概述

本策略融合了超级趋势指标和商品通道指数(CCI)指标,实现了一个多时间框架的趋势追踪和交易信号生成。该策略的主要思想是利用CCI指标判断短期趋势方向,同时结合超级趋势指标判断中长期趋势方向。当短期和中长期趋势一致时,产生交易信号。

策略原理

CCI指标判断短期趋势

CCI指标能判断超买超卖现象,当CCI指标从下向上穿过0轴线时为多头信号,反之为空头信号。本策略即利用这一特性,判断短期趋势方向。

cci_period = input(28, "CCI Period")

cci = cci(source, cci_period)

ML = input(0, "CCI Mid Line pivot")

以上代码定义了CCI指标的周期和中轴线位置。

TrendUp := cci[1] > ML ? max(Up,TrendUp[1]) : Up

TrendDown := cci[1]< ML ? min(Dn,TrendDown[1]) : Dn

这部分代码判断cci是否上穿0轴线,如果是则更新超级趋势的上轨,下穿则更新下轨。

超级趋势指标判断中长期趋势

超级趋势指标通过将ATR指标与价格进行组合,能判断中长期趋势的方向。当价格突破超级趋势的上轨时为多头信号,下轨为空头信号。

本策略中超级趋势指标的计算公式如下:

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

其中Factor和Pd为可调节的参数。

Trend变量判断超级趋势的当前方向:

Trend := cci > ML ? 1: cci < ML ? -1: nz(Trend[1],1)

整合CCI和超级趋势

通过整合CCI指标和超级趋势指标,本策略实现了多时间框架下的趋势判断。CCI指标捕捉短期趋势,超级趋势指标判断中长期趋势。

当二者方向一致时,产生更可靠的交易信号。

isLong = st_trend == 1

isShort = st_trend == -1

入场时机为短期和中长期同向,出场时机为短期和中长期反向。

策略优势

多时间框架判断

本策略同时整合了短期和中长期趋势判断指标,使交易信号更加可靠。

参数可调

超级趋势指标中的Factor参数和CCI指标的cci_period可根据市场调整,使策略更具灵活性。

简单清晰

策略结构简单清晰,容易理解和实现,非常适合量化交易初学者。

适用范围广

可适用于股票、外汇、加密货币等市场,也可根据参数设置调整适用不同品种。

策略风险及解决方法

价格震荡大

当价格波动剧烈时,会出现许多虚假信号。可适当调大超级趋势的Factor参数,降低策略的交易频率。

追随强势不足

超级趋势本身对强势的追随并不足够,可考虑与动量指标结合,在趋势加速阶段追踪趋势。

停损策略

本策略没有设置止损,可结合ATR指标的大小设置 trails 止损。

策略优化方向

市场相关性

根据不同市场的特点,调整超级趋势和CCI的参数,提高策略稳定性。

动量指标结合

与MACD,KDJ等动量指标结合,在趋势加速阶段追踪趋势,可获得更高收益。

集成学习

使用机器学习和集成学习方法对策略参数和交易规则进行优化。

总结

本策略成功结合超级趋势和CCI指标,实现了多时间框架下的趋势判断。策略简单易懂,参数可调,收益潜力较大。可通过调参、止损和集成学习等方式进一步优化,使之成为一个可靠、稳定、高效的交易策略。

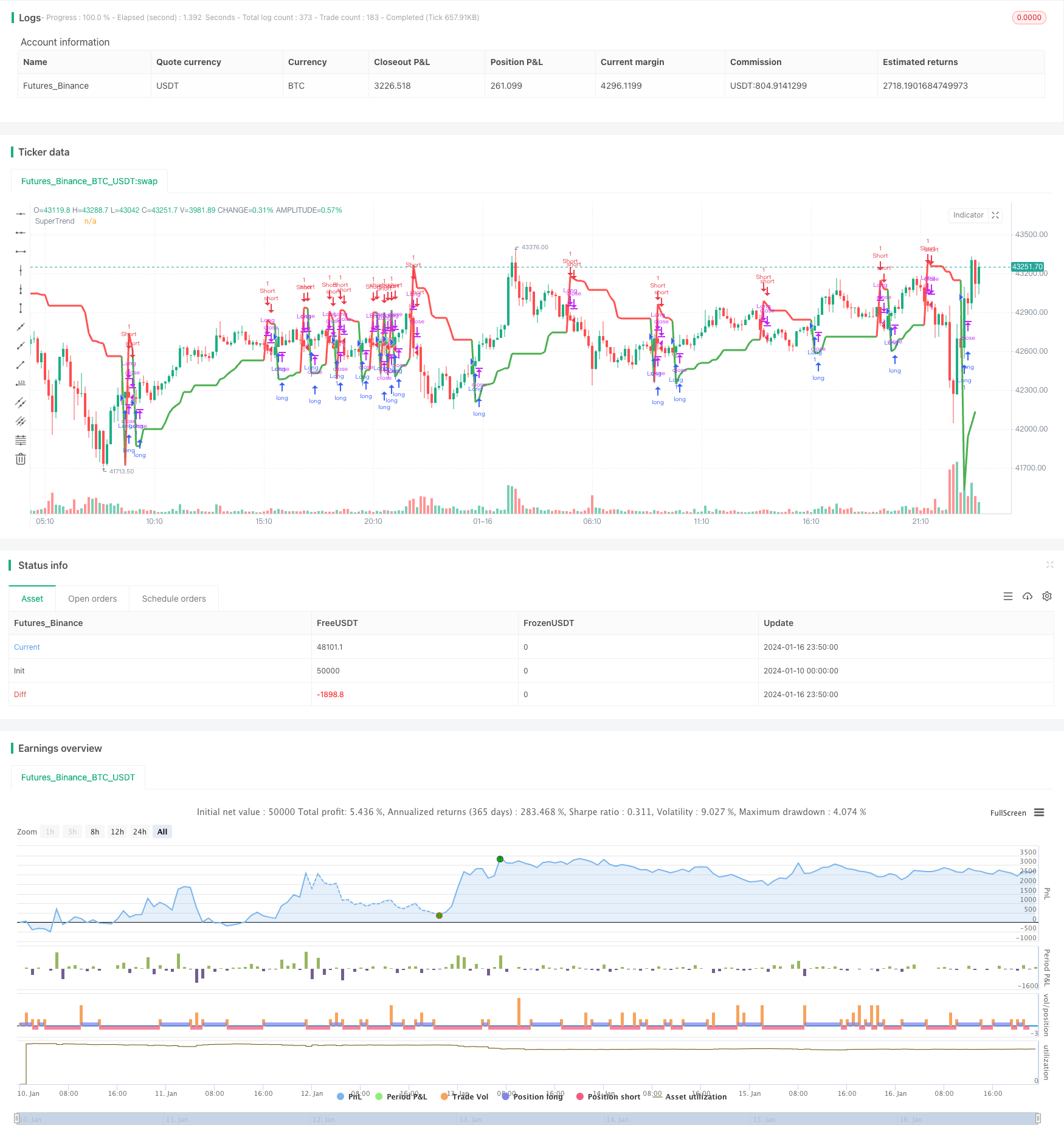

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//@author=Daveatt

StrategyName = "Best Supertrend CCI Strategy"

ShortStrategyName = "Best Supertrend CCI Strategy"

strategy(title=StrategyName, shorttitle=ShortStrategyName, overlay=true )

//////////////////////////

//* COLOR CONSTANTS *//

//////////////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

GOLD = #FFD700

WHITE = color.white

// Plots

GREEN_LIGHT = color.new(color.green, 40)

RED_LIGHT = color.new(color.red, 40)

BLUE_LIGHT = color.new(color.aqua, 40)

PURPLE_LIGHT = color.new(color.purple, 40)

source = input(close)

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

/////////////////////////////////// CCI /////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

cci_period = input(28, "CCI Period")

cci = cci(source, cci_period)

//UL = input(80, "Upper level")

//LL = input(20, "Lower Level")

ML = input(0, "CCI Mid Line pivot")

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////// SUPERTREND /////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

Factor=input(3,title="[ST] Factor", minval=1,maxval = 100, type=input.float)

Pd=input(3, title="[ST] PD", minval=1,maxval = 100)

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

/////////////////////// SUPERTREND DETECTION //////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

f_supertrend(Factor, Pd) =>

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

TrendUp = 0.0

TrendUp := cci[1] > ML ? max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := cci[1]< ML ? min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := cci > ML ? 1: cci < ML ? -1: nz(Trend[1],1)

Tsl = Trend==1? TrendUp: TrendDown

[Trend, Tsl]

[st_trend, st_tsl] = f_supertrend(Factor, Pd)

// Plot the ST

linecolor = close >= st_tsl ? color.green : color.red

plot(st_tsl, color = linecolor , linewidth = 3,title = "SuperTrend", transp=0)

isLong = st_trend == 1

isShort = st_trend == -1

longClose = isLong[1] and isShort

shortClose = isShort[1] and isLong

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=longClose )

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=shortClose )