概述

该策略是一个基于布林带的趋势追踪策略。它利用布林带上下轨来判断价格趋势,发出买入和卖出信号。具体来说,当收盘价上穿上轨时,做多;当收盘价下穿下轨时,做空。

策略原理

该策略使用布林带的上下轨来判断趋势。布林带中线为n天收盘价的简单移动平均线,带宽为中线正负k倍的n天收盘价标准差。其公式如下:

中线:SMA(收盘价,n)

上轨:中线 + k * STDEV(收盘价,n)

下轨:中线 - k * STDEV(收盘价,n)

当价格突破上轨时,说明超过了中线上下波动的范围,表明目前处于上涨趋势;当价格跌破下轨时,说明超过了中线上下波动的范围,表明目前处于下跌趋势。

基于此,该策略判断如下:

- 当收盘价上穿上轨时,做多

- 当收盘价下穿下轨时,做空

利用布林带判断趋势针对中长线比较有效。

优势分析

该策略主要优势有:

利用布林带判断趋势,比较可靠。布林带考虑了股价的波动性,能比较好地判断趋势转折点。

策略判断规则简单清晰,容易理解,容易实现。

无须预测股价,只要跟踪股价与布林带的关系,操作上比较容易。

利用突破上下轨发出信号,比较及时,不会错过趋势机会。

风险分析

该策略也存在一些风险:

布林带并不能完全预测股价走势,上下轨突破后,股价走势不一定会持续,存在一定的错误信号概率。

股价可能会在上下轨附近震荡,导致多次小亏损。

参数设定不当也会导致失误信号。如n值取太小,布林带变化太快,信号频繁;k值取太大,布林带变化太慢,信号滞后。

大盘走势可能对单只股票产生影响,难以完全避免系统风险。

对应的风险控制措施有:

适当调整参数n和k值,平衡布林带的灵敏度。

增加止损,控制单笔亏损。

结合其他技术指标过滤信号。

优化方向

该策略可从以下几个方面进行优化:

优化参数设定。可以测试不同n值参数对结果的影响;也可以使k值参数动态变化,在股价波动大时带宽扩大。

增加过滤条件,利用其他指标如MACD、KDJ等对买卖信号进行过滤,减少错误信号。

增加止损机制,设定移动止损或者缩量止损,控制亏损。

可以基于布林带幅度,判断目前股价波动幅度的高低,从而调整仓位。布林带越宽示波动越大,这个时候降低仓位。

结合趋势判断指标,在确定的大方向下使用布林带发信号。

总结

该策略整体来说是一种较为可靠的趋势追踪策略。它利用布林带的上下轨判断价格趋势,简单易操作。主要优势是信号发出及时,能及时捕捉趋势机会。但也存在一定误信号概率和调参优化难度。可以通过参数优化、增加过滤器等方法来控制风险和提高策略稳定性。总体而言,该策略适合对趋势判断要求不高、追求高操作频率的投资者。

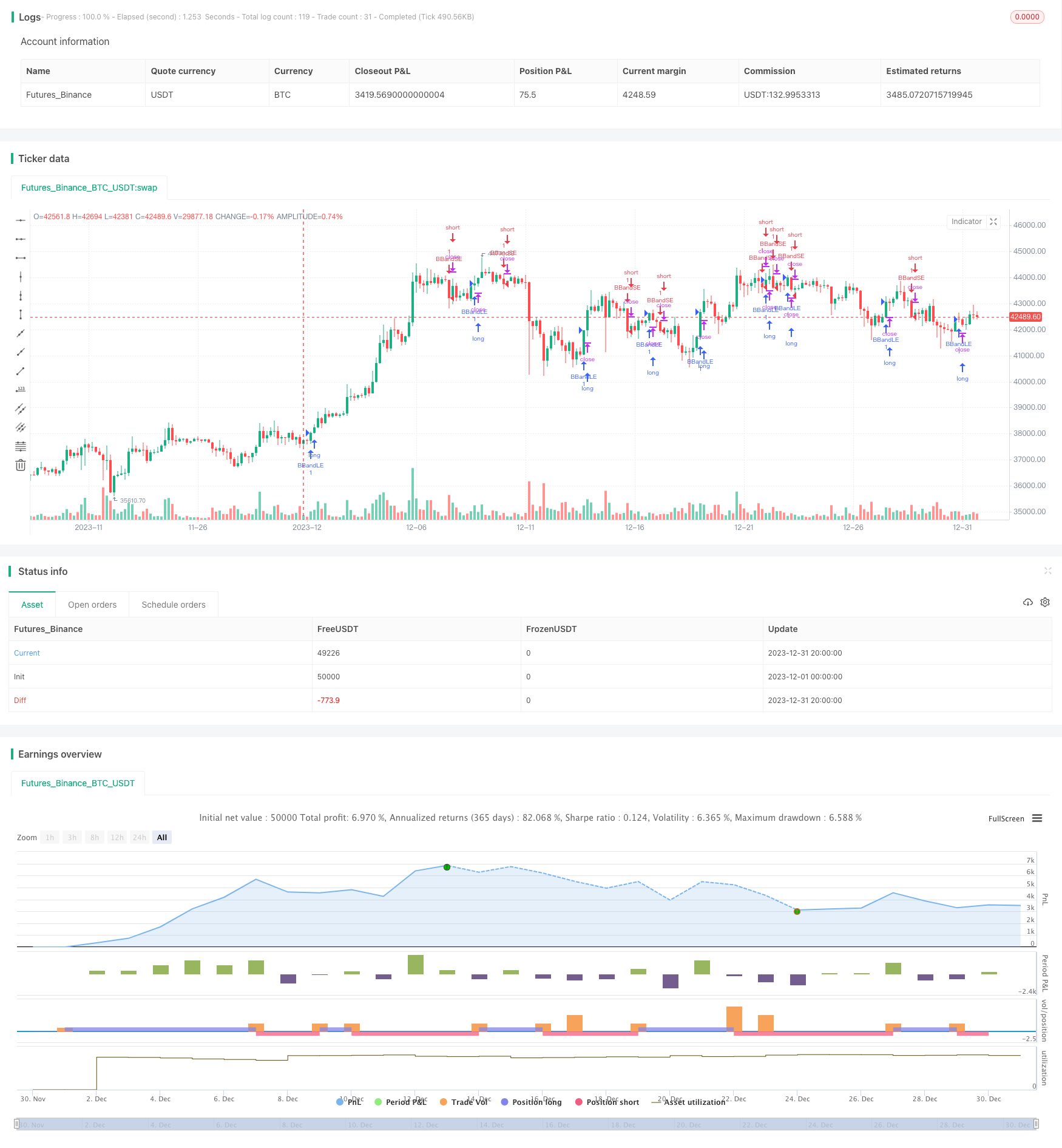

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger Bands Trend Strategy", shorttitle="BB Trend", overlay=true)

source = close

length = input(8, minval=1)

mult = input(1.00, minval=0.001, maxval=50)

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

buyEntry = crossover(source, upper)

sellEntry = crossunder(source, lower)

if (crossover(source, upper))

strategy.entry("BBandLE", strategy.long, stop=upper, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (crossunder(source, lower))

strategy.entry("BBandSE", strategy.short, stop=lower, oca_name="BollingerBands", comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)