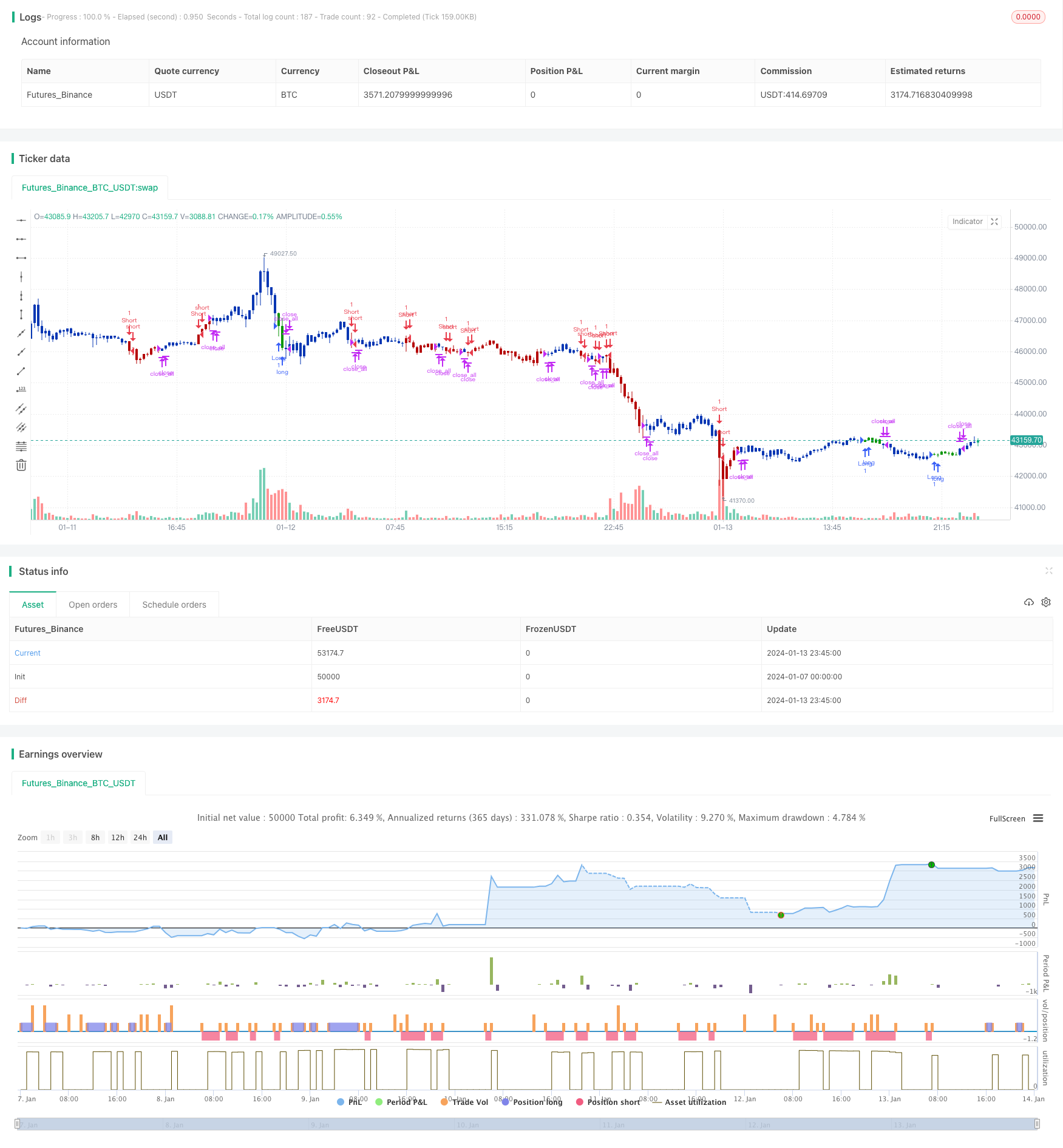

双重确认量化交易策略综合考虑了价格和成交量因素,回测效果理想。通过参数调优和优化信号过滤,该策略有望进一步增强稳定性,成为量化交易的有力工具。

策略源码

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 14/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Percentage Volume Oscillator (PVO) is a momentum oscillator for volume.

// PVO measures the difference between two volume-based moving averages as a

// percentage of the larger moving average. As with MACD and the Percentage Price

// Oscillator (PPO), it is shown with a signal line, a histogram and a centerline.

// PVO is positive when the shorter volume EMA is above the longer volume EMA and

// negative when the shorter volume EMA is below. This indicator can be used to define

// the ups and downs for volume, which can then be use to confirm or refute other signals.

// Typically, a breakout or support break is validated when PVO is rising or positive.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PVO(LengthShortEMA,LengthLongEMA,LengthSignalEMA) =>

pos = 0.0

xShortEMA = ema(volume , LengthShortEMA)

xLongEMA = ema(volume , LengthLongEMA)

xPVO = ((xShortEMA - xLongEMA) / xLongEMA) * 100

xSignalEMA = ema(xPVO , LengthSignalEMA)

xPVOHisto = xPVO - xSignalEMA

pos := iff(xSignalEMA < xPVO, -1,

iff(xSignalEMA > xPVO, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Percentage Volume Oscillator (PVO)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Percentage Volume OscillatorA ----")

LengthShortEMA = input(12, minval=1)

LengthLongEMA = input(26, minval=1)

LengthSignalEMA = input(9, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPVO = PVO(LengthShortEMA,LengthLongEMA,LengthSignalEMA)

pos = iff(posReversal123 == 1 and posPVO == 1 , 1,

iff(posReversal123 == -1 and posPVO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )