概述

移动平均线交叉与平仓交易策略是一种基于9日指数移动平均线(EMA)和20日简单移动平均线(MA)的价格运动来进行交易操作的策略。该策略利用EMA和MA的交叉信号来判断趋势方向,以发出买入和卖出信号。一旦价格重新跨过移动平均线,该策略会平仓现有头寸。

策略原理

EMA和MA的计算

- EMA9 计算9日的指数移动平均线。EMA赋予最近期价格更大权重,使其更灵敏地响应新的信息。

- MA20 计算20日的简单移动平均线。MA是过去20日收盘价的平均值。

买入和卖出条件

- 买入条件:当收盘价高于9日EMA和20日MA时成立。该信号被视为多头信号。

- 卖出条件:当收盘价低于9日EMA和20日MA时成立。该信号被视为空头信号。

开仓和平仓

- 当买入条件成立时,执行买入开仓操作。

- 当卖出条件成立时,执行卖出开仓操作。

- 当价格重新跨过9日EMA或20日MA时,不论当前持仓方向,执行平仓操作。

K线配色

- 买入K线标为绿色

- 卖出K线标为红色

- 其他K线默认白色

EMA和MA画图

在图表上绘制9日EMA和20日MA曲线,以便观察价格与移动平均线的相对位置。

策略优势分析

该策略融合了EMA和MA两个广泛使用的技术指标,充分利用了它们平滑价格、判断趋势方向的优点。相比单一使用EMA或MA,该组合能提供更可靠的交易信号。

EMA和MA线的交叉信号简单明了,可以清楚判断市场 Bachelder 的变化,避免错误交易。

策略直接在K线上进行视觉化配色,无需复杂计算即可直观判断当前趋势和信号。

自动执行开仓和平仓操作,严格遵循事先制定的交易规则,有助于风险控制。

风险分析

移动平均线属于趋势跟随指标,在盘整时期会产生大量虚假信号。应避免在震荡趋势中使用该策略。

在价格剧烈波动时,移动平均线可能产生滞后,导致错过最佳入场或出场时机。

EMA和MA的参数设置会对交易结果产生很大影响。应调整参数以适应不同品种和交易周期。

自动交易策略无法像人工交易员般应对各种复杂情况,难以在危急时刻关闭误导头寸。应预先设置止损和止盈。

优化方向

可测试不同长度的EMA和MA参数组合,选择产生信号最优且最大限度减少虚假信号的参数。

可结合波动率指标如ATR来过滤部分高风险信号,以控制潜在亏损。

将策略与其他指标或信号结合使用,如量价指标、布林带,来验证信号的可靠性。

添加止损和止盈逻辑以主动控制头寸风险。止损可基于ATR倍数或价格级别来设定。

总结

移动平均线交叉与平仓交易策略通过EMA和MA的交叉为基础判断市场趋势方向,以发出交易信号。该策略简单实用,容易实现自动化交易。但如其他技术指标策略一样,其 parameter 设置和市场情况对结果影响很大,在实战中需要不断调整优化以适应市场变化。

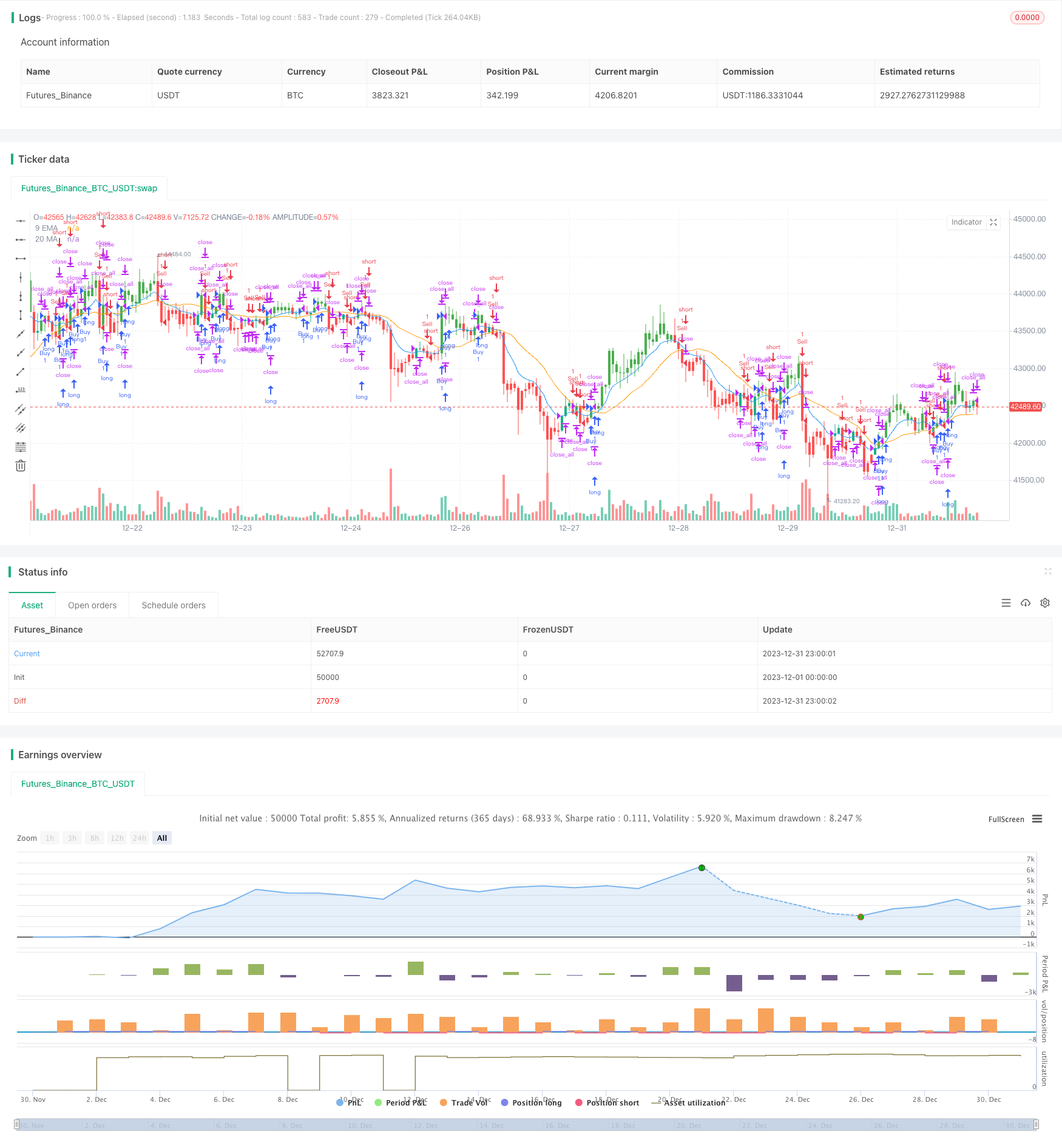

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA and MA Crossover with Close Strategy", shorttitle="EMA_MA_Close", overlay=true)

// Define the length of the Exponential Moving Average and Moving Average

lengthEMA = 9

lengthMA = 20

// Calculate the 9 EMA and 20 MA

ema9 = ema(close, lengthEMA)

ma20 = sma(close, lengthMA)

// Define the buy and sell conditions

buyCondition = close > ema9 and close > ma20

sellCondition = close < ema9 and close < ma20

// Define the close position condition

closeCondition = crossover(close, ema9) or crossover(close, ma20)

// Execute buy or sell orders

if (buyCondition)

strategy.entry("Buy", strategy.long)

else if (sellCondition)

strategy.entry("Sell", strategy.short)

// Close any position if the close condition is met

if (closeCondition)

strategy.close_all()

// Coloring the candles based on conditions

barcolor(buyCondition ? color.green : na)

barcolor(sellCondition ? color.red : na)

// Plotting the EMA and MA for reference

plot(ema9, color=color.blue, title="9 EMA")

plot(ma20, color=color.orange, title="20 MA")