概述

ADX动态平均趋势指标策略是一种利用ADX指标判断市场趋势强弱以及趋势方向的量化交易策略。该策略通过计算平均方向指数(ADX)判断市场是否存在趋势,通过计算正向指标(DI+)和负向指标(DI-)判断趋势的方向,从而产生买入和卖出信号。

策略原理

该策略首先利用ADX指标判断市场是否存在趋势。ADX高于用户设定的关键值(默认为23),表示市场趋势较强。当ADX的当前值高于ADX之前n天的值时(n为用户设定的回看天数,默认为3天),表示ADX正在上涨,市场趋势正在形成。

然后策略利用DI+和DI-判断市场趋势的方向。当DI+高于DI-时,表示市场处于上涨趋势;当DI+低于DI-时,表示市场处于下跌趋势。

最后,策略综合判断ADX和DI的情况,产生具体的买入和卖出信号:

- 当ADX上涨,高于关键值,且DI+高于DI-,产生买入信号

- 当ADX上涨,高于关键值,且DI+低于DI-,产生卖出信号

- 当ADX转为下降,产生平仓信号

该策略还提供移动平均线过滤和定制回测时间范围等功能,可以按需配置。

优势分析

ADX动态平均趋势指标策略具有以下优势:

- 可以自动判断市场趋势存在与否,避免无效交易

- 可以自动判断市场趋势方向,进行趋势追踪

- 提供趋势存在时买入/趋势消失时平仓的清晰逻辑

- 可配置移动平均线进行过滤,避免假突破

- 可配置回测时间范围进行历史测试

- 指标和参数可调整,可以针对不同品种进行优化

风险分析

该策略也存在一些风险:

- ADX指标存在滞后,可能错过趋势早期机会

- 多空判断依赖DI指标,DI指标敏感,可能产生错误信号

- 移动平均线过滤可能错过短线机会

- 回测时间范围不当可能导致过拟合

- 指标参数设置不当可能影响策略效果

为了降低风险,可以考虑以下几点:

- 适当缩短ADX参数,减少滞后

- 调整或删除DI过滤,防止错误信号

- 适当缩短移动平均线周期

- 扩大回测时间范围,进行全样本测试

- 优化指标参数,寻找最佳设置

优化方向

该策略可以从以下几个方面进行优化:

- 结合多个股票进行组合测试,分散单一股票风险

- 增加止损逻辑以控制单笔损失

- 结合其他指标进行组合验证,提高信号准确率

- 引入机器学习算法判断买卖信号

- 增加自动参数优化模块,实现动态参数调整

总结

ADX动态平均趋势指标策略利用ADX判断趋势存在和DI判断趋势方向,在趋势存在时产生交易信号,策略思路清晰。该策略可以自动判断趋势,追踪趋势,在一定程度上规避非趋势市场的无效交易。通过一定的优化,该策略可以成为中长线量化交易的有力工具。

策略源码

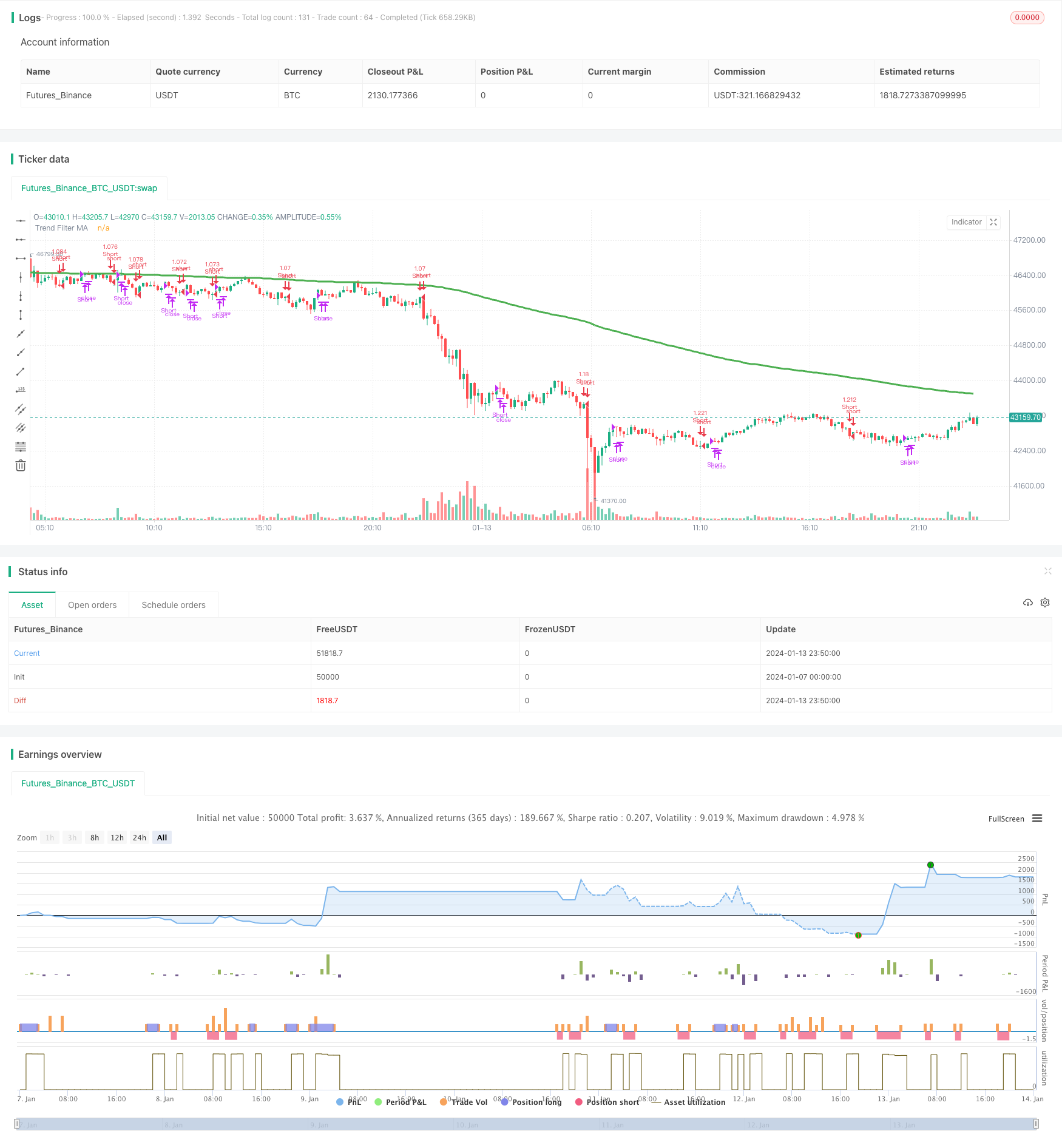

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © millerrh with inspiration from @9e52f12edd034d28bdd5544e7ff92e

//The intent behind this study is to look at ADX when it has an increasing slope and is above a user-defined key level (23 default).

//This is to identify when it is trending.

//It then looks at the DMI levels. If D+ is above D- and the ADX is sloping upwards and above the key level, it triggers a buy condition. Opposite for short.

//Can use a user-defined moving average to filter long/short if desried.

// NOTE: THIS IS MEANT TO BE USED IN CONJUNCTION WITH MY "ATX TRIGGER" INDICATOR FOR VISUALIZATION. MAKE SURE SETTINGS ARE THE SAME FOR BOTH.

strategy("ADX | DMI Trend", overlay=true, initial_capital=10000, currency='USD',

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.04)

// === BACKTEST RANGE ===

From_Year = input(defval = 2019, title = "From Year")

From_Month = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

From_Day = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

To_Year = input(defval = 9999, title = "To Year")

To_Month = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

To_Day = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

Start = timestamp(From_Year, From_Month, From_Day, 00, 00) // backtest start window

Finish = timestamp(To_Year, To_Month, To_Day, 23, 59) // backtest finish window

// == INPUTS ==

// ADX Info

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Period")

keyLevel = input(23, title="Keylevel for ADX")

adxLookback = input(3, title="Lookback Period for Slope")

// == FILTERING ==

// Inputs

useMaFilter = input(title = "Use MA for Filtering?", type = input.bool, defval = true)

maType = input(defval="EMA", options=["EMA", "SMA"], title = "MA Type For Filtering")

maLength = input(defval = 200, title = "MA Period for Filtering", minval = 1)

// Declare function to be able to swap out EMA/SMA

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

maFilter = ma(maType, close, maLength)

plot(maFilter, title = "Trend Filter MA", color = color.green, linewidth = 3, style = plot.style_line, transp = 50)

// Check to see if the useMaFilter check box is checked, this then inputs this conditional "maFilterCheck" variable into the strategy entry

maFilterCheck = if useMaFilter == true

maFilter

else

close

// == USE BUILT-IN DMI FUNCTION TO DETERMINE ADX AND BULL/BEAR STRENGTH

[diplus, diminus, adx] = dmi(dilen, adxlen)

buySignal = (adx[0]-adx[adxLookback] > 0) and adx > keyLevel and diplus > diminus and close >= maFilterCheck

// buySignalValue = valuewhen(buySignal, close, 0)

shortSignal = (adx[0]-adx[adxLookback] > 0) and adx > keyLevel and diplus < diminus and close <= maFilterCheck

// shortSignalValue = valuewhen(shortSignal, close, 0)

sellCoverSignal = adx[0]-adx[adxLookback] < 0

// == ENTRY & EXIT CRITERIA

// Triggers to be TRUE for it to fire of the BUY Signal : (opposite for the SELL signal).

// (1): Price is over the 200 EMA line. (EMA level configurable by the user)

// (2): "D+" is OVER the "D-" line

// (3): RSI 7 is under 30 (for SELL, RSI 7 is over 70)

// 1* = The ultimate is to have a combination line of 3 EMA values, EMA 14, EMA 50 and EMA 200 - And if price is over this "combo" line, then it's a strong signal

// == STRATEGY ENTRIES/EXITS ==

strategy.entry("Long", strategy.long, when = buySignal)

strategy.close("Long", when = sellCoverSignal)

strategy.entry("Short", strategy.short, when = shortSignal)

strategy.close("Short", when = sellCoverSignal)

// == ALERTS ==

// alertcondition(buySignal, title='ADX Trigger Buy', message='ADX Trigger Buy')

// alertcondition(sellSignal, title='ADX Trigger Sell', message='ADX Trigger Sell')