概述

反向动量交易策略(Reverse Momentum Trading Strategy)是一个基于改进型MACD指标的短线交易策略。该策略借鉴了William Blau在他的著作《动量,方向和背离》(Momentum, Direction and Divergence)中提出的思想,利用价格与动量之间的关系,构建一个与标准MACD指标意义相反的自定义MACD指标,在指标形成买卖信号时进行反向操作,即买入该指标卖出信号,卖出该指标买入信号。

策略原理

该策略的核心指标是改进型MACD,指标公式如下:

fastMA = ema(close, 32)

slowMA = ema(close, 5)

xmacd = fastMA - slowMA

xMA_MACD = ema(xmacd, 5)

其中,fastMA是32周期的指数移动平均线,slowMA是5周期的指数移动平均线。两条移动平均线的差值构成xmacd,再对xmacd计算5周期指数移动平均得到xMA_MACD。

当xmacd上穿xMA_MACD时生成卖出信号,当xmacd下穿xMA_MACD时生成买入信号。该信号意义与标准MACD指标相反,标准MACD指标上穿发出买入信号,下穿发出卖出信号。

策略优势

利用价格与动量关系,捕捉潜在趋势反转机会。

改进型MACD指标设定更科学,参数优化充分,可减少假信号。

反向操作思路独特,增加策略系统多样性。

可在趋势市场中获利,也可在盘整市场中获利。

策略风险

反向操作风险高,需要谨慎使用。

须防止止损点过小而被止损。可适当放宽止损范围,降低被套风险。

须警惕反转信号漏失而错过反转机会。可适当优化参数,减少信号漏失。

须防止效率过低而亏损。可测试不同品种参数效果,选择效率更高品种交易。

策略优化方向

测试不同长短周期参数组合优化指标形态。

加入趋势判断指标,避免行情剧烈波动期反向做多做空。

结合波浪理论、支撑阻力位等技术指标判断潜在反转机会。

优化止损机制,防止过于激进的止损被套。

总结

反向动量交易策略整合多种技术分析理论与指标信号,在价格与动量背离时捕捉反转机会。该策略思路新颖,具有很强的实用价值。但反向操作风险较大,需要严格的资金管理,谨慎的参数优化与风险控制,方能获得稳定收益。

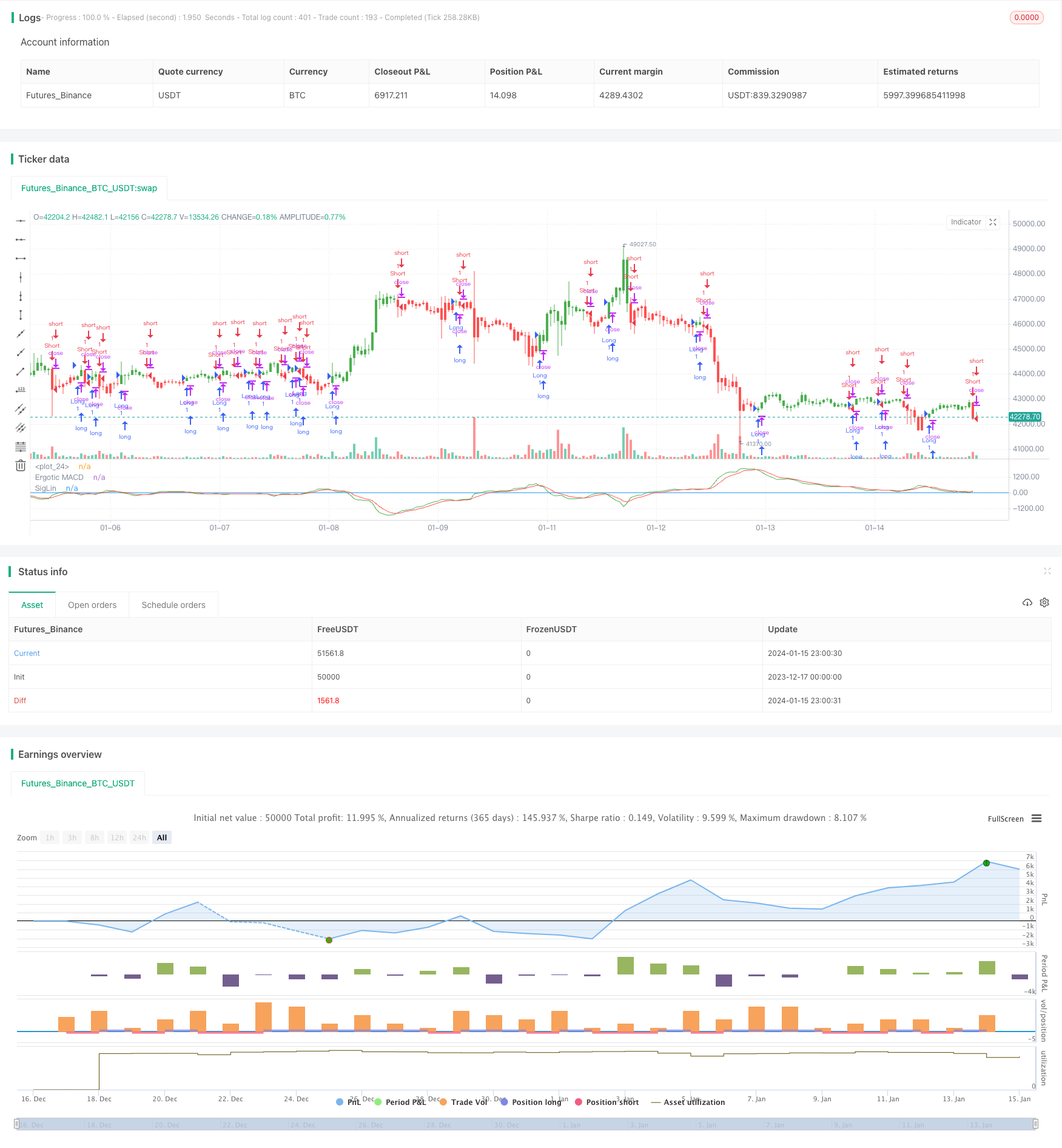

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 09/12/2016

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship

// between price and momentum in step-by-step examples. From this grounding,

// he then looks at the deficiencies in other oscillators and introduces some

// innovative techniques, including a fresh twist on Stochastics. On directional

// issues, he analyzes the intricacies of ADX and offers a unique approach to help

// define trending and non-trending periods.

// Blau`s indicator is like usual MACD, but it plots opposite of meaningof

// stndard MACD indicator.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Ergotic MACD Strategy Backtest")

r = input(32, minval=1)

SmthLen = input(5, minval=1)

reverse = input(false, title="Trade reverse")

hline(0, color=blue, linestyle=line)

source = close

fastMA = ema(source, r)

slowMA = ema(source, 5)

xmacd = fastMA - slowMA

xMA_MACD = ema(xmacd, 5)

pos = iff(xmacd < xMA_MACD, 1,

iff(xmacd > xMA_MACD, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xmacd, color=green, title="Ergotic MACD")

plot(xMA_MACD, color=red, title="SigLin")