概述

本策略基于相对强弱指数(RSI)指标设计了一个短线交易策略,主要用于15分钟时间框架下的交易。该策略通过计算RSI指标判断市场是否超买超卖,发出买入和卖出信号。当RSI指标上穿过低点30时产生买入信号,而当RSI指标下穿高点70时产生卖出信号。本策略适用于短线范围交易,可以捕捉中间的波动获利。

策略原理

RSI指标是通过计算一定时间周期内价格涨跌幅度的比值,来判断市场是否超买或超卖的技术分析工具。RSI指标数值范围在0到100之间。数值在30以下表明资产被超卖现象,数值在70以上表明资产被超买现象。

本策略设置RSI指标参数为14周期,超买线为70,超卖线为30。当RSI从下方上穿30时产生买入信号,这意味着市场由超卖转为多头;当RSI从上方下穿70时产生卖出信号,这意味着市场由多头转为空头。策略收到信号后,以整个账户资金的1倍杠杆定向做多或做空,实现短线交易获利。

优势分析

本策略最大的优势是规则简单清晰,容易理解和实现。相对强弱指数是一种很经典的量化指标,被广泛运用于判断市场的超买超卖现象。策略本身不需要预测市场未来走势和价格目标,只需要跟随RSI指标信号即可,降低了策略优化难度。

另一个优势是策略适应性强。本策略可应用在任何品种和任何时间框架,特别适合中短线捕捉区间震荡。此外,策略只需优化三个参数:RSI周期、超买线、超卖线,参数空间小,易于测试和优化找到最佳参数组合。

风险分析

本策略最大的风险在于持仓时间不确定。当市场出现长时间的超买或超卖时,会导致策略持仓时间过长而承受更大的亏损。此时需要及时止损来控制风险。

另一个风险是交易频率可能过高。当市场在RSI超买超卖线附近上下波动时,会频繁触发买入卖出信号,增加交易费用和滑点成本。这需要适当调整参数,扩大超买超卖区间距离来减少无谓交易。

优化方向

本策略可以从以下几个方面进行优化:

优化RSI参数,调整周期参数以及超买超卖线位置,找到最佳参数组合

增加止损止盈策略,设定合理的止损位和止盈位

增加过滤条件,避免无谓交易。例如设置最小波动幅度、交易量过滤等

优化资金利用率,设置动态仓位控制

结合其他指标进行组合,提高策略稳定性

总结

本策略基于RSI指标设计了一个简单实用的短线交易策略。策略信号规则清晰,易于实现,资金利用率高,适合中短线捕捉市场的超买超卖现象进行否极性交易。通过持续的测试与优化,本策略可以成为一个非常稳定可靠的量化交易系统。

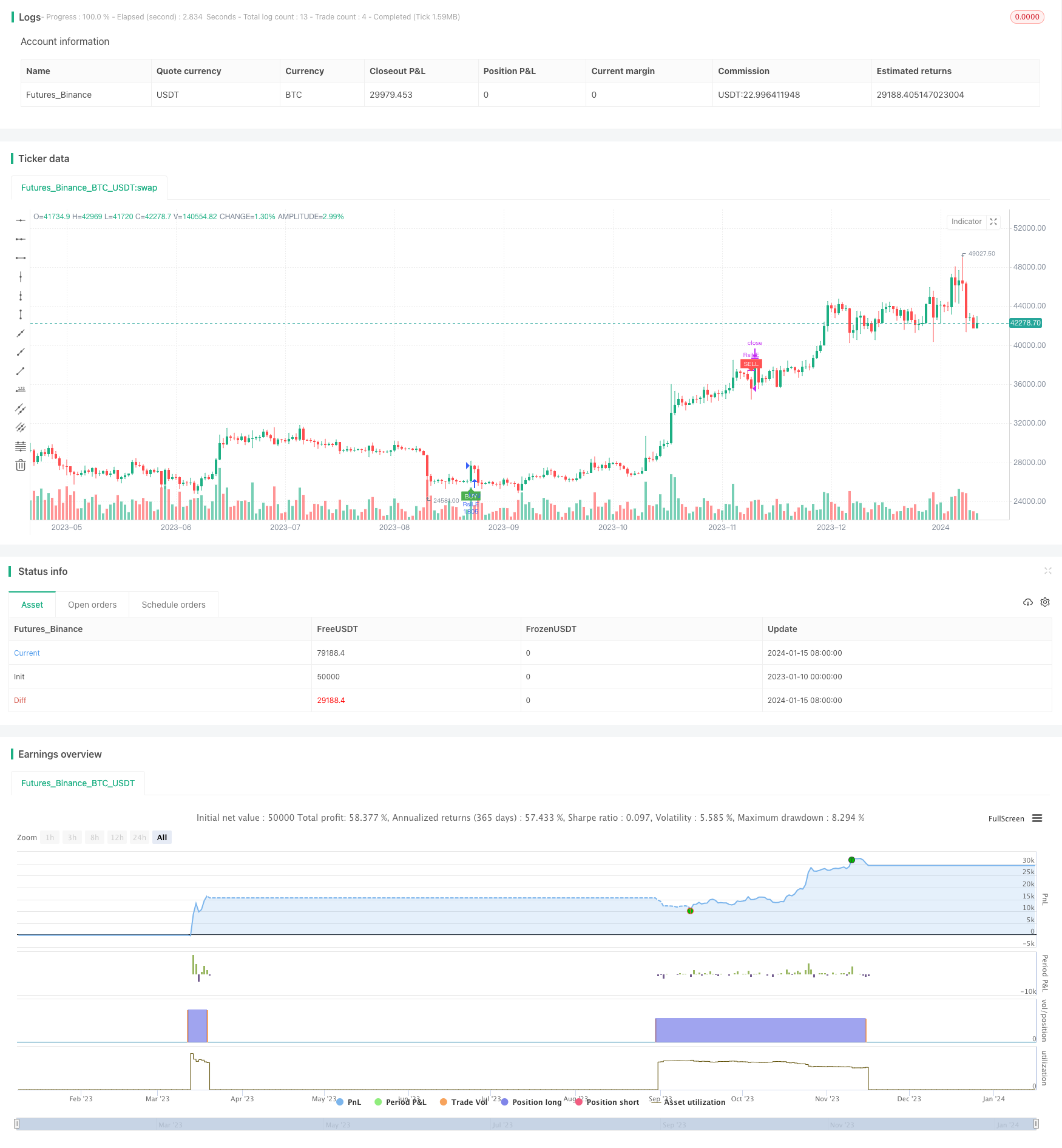

/*backtest

start: 2023-01-10 00:00:00

end: 2024-01-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI Strategy", overlay=true)

length = input( 14 )

overSold = input( 30 )

overBought = input( 70 )

sl_inp = input(10.0, title='Stop Loss %')/100

tp_inp = input(1.0, title='Take Profit %')/100

haOpen = 0.0

haOpen := haOpen[1]

st_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

price = close

vrsi = rsi(price, length)

co = crossover(vrsi, overSold)

cu = crossunder(vrsi, overBought)

strategy.initial_capital =50000

orderSize = ((strategy.initial_capital * 1) / close)

if (not na(vrsi))

if (co)

strategy.order("RsiLE", strategy.long, orderSize, take_level, st_level, comment="RsiLE")

if (cu)

strategy.close("RsiLE")//strategy.entry("RsiSE", strategy.short, qty=orderSize, comment="RsiSE")

plotshape(not na(vrsi) and co and haOpen == 0.0, style=shape.labelup, location=location.belowbar, color=color.green, size=size.tiny, title="buy label", text="BUY", textcolor=color.white)

plotshape(not na(vrsi) and co and haOpen == 1.0, style=shape.labelup, location=location.belowbar, color=color.orange, size=size.tiny, title="buy label", text="INC", textcolor=color.white)

plotshape(not na(vrsi) and cu and haOpen == 1.0, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.tiny, title="sell label", text="SELL", textcolor=color.white)

if (not na(vrsi))

if (co)

haOpen := 1.0

if (cu)

haOpen := 0.0

//strategy.exit("Stop Loss/TP","RsiLE", stop=stop_level, limit=take_level)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)