概述

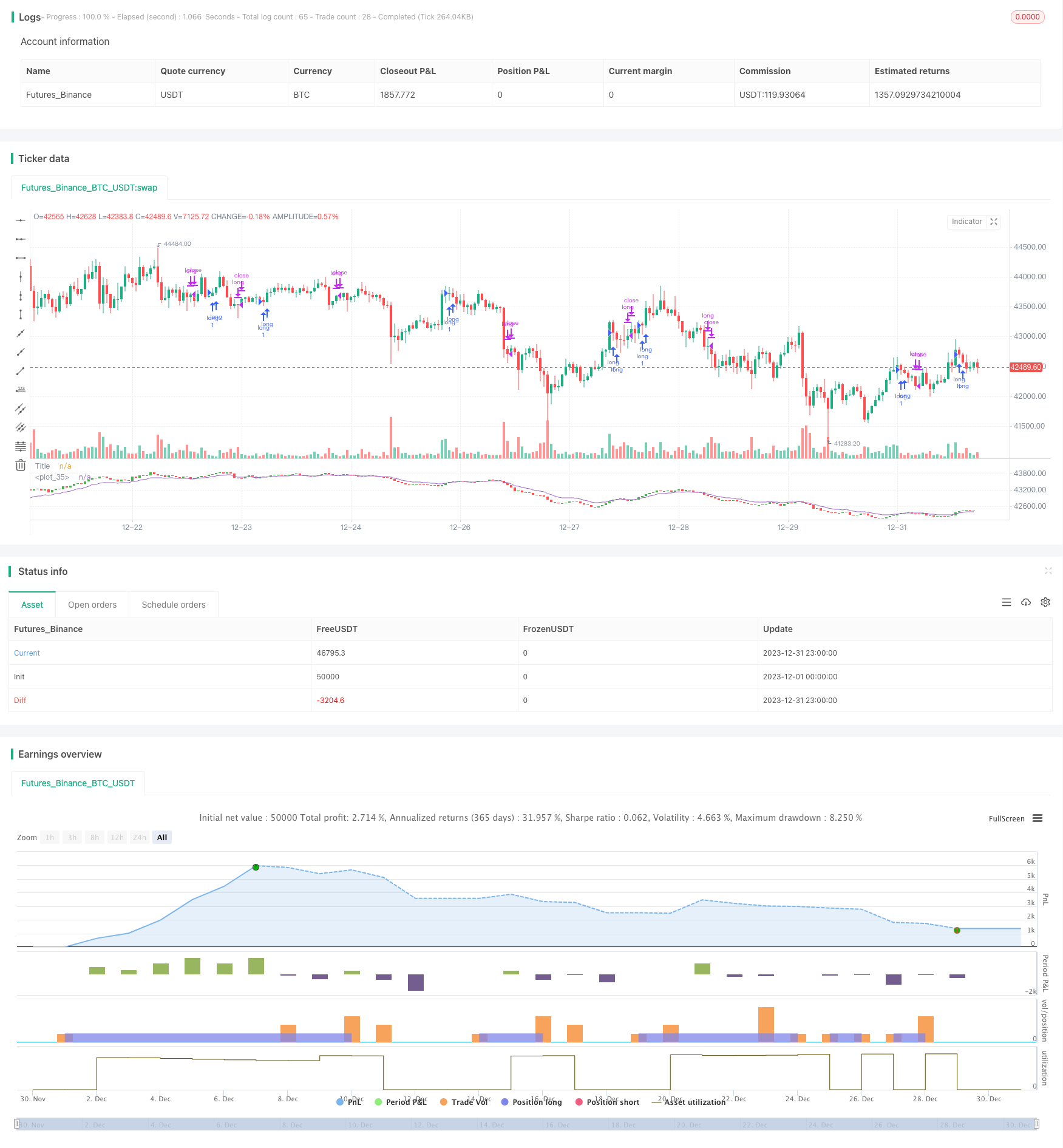

本策略通过构建基于斐波那契数列计算的平均K线和移动平均线,结合多种价格技术指标规则,实现仅做多不做空的量化交易。初步测试表明,该策略在大周期图形上表现较好。

策略原理

本策略主要通过以下步骤实现:

根据斐波那契数列,计算最近10个斐波那契周期的平均收盘价、最高价、最低价和开盘价,构建平均K线。

对平均收盘价计算1、2、3、5、8、13、21、34和55周期的指数移动平均线(EMA),并计算这9个EMA的平均值,得到平均EMA。

设置做多和平仓条件:当平均K线形态显示多头信号(收阳、阳包阳等)且收盘价高于平均EMA时开仓做多;当平均K线形态显示空头信号(收阴、阴包阴等)且收盘价低于平均EMA时平仓。

通过计算平均K线滤波价格波动,再结合均线指标发出交易信号,可以有效识别趋势,控制交易风险。

策略优势

基于斐波那契数列计算平均K线,可以有效滤波随机价格波动,识别趋势信号。

多个EMA均值构建平均EMA,可以增强支持阻力位的稳定性,提高信号质量。

仅做多不做空可以减少交易次数,降低交易成本和滑点影响。

在大周期运行表现较好,适合中长线操作。

策略风险

仅做多的策略在空头市场中可能遭受较大亏损。

EMA均线容易产生滞后,可能错过最佳入场时点。

过于追求大周期操作,可能错过中短线机会。

参数优化空间有限,实盘表现可能弱于参数优化的回测结果。

优化方向

可以测试添加适当的止损策略,在亏损扩大时止损出场。

可以结合波动率指标如ATR,动态调整仓位规模。

可以测试在下跌趋势中适当介入做空,增加策略收益。

可以优化EMA的周期参数,找到最佳参数组合。

总结

本策略通过构建斐波那契平均K线和均线指标,识别趋势信号实现量化交易。策略具有计算平均K线滤波价格优势,以及仅做多操作减少交易成本优势。同时也存在只做多的市场风险,以及EMA滞后的问题。总体来说,本策略从多个维度控制了交易风险,在大周期中表现较好,适合中长线操作。通过继续优化可以提升策略稳定性和收益水平。

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("Fibonacci candle", overlay=false )

//plot of our fibonacci candle

// Fibonacci

// Fn = Fn-1 + Fn-2

// F10 = 55

// 0 1 2 3 5 8 13 21 34 55

avg_close = (close[0] + close[1] + close[2] + close[3] +close[5] + close[8] + close[13]+ close[21] + close[34] + close[55]) / 10

avg_high = (high[0] + high[1] + high[2] + high[3] +high[5] + high[8] + high[13]+ high[21] + high[34] + high[55]) / 10

avg_low = (low[0] + low[1] + low[2] + low[3] +low[5] + low[8] + low[13]+ low[21] + low[34] + low[55]) / 10

avg_open = (open[0] + open[1] + open[2] + open[3] +open[5] + open[8] + open[13]+ open[21] + open[34] + open[55]) / 10

src = avg_close//input(avg_close, title="Source")

out55 = ema(src, 55)

out1 = ema(src, 1)

out2 = ema(src, 2)

out3 = ema(src, 3)

out5 = ema(src, 5)

out8 = ema(src, 8)

out13 = ema(src, 13)

out21 = ema(src, 21)

out34 = ema(src, 34)

avg_ema = (out55 + out1 + out2 + out3+ out5 + out8 + out13 + out21 + out34)/9

plot(avg_ema)

plotcandle(avg_open, avg_high, avg_low, avg_close, title='Title', color = avg_open < avg_close ? color.green : color.red, wickcolor=color.white)

long = avg_open < avg_close and avg_close > avg_close[1] and avg_high > avg_high[1] and avg_close[1] > avg_close[2] and avg_high[1] > avg_high[2]

short = avg_open > avg_close and avg_close < avg_close[1] and avg_low < avg_low[1] and avg_close[1] < avg_close[2] and avg_low[1] < avg_low[2]

strategy.entry("long",1,when=long and avg_close > avg_ema)

strategy.close('long',when=short and avg_close < avg_ema)