本策略通过计算价格的ATR波动率,结合不同周期的VWAP均价,设定长仓入场和出场条件,实现股票的趋势跟踪交易。

策略概述

该策略主要应用于股票类产品的趋势追踪,通过计算ATR波动率并结合不同周期的VWAP价格,设定买入卖出条件,实现对趋势的判断和跟踪。策略较为灵活,可在长线和短线之间切换,适用于捕捉中长线趋势。

策略原理

策略利用ATR指标计算价格波动率,并结合价格是否突破波动率通道判断趋势方向。同时引入不同周期的VWAP价格判断长短线趋势一致性。具体逻辑如下:

- 计算价格的ATR波动率通道

- 判断价格是否突破波动率通道

- 突破上轨时判断为看多趋势

- 突破下轨时判断为看空趋势

- 引入周线和日线VWAP价格

- 价格突破波动率上轨时,如果日线和周线VWAP均在价格上方,则产生长仓信号

- 价格突破波动率下轨时,如果日线和周线VWAP均在价格下方,则产生空仓信号

以上为策略的核心逻辑。ATR波动率判断短期趋势,VWAP价格判断长期趋势,二者结合判断趋势一致性,从而产生交易信号。

策略优势

- 利用ATR和VWAP的组合判断趋势,更加可靠

- 可配置ATR周期参数,调整策略的灵敏度

- 引入不同周期VWAP,判断长短线趋势一致性

- 可灵活在长线和短线之间切换

- 适用于追踪股票中长线趋势

策略风险与优化

- 作为趋势跟踪策略,在震荡调整阶段会产生更多交易,带来滑点风险

- ATR和VWAP参数设置会影响策略表现,需要针对不同品种谨慎测试

- 可考虑加入止损机制,控制单笔损失

- 可结合均线等指标过滤入场信号,减少不必要交易

总结

本策略通过ATR波动率和VWAP双重判断,实现对股票趋势的跟踪。策略优化空间较大,可调整参数或加入其他技术指标优化信号。总体来说,策略逻辑清晰易懂,表现稳健,适合追踪中长线趋势。

策略源码

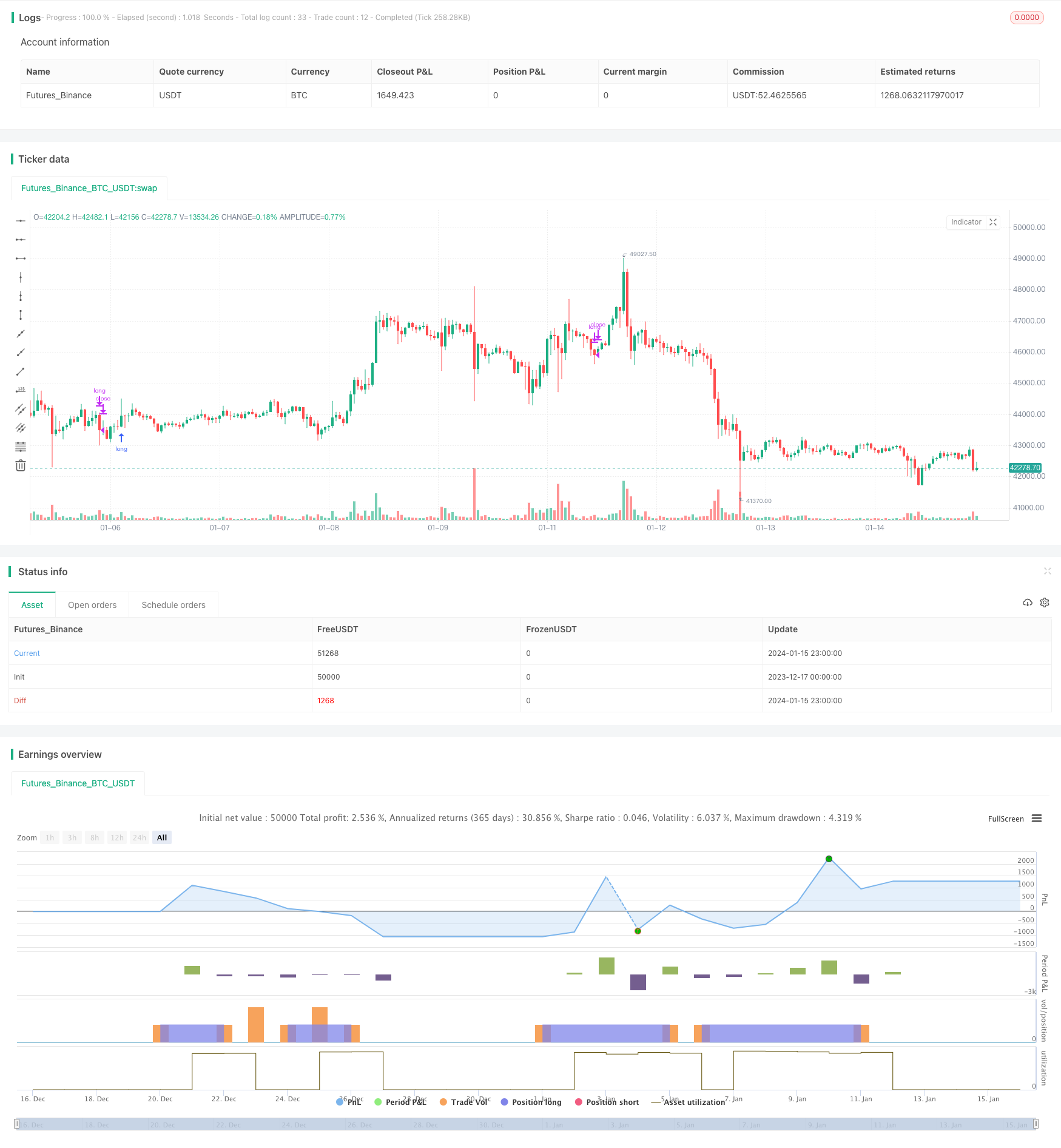

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title="VWAP MTF STOCK STRATEGY", overlay=true )

// high^2 / 2 - low^2 -2

h=pow(high,2) / 2

l=pow(low,2) / 2

o=pow(open,2) /2

c=pow(close,2) /2

x=(h+l+o+c) / 4

y= sqrt(x)

source = y

useTrueRange = false

length = input(27, minval=1)

mult = input(0, step=0.1)

ma = sma(source, length)

range = useTrueRange ? tr : high - low

rangema = sma(range, length)

upper = ma + rangema * mult

lower = ma - rangema * mult

crossUpper = crossover(source, upper)

crossLower = crossunder(source, lower)

bprice = 0.0

bprice := crossUpper ? high+syminfo.mintick : nz(bprice[1])

sprice = 0.0

sprice := crossLower ? low -syminfo.mintick : nz(sprice[1])

crossBcond = false

crossBcond := crossUpper ? true

: na(crossBcond[1]) ? false : crossBcond[1]

crossScond = false

crossScond := crossLower ? true

: na(crossScond[1]) ? false : crossScond[1]

cancelBcond = crossBcond and (source < ma or high >= bprice )

cancelScond = crossScond and (source > ma or low <= sprice )

longOnly = true

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2000, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2021, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

srcX = input(ohlc4)

t = time("W")

start = na(t[1]) or t > t[1]

sumSrc = srcX * volume

sumVol = volume

sumSrc := start ? sumSrc : sumSrc + sumSrc[1]

sumVol := start ? sumVol : sumVol + sumVol[1]

vwapW= sumSrc / sumVol

//crossUpper = crossover(source, upper)

//crossLower = crossunder(source, lower)

shortCondition = close < vwap and time_cond and (close < vwapW)

longCondition = close > vwap and time_cond and (close > vwapW)

if(longOnly and time_cond)

if (crossLower and close < vwapW )

strategy.close("long")

if (crossUpper and close>vwapW)

strategy.entry("long", strategy.long, stop=bprice)