概述

动量趋势同步策略通过整合相对动量指数(RMI)和超级趋势指标的优势,实现了动量分析和趋势判断的有效结合。该策略同时关注价格变化趋势和市场动量水平,从更全面的角度判断市场走向。

策略原理

相对动量指数(RMI)

RMI是相对强度指数(RSI)的改进版本。它融合了价格变化的方向性、幅度等更多特征,能更准确判断市场动量。

RMI计算方法

RMI的计算方式是:先计算一定周期内的平均涨幅和平均跌幅。与RSI不同的是,RMI使用当日收盘价相对前一日收盘价的变化值,而不是简单的正增长和负增长。然后将平均涨幅除以平均跌幅,再进行归一化处理,使值落在0-100区间。

动量判断

本策略使用RMI与MFI的均值,与预设的正动量阈值和负动量阈值进行比较,判断当前市场动量水平,以此来决定建仓与平仓。

超级趋势指标

超级趋势指标基于更高时间周期计算,能提供对大趋势的判断。它会根据真实波幅ATR动态调整参数,从而有效识别趋势转折点。

本策略还加入了交易量加权均线VWMA,进一步增强了识别重要趋势转变的能力。

交易方向选择

本策略可以选择做多、做空或双向交易。这使得交易者可以根据自己的市场观点和风险偏好进行灵活调整。

策略优势分析

结合动量与趋势判断

相比单一使用动量指标或趋势指标的策略,本策略通过整合RMI和超级趋势指标的优势,实现了更准确的市场走势判断。

多时间周期分析

应用不同周期的RMI和超级趋势指标,使得对短期和长期趋势的把握更加到位。

实时止损策略

基于超级趋势的实时止损机制,可以有效控制单笔亏损。

交易方向灵活可调

做多、做空或双向交易的选择,使该策略可以适应不同的市场环境。

风险分析

参数优化难度大

RMI和超级趋势等参数的优化复杂,不当設定可能影响策略效果。

止损过于拉近可能导致过多止损

对小周期的市场波动过于敏感,会造成止损过于频繁的问题。

解决方法:适当放宽止损范围,或采用其他震荡型止损方式。

策略优化方向

多品种适应性优化

扩大适用的品种范围,识别不同品种的参数优化方向。使策略能够在更多市场中进行复制。

动态止损优化

加入动态止损方式,使止损线能更好跟踪当前波段,减少小震荡造成的过度止损。

增加过滤条件

结合更多指标判断作为过滤条件,避免在无明确信号的情况下建仓。

总结

该策略通过RMI和超级趋势指标的巧妙结合,实现了准确的市场状态判断。在控制风险方面也较为出色。通过深入优化,相信其在多品种和多周期上的表现会越来越出色。

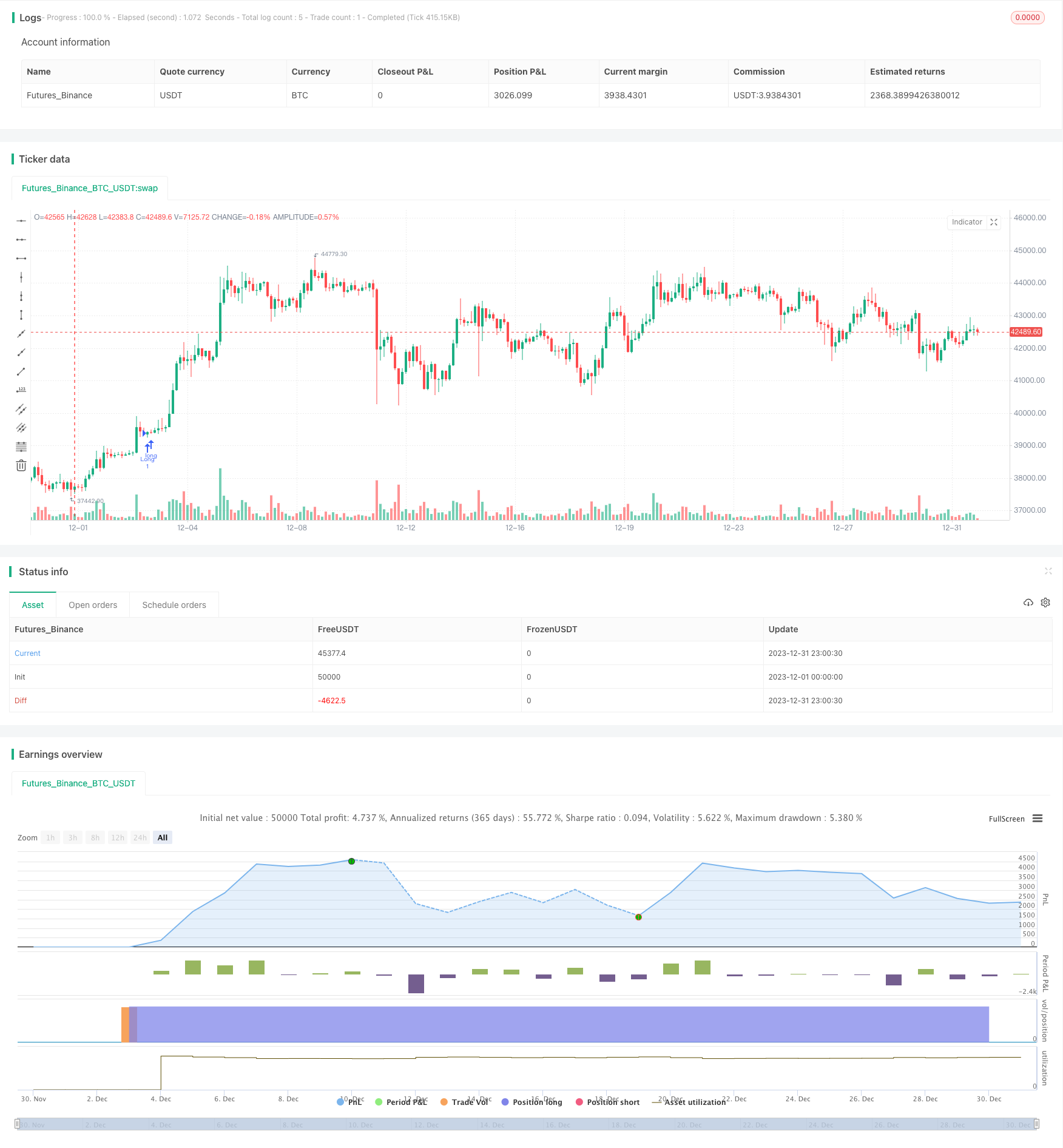

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @ presentTrading

//@version=5

strategy("RMI Trend Sync - Strategy [presentTrading]", shorttitle = "RMI Sync [presentTrading]", overlay=true )

// ---> Inputs --------------

// Add Button for Trading Direction

tradeDirection = input.string("Both", "Select Trading Direction", options=["Long", "Short", "Both"])

// Relative Momentum Index (RMI) Settings

Length = input.int(21, "RMI Length", group = "RMI Settings")

pmom = input.int(70, "Positive Momentum Threshold", group = "RMI Settings")

nmom = input.int(30, "Negative Momentum Threshold", group = "RMI Settings")

bandLength = input.int(30, "Band Length", group = "Momentum Settings")

rwmaLength = input.int(20, "RWMA Length", group = "Momentum Settings")

// Super Trend Settings

len = input.int(10, "Super Trend Length", minval=1, group="Super Trend Settings")

higherTf1 = input.timeframe('480', "Higher Time Frame", group="Super Trend Settings")

factor = input.float(3.5, "Super Trend Factor", step=.1, group="Super Trend Settings")

maSrc = input.string("WMA", "MA Source", options=["SMA", "EMA", "WMA", "RMA", "VWMA"], group="Super Trend Settings")

atr = request.security(syminfo.tickerid, higherTf1, ta.atr(len))

TfClose1 = request.security(syminfo.tickerid, higherTf1, close)

// Visual Settings

filleshow = input.bool(true, "Display Range MA", group = "Visual Settings")

bull = input.color(#00bcd4, "Bullish Color", group = "Visual Settings")

bear = input.color(#ff5252, "Bearish Color", group = "Visual Settings")

// Calculation of Bar Range

barRange = high - low

// RMI and MFI Calculations

upChange = ta.rma(math.max(ta.change(close), 0), Length)

downChange = ta.rma(-math.min(ta.change(close), 0), Length)

rsi = downChange == 0 ? 100 : upChange == 0 ? 0 : 100 - (100 / (1 + upChange / downChange))

mf = ta.mfi(hlc3, Length)

rsiMfi = math.avg(rsi, mf)

// Momentum Conditions

positiveMomentum = rsiMfi[1] < pmom and rsiMfi > pmom and rsiMfi > nmom and ta.change(ta.ema(close,5)) > 0

negativeMomentum = rsiMfi < nmom and ta.change(ta.ema(close,5)) < 0

// Momentum Status

bool positive = positiveMomentum ? true : negativeMomentum ? false : na

bool negative = negativeMomentum ? true : positiveMomentum ? false : na

// Band Calculation

calculateBand(len) =>

math.min(ta.atr(len) * 0.3, close * (0.3/100)) * 4

band = calculateBand(bandLength)

// Range Weighted Moving Average (RWMA) Calculation

calculateRwma(range_, period) =>

weight = range_ / math.sum(range_, period)

sumWeightedClose = math.sum(close * weight, period)

totalWeight = math.sum(weight, period)

sumWeightedClose / totalWeight

rwma = calculateRwma(barRange, rwmaLength)

colour = positive ? bull : negative ? bear : na

rwmaAdjusted = positive ? rwma - band : negative ? rwma + band : na

max = rwma + band

min = rwma - band

longCondition = positive and not positive[1]

shortCondition = negative and not negative[1]

longExitCondition = shortCondition

shortExitCondition = longCondition

// Dynamic Trailing Stop Loss

vwma1 = switch maSrc

"SMA" => ta.sma(TfClose1*volume, len) / ta.sma(volume, len)

"EMA" => ta.ema(TfClose1*volume, len) / ta.ema(volume, len)

"WMA" => ta.wma(TfClose1*volume, len) / ta.wma(volume, len)

upperBand = vwma1 + factor * atr

lowerBand = vwma1 - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

float superTrend = na

int direction = na

superTrend := direction == -1 ? lowerBand : upperBand

longTrailingStop = superTrend - atr * factor

shortTrailingStop = superTrend + atr * factor

// Strategy Order Execution

if (tradeDirection == "Long" or tradeDirection == "Both")

strategy.entry("Long", strategy.long, when = longCondition)

strategy.exit("Exit Long", "Long", when=longExitCondition, stop = longTrailingStop)

if (tradeDirection == "Short" or tradeDirection == "Both")

strategy.entry("Short", strategy.short, when =shortCondition)

strategy.exit("Exit Short", "Short", when=shortExitCondition, stop = shortTrailingStop)