概述

该策略通过计算不同周期的移动平均线,并判断它们的金叉死叉形成交易信号,属于典型的趋势跟踪策略。主要使用了加权移动平均线WMA和自适应移动平均线ALMA。

策略原理

该策略首先计算价格的中短期移动平均线ma1和ma2,其中ma1周期更短,ma2周期更长。然后计算ma1和ma2的差值ma3,再对ma3计算出平滑移动平均线ma4。当ma3上穿ma4时产生买入信号,下穿时产生卖出信号。

这样,ma3反映价格的中短期趋势方向,ma4过滤掉ma3中的部分噪音,形成较为可靠的交易信号。ma1和ma2的周期比通过参数maLen设定,用户可以根据不同市场调整周期得到最佳参数组合。

策略优势

该策略具有以下优势:

使用自适应移动平均线ALMA和加权移动平均线WMA,能更好地适应市场变化。

应用多周期价格平均的方法,使交易信号更加可靠。

参数可调,用户可以针对不同市场进行优化,适用面广。

策略思路清晰易懂,容易实施。

可在趋势型和震荡型市场中均获得不错效果。

风险及解决

该策略也存在一些风险:

在剧烈变动的行情中,移动平均线策略容易产生交易信号不明确、延迟等问题。可通过调整移动平均线周期及参数进行优化。

纯趋势跟踪策略,在震荡盘整阶段容易产生亏损。可结合其他指标作为过滤条件。

参数设置不当可能导致超短周期而出现过度交易。应谨慎选择合适的参数。

策略优化

该策略可从以下几个方面进行优化:

测试更多类型的移动平均线,如线性移动平均线、权重移动平均线等。

增加基于波动率、价格通道等指标的止损机制。

结合多个时间周期分析,采取滚动优化参数。

增加机器学习算法,实现参数的自动优化。

总结

本策略基于移动平均线的金叉死叉形成交易信号。应用自适应移动平均线和多时间周期价格平均,使信号更加精确可靠。该策略参数可调,适用面广,思路简单清晰,在趋势市场中效果较好,具有很高的实战价值。

策略源码

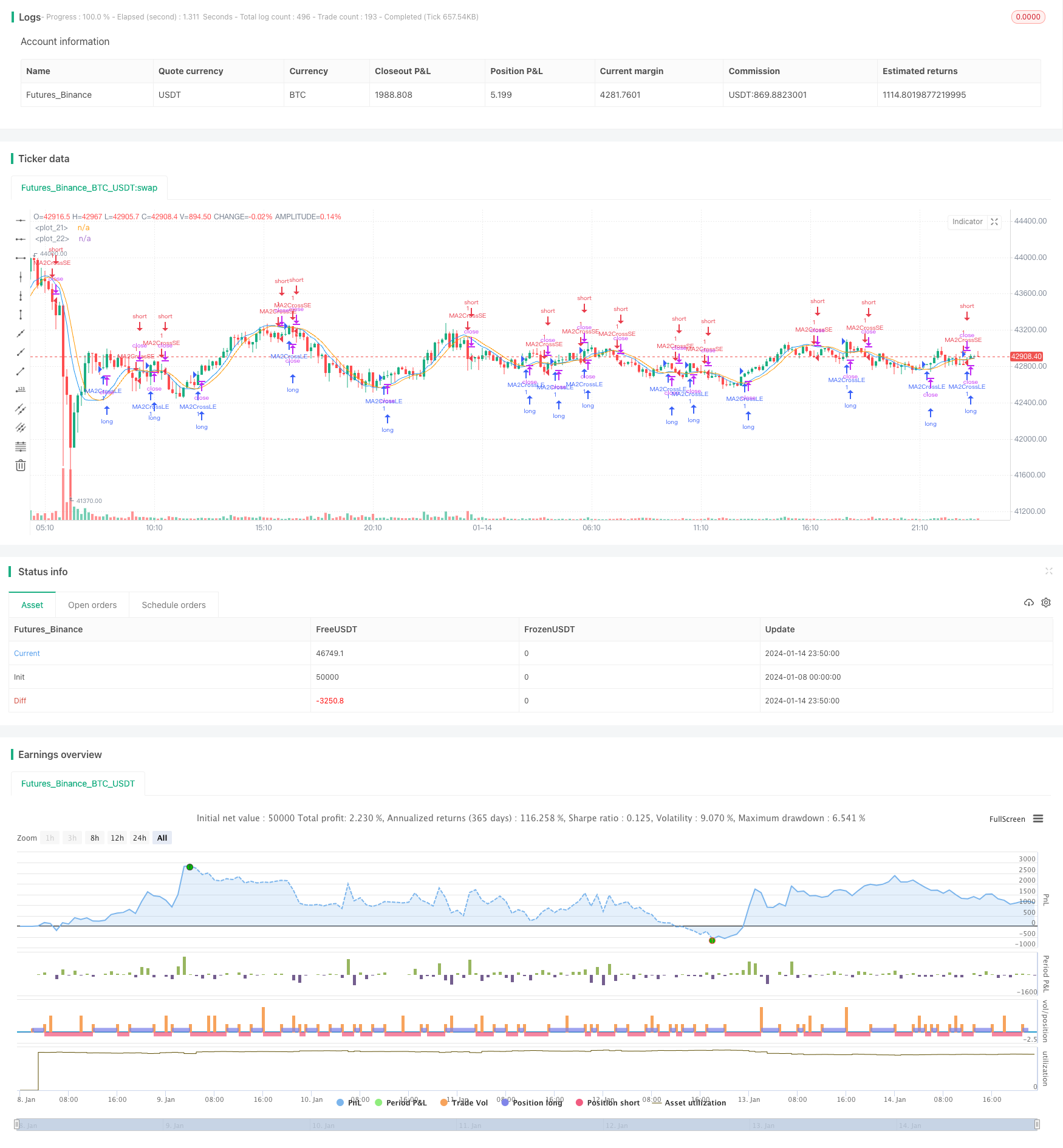

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Oracle Move Strategy", overlay=true)

maLen = input(30, "ma period")

mode = input(defval="wma", options=["alma", "ema", "wma"])

price = close

ma(src, len) =>

mode=="alma" ? alma(src, len, 0.85, 6) :

mode=="ema"? ema(src, len) :

wma(src, len)

ma1 = ma(price, floor(maLen / 2))

ma2 = ma(price, maLen)

ma3 = 2.0 * ma1 - ma2

ma4 = ma(ma3, floor(sqrt(maLen)))

//plot(ma1, color = red)

//plot(ma2, color = green)

plot(ma3, color = blue)

plot(ma4, color = orange)

mafast = ma3

maslow = ma4

if (crossover(mafast, maslow))

strategy.entry("MA2CrossLE", strategy.long, comment="MA2CrossLE")

if (crossunder(mafast, maslow))

strategy.entry("MA2CrossSE", strategy.short, comment="MA2CrossSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)