概述

本策略基于William Blau在其1995年出版的《动量,方向和背离》一书中描述的技术指标“动量均差指标”设计。该指标聚焦于价格动量、价格方向和价格背离三个关键要素,深入剖析价格与动量之间的关系。

策略原理

该策略使用动量均差指标判断价格趋势和破裂点。首先计算价格的EMA均线,然后计算价格距该EMA线的偏差。对这个偏差再进行双重EMA平滑处理,得到最终的动量均差指标曲线。当该曲线上穿或下穿其自身的信号线时产生交易信号。具体来说,计算流程如下:

- 计算价格的EMA均线xEMA

- 计算价格与xEMA的偏差xEMA_S

- 对xEMA_S进行EMA平滑,参数为s,得到xEMA_U

- 对xEMA_U再进行EMA平滑,参数为u,得到信号线xSignal

- 比较xEMA_U与xSignal的大小关系:

- xEMA_U > xSignal 为多头信号

- xEMA_U < xSignal 为空头信号

- 生成交易信号possig

根据possig信号进行买入和卖出操作。

优势分析

该策略具有以下优势:

- 使用双EMA滤波器,可以有效过滤假突破,提高信号的可靠性

- 基于EMA,对短期价格变动较为敏感,可以捕捉趋势的转折点

- 采用参数化设计,可以按需调整参数,适应不同周期和品种

- 包含长短双向交易信号,可以利用价格双向波动获利

风险分析

该策略也存在一些潜在风险:

- EMA对参数选择较为敏感,不当设置可能错过信号或产生错误信号

- 多头和空头信号可能同时出现,需要设置过滤条件避免互相抵消

- 双重EMA滤波可能过度过滤掉有效信号,导致漏单

- 未考虑大周期趋势关系,存在逆势交易风险

可通过优化参数,设定过滤条件,引入趋势判断等方式来减少这些风险。

优化方向

该策略的优化方向如下:

- 优化参数r、s、u值,使其更符合不同周期和品种特征

- 增加趋势判断模块,避免逆势操作

- 增加过滤条件,如通道突破等,避免无效信号

- 结合其他因子和模型,提高策略效果

总结

本策略基于价格与动量关系的动量均差指标,捕捉价格反转时点。它参数化且可优化设计,可以适应不同周期和品种。但也存在一定假信号和逆势交易风险。通过进一步优化参数与模型,结合趋势判断等,可望获得更好绩效。

策略源码

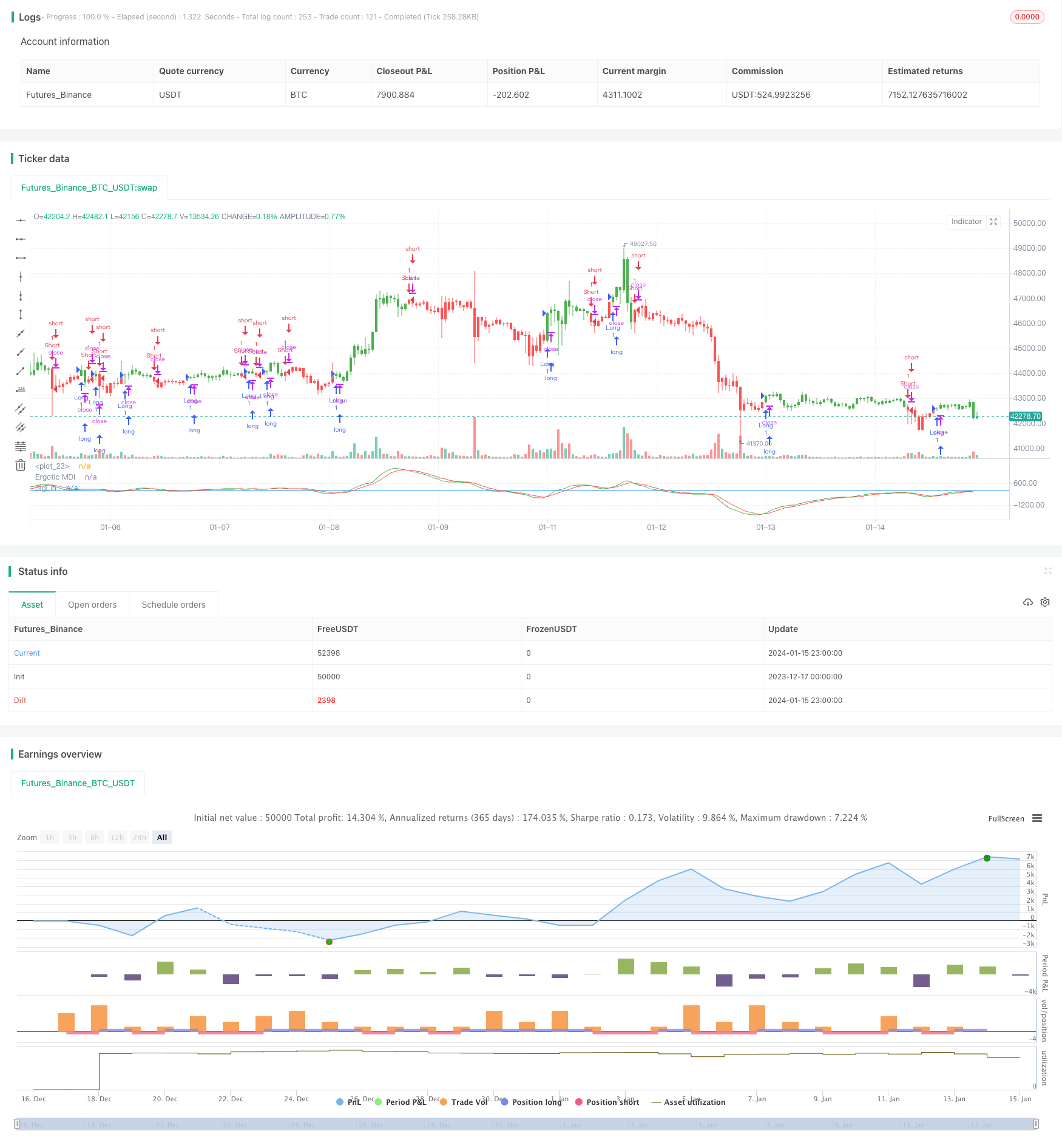

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/12/2016

// This is one of the techniques described by William Blau in his book "Momentum,

// Direction and Divergence" (1995). If you like to learn more, we advise you to

// read this book. His book focuses on three key aspects of trading: momentum,

// direction and divergence. Blau, who was an electrical engineer before becoming

// a trader, thoroughly examines the relationship between price and momentum in

// step-by-step examples. From this grounding, he then looks at the deficiencies

// in other oscillators and introduces some innovative techniques, including a

// fresh twist on Stochastics. On directional issues, he analyzes the intricacies

// of ADX and offers a unique approach to help define trending and non-trending periods.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Ergotic MDI (Mean Deviation Indicator) Bactest")

r = input(32, minval=1)

s = input(5, minval=1)

u = input(5, minval=1)

SmthLen = input(3, minval=1)

reverse = input(false, title="Trade reverse")

hline(0, color=blue, linestyle=line)

xEMA = ema(close, r)

xEMA_S = close - xEMA

xEMA_U = ema(ema(xEMA_S, s), u)

xSignal = ema(xEMA_U, u)

pos = iff(xEMA_U > xSignal, 1,

iff(xEMA_U < xSignal, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xEMA_U, color=green, title="Ergotic MDI")

plot(xSignal, color=red, title="SigLin")