概述

这个Pine脚本策略在TradingView平台上实现了一种每日均成本策略,同时结合了EMA指标的触碰信号来确定入场点。策略遵循均成本投资法则,每天以固定金额进行买入,以分散风险。同时,通过EMA的触碰信号来指导具体的入场时机。

策略原理

该策略主要具有以下几个特点:

每日均成本投资法则

- 每天以固定金额进行买入,无论市场涨跌

- 长期分散投资,降低单笔投资的风险

EMA指标确定入场点

- 当收盘价上穿5日、10日、20日等EMA时,触发买入

- EMA线作为支持,能较好避开短期调整

动态止损机制

- 当收盘价跌破20日简单移动均线时,止损清仓

- 避免亏损进一步扩大

最大仓位限制

- 最大允许300笔交易,控制仓位规模和风险

- 防止过度投资导致的资金不足

具体来说,策略每天投入固定金额,按当日收盘价计算可以购买的股票数量。在这个基础上,如果当天的收盘价上穿5日、10日、20日等EMA中的任意一条时,就会触发买入信号。一旦累积的仓位达到最大限制的300笔时,就不会有新的买入操作。另外,如果收盘价跌破20日SMA,或者到达提前设定的退出日期,就会清仓止损。该策略还在价格图上绘制不同周期的EMA线,方便直观分析。

优势分析

该策略具有以下几个优势:

分散投资,降低单笔投资风险

- 每天进行小额、固定金额投资,无论涨跌

- 不会出现 reunrung 追高的问题

EMA结合,避开短期调整

- EMA上穿作为买入信号,避开回撤期间的买入

- 回撤期间继续分批买入,分散风险

动态止损,控制亏损

- 设定止损线,可以及时止损

- 防止出现大额亏损

最大仓位限制,控制风险

- 最大仓位可以预先设定,防止过度投资

- 在ETP承担能力范围内进行投资

直观的EMA显示,易于判定

- 价格图上绘制不同EMA周期的线

- 一目了然,便于操作员监控

高度可定制化

- 可以自定义投入金额、EMA周期、止损线等

- 根据个人风险偏好进行调整

风险分析

该策略也存在一些风险需要注意:

系统性风险难以规避

- 遇到黑天鹅事件,可能面临较大亏损

- 分散投资可以降低风险,无法完全规避

固定投资金额带来的风险

- 每天固定金额投入,价格剧烈上涨时可能后悔

- 可以采用动态调整投入金额的优化

EMA无法对极端行情作出反应

- EMA对突发事件反应迟缓,无法及时止损

- 可以考虑与KD、BOLL等指标结合,识别极端行情

仓位限制也限制了盈利空间

- 仓位有上限,无法无限增持

- 需要综合考量,在风险和收益间找到平衡

停损点设置需要经验和技巧

- 停损点过近则容易被突破,过远又无法及时止损

- 需要通过反复测试取得平衡

优化方向

该策略还具有进一步优化的空间:

增加动态调整每日投入金额

- 可以根据特定指标,动态调整每日投入

- 在看好行情时增加投入,看淡时减少

结合更多指标判断入场

- 除了EMA,还可以引入KD、BOLL等指标判定

- 提高对极端行情的判断能力

采用指数移动平均

- EMA对突发事件反应迟缓,可以考虑采用DEMA、TEMA等

- 更快捕捉新的趋势方向

动态调整最大仓位

- 可以根据策略盈利情况,动态调整最大仓位

- 在估值合理时适当加大仓位

采用渐进式止损

- 现有策略为直接清仓止损,可以采用渐进清仓

- 防止止损点被「抄底」的风险

总结

总的来说,该每日均成本策略结合EMA触碰信号,实现了长期分批投资的思路。相比单次大手开仓,可以分散风险,避免在高点狂欢。EMA的加入也在一定程度上避让了短期调整带来的风险,采取止损措施控制最大亏损。同时,仍需要注意黑天鹅风险,以及固定投入金额无法充分抓住机会带来的遗憾等问题。这些都为策略进一步的优化提供了方向。通过参数调整与指标组合,可以逐步优化并实现既高效又稳定的量化交易策略。

策略源码

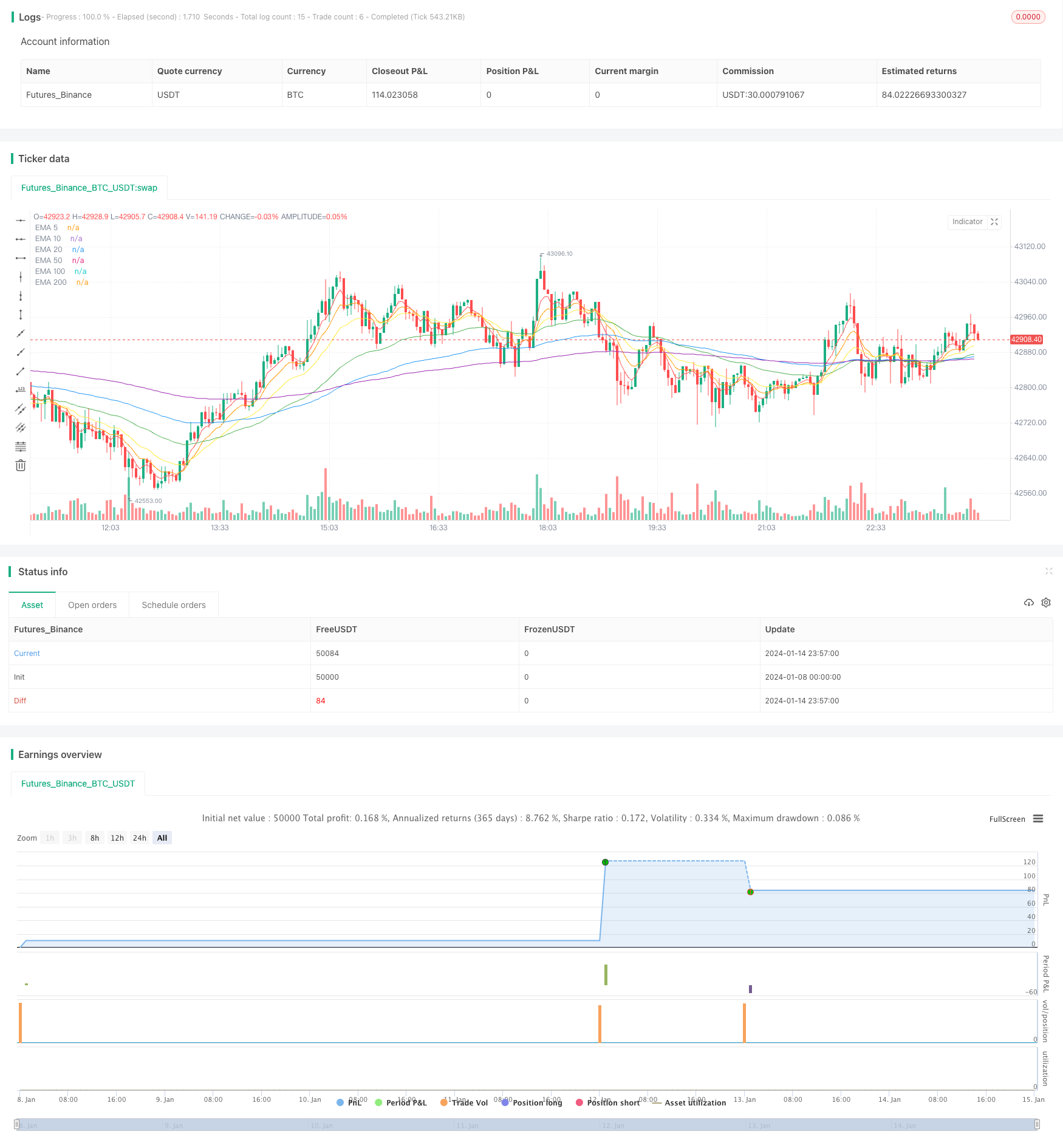

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Daily DCA Strategy with Touching EMAs", overlay=true, pyramiding=10000)

// Customizable Parameters

daily_investment = input(50000, title="Daily Investment")

start_year = input(2022, title="Start Year")

start_month = input(1, title="Start Month")

start_day = input(1, title="Start Day")

end_year = input(2023, title="End Year")

end_month = input(12, title="End Month")

end_day = input(1, title="End Day")

trade_count_limit = input(10000, title="Pyramiding Limit")

enable_sell = input(true, title="Enable Sell")

start_date = timestamp(start_year, start_month, start_day)

var int trade_count = 0

// Calculate the number of shares to buy based on the current closing price

shares_to_buy = daily_investment / close

// Check if a new day has started and after the start date

isNewDay = dayofmonth != dayofmonth[1] and time >= start_date

// Buy conditions based on EMA crossovers

ema5_cross_above = crossover(close, ema(close, 5))

ema10_cross_above = crossover(close, ema(close, 10))

ema20_cross_above = crossover(close, ema(close, 20))

ema50_cross_above = crossover(close, ema(close, 50))

ema100_cross_above = crossover(close, ema(close, 100))

ema200_cross_above = crossover(close, ema(close, 200))

if isNewDay and (ema5_cross_above or ema10_cross_above or ema20_cross_above or ema50_cross_above or ema100_cross_above or ema200_cross_above) and trade_count < trade_count_limit

strategy.entry("Buy", strategy.long, qty=shares_to_buy)

trade_count := trade_count + 1

// Dynamic sell conditions (optional)

sell_condition = true

if enable_sell and sell_condition

strategy.close_all()

// EMA Ribbon for visualization

plot(ema(close, 5), color=color.red, title="EMA 5")

plot(ema(close, 10), color=color.orange, title="EMA 10")

plot(ema(close, 20), color=color.yellow, title="EMA 20")

plot(ema(close, 50), color=color.green, title="EMA 50")

plot(ema(close, 100), color=color.blue, title="EMA 100")

plot(ema(close, 200), color=color.purple, title="EMA 200")