概述

双移动均线黄金交叉策略是一种基于移动平均线的量化交易策略。该策略通过计算不同周期的移动平均线,判断市场趋势和买卖时机。当短期移动平均线上穿长期移动平均线时,产生黄金交叉,作为买入信号;当短期移动平均线下穿长期移动平均线时,产生死亡交叉,作为卖出信号。

策略原理

双移动均线黄金交叉策略的核心逻辑基于移动平均线的平滑特性。移动平均线能够有效过滤市场噪音,指示大致趋势方向。短期移动平均线对价格变化更加敏感,能够捕捉到最近一段时间内的价格波动信息;而长期移动平均线对最近价格变化的响应较慢,能反映市场长期趋势。当短期移动平均线上穿长期移动平均线时,说明市场正在形成新的上涨趋势;当短期移动均线下穿长期移动均线时,说明涨势可能结束,需要考虑离场。

双移动均线策略的另一个关键点是 RSI 指标。RSI 能够有效判断市场是否处于超买超卖状态。结合 RSI 可以避免在市场转折点附近产生错误交易。这套策略只有在 RSI 指标符合条件的情况下,才会产生买入和卖出信号。

具体来说,该策略的交易决策逻辑如下:

- 计算 20 周期、50 周期和 100 周期的移动平均线

- 判断 20 周期移动平均线是否上穿 50 周期和 100 周期的移动平均线,若满足则可能进入趋势性上涨阶段

- 同时检测 RSI 指标是否小于 50,表明没有进入超买区域

- 当上述三个条件同时满足时,产生买入信号

- 判断 20 周期移动平均线是否下穿 50 周期和 100 周期的移动平均线,若满足则可能进入趋势性下跌阶段

- 同时检测 RSI 指标是否超过 48.5,表明没有进入超卖区域

- 当上述三个条件同时满足时,产生卖出信号

通过多参数组合,该策略能够有效过滤假信号,提高交易决策的准确性。

策略优势

双移动均线黄金交叉策略具有以下几个优势:

- 策略简单清晰,容易理解和实现

- 参数优化灵活,可以调整移动平均线的周期使之适应不同市场

- 移动平均线和 RSI 指标的组合使用,能够有效过滤噪音,评估市场实际趋势

- 回测数据表明,该策略收益稳定,回撤较小

- 可通过集成机器学习等高级技术进一步优化策略参数

策略风险

双移动均线黄金交叉策略也存在以下风险:

- 当市场出现剧烈波动时,移动平均线产生滞后,可能错过最佳买卖点

- 策略依赖参数优化,如果参数设定不当,会大幅影响策略收益

- 长期运行时,市场结构可能发生变化,移动平均线和 RSI 参数需要调整

- 机械化交易策略容易集中持仓,市场转折时风险较大

为降低风险,可以从以下几个方面进行优化:

- 结合波动率指标等评估市场波动频率和幅度,动态调整移动平均线周期

- 增加机器学习模型对参数进行动态优化

- 设置止损止盈条件,避免单笔损失过大

- 采用仓位管理系统,根据市场情况调整仓位规模,降低集中持仓风险

策略优化方向

双移动均线黄金交叉策略还有进一步优化的空间:

- 增加其他指标过滤信号,如成交量,布林带等,提升策略稳定性

- 采用机器学习对参数进行动态优化,使策略更加智能化

- 设计自适应移动平均线周期设置方案,根据市场结构变化调整参数

- 结合高级risk management系统,动态调整仓位,降低策略风险

- 构建算法交易组合,融合多种交易策略提高稳定性

总结

双移动均线黄金交叉策略是一个非常经典的规则型量化交易策略。它简单易于实现,参数优化灵活,收益表现也较为优秀,是初学者入门量化交易的不错选择。但该策略也存在一定限制,通过进一步的研究和优化,可以使其向更高的智能化和稳定性迈进,真正做到持续盈利。

策略源码

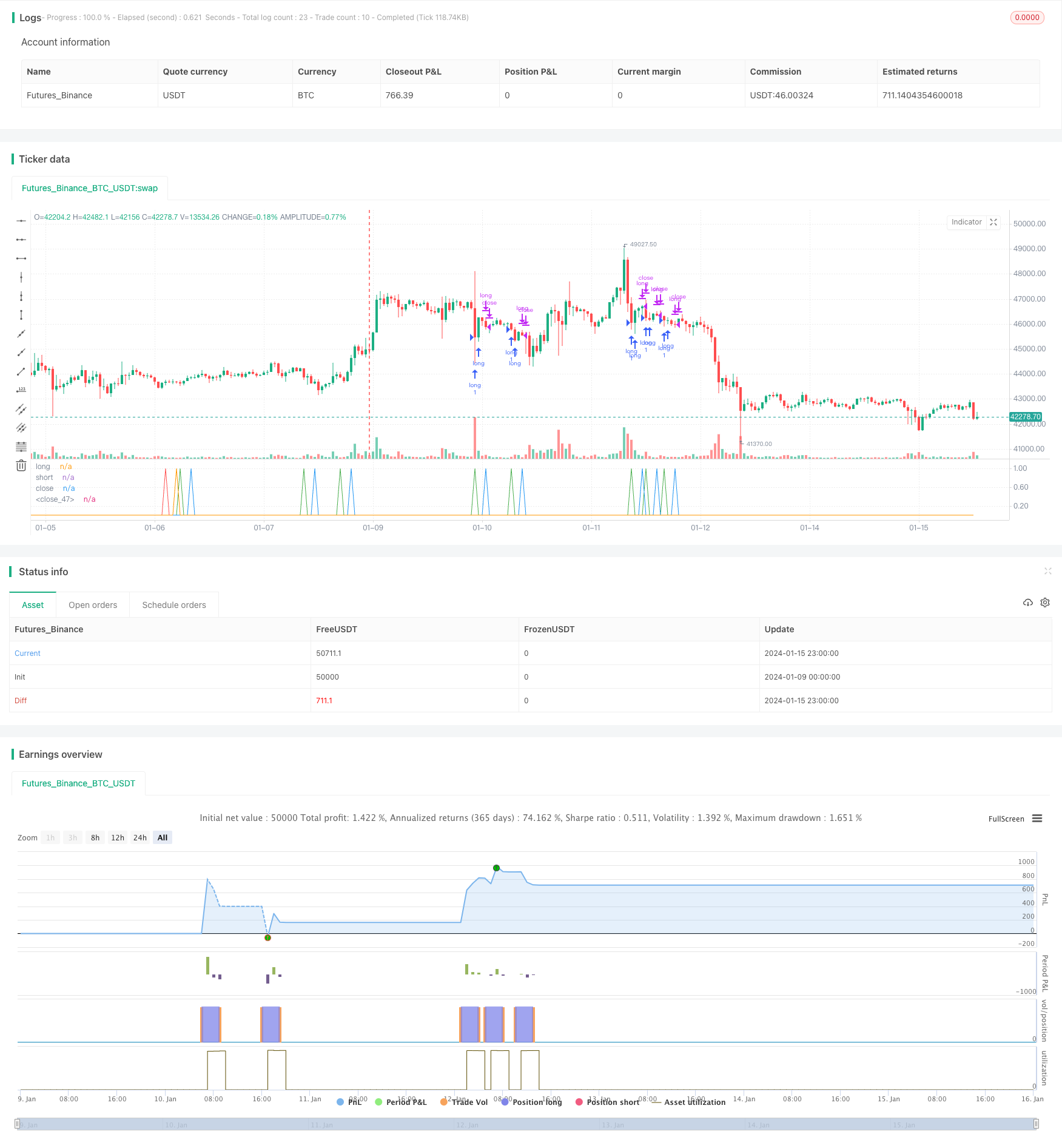

/*backtest

start: 2024-01-09 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Based on Larry Connors RSI-2 Strategy - Lower RSI

strategy(title="EA_3Minute_MagnetStrat", shorttitle="EA_3Minute_MagnetStrat", overlay=false)

src = close,

//RSI CODE

up = rma(max(change(src), 0), 30)

down = rma(-min(change(src), 0), 30)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//Criteria for Moving Avg rules

ma20= vwma(close,20)

ma50 = vwma(close,50)

ma100= vwma(close,100)

//Rule for RSI Color

//col = ma30 > ma50 > ma200 and rsi <=53?lime: ma50 < ma200 and rsi >= 60?red : silver

long1 = ma20 > ma50 and ma50 > ma100 and rsi < 50

short1 = ma20 < ma50 and ma50 < ma100 and rsi > 48.5

//plot(rsi, title="RSI", style=line, linewidth=1,color=col)

//plot(100, title="Upper Line 100",style=line, linewidth=3, color=aqua)

//plot(0, title="Lower Line 0",style=line, linewidth=3, color=aqua)

//band1 = plot(60, title="Upper Line 60",style=line, linewidth=1, color=aqua)

//band0 = plot(44, title="Lower Line 40",style=line, linewidth=1, color=aqua)

//fill(band1, band0, color=silver, transp=90)

//strategy.entry ("buy", strategy.long, when=long)

//strategy.entry ("sell", strategy.short, when=short)

//plot(long,"long",color=green,linewidth=1)

//plot(short,"short",color=red,linewidth=1)

//

long = long1[1] == 0 and long1 == 1

short = short1[1] == 0 and short1 == 1

longclose = long[3] == 1

shortclose = short[3] == 1

//Alert

strategy.entry("short", strategy.short,qty = 1, when=short)

strategy.entry("long", strategy.long,qty=1, when=long)

plot(long,"long",color=green,linewidth=1)

plot(short,"short",color=red,linewidth=1)

strategy.close("long",when=longclose)

strategy.close("short",when=shortclose)

//strategy.exit(id="long",qty = 100000,when=longclose)

//strategy.exit(id="short",qty = 100000,when=shortclose)

plot(longclose,"close",color=blue,linewidth=1)

plot(shortclose,"close",color=orange,linewidth=1)

//strategy.exit(id="Stop", profit = 20, loss = 100)