概述

这个策略结合了随机指标RSI、移动平均线SMA和加权移动平均线WMA来寻找买入卖出信号。它同时在5分钟和1小时时间框架判断趋势方向。在企稳的趋势中,当快线RSI上穿或下穿慢线时产生交易信号。

策略原理

该策略首先在1小时和5分钟两个时间框架分别计算144周期加权移动平均线WMA和5周期简单移动平均线SMA。只有当5分钟SMA在WMA之上时,才认为是多头市场。然后策略计算RSI的多空指标,以及对应的K线和D线。当K线从超买区域下穿D线时,产生卖出信号;当K线从超卖区域上穿D线时,产生买入信号。

优势分析

这是一个非常有效的趋势跟踪策略。它同时结合了两个时间框架判断趋势,非常有效地减少了错误信号。另外,它结合多种指标进行过滤,包括RSI、SMA和WMA,使信号更加可靠。通过让RSI驱动KDJ,它也修改了普通KDJ策略中容易产生的假信号问题。此外,该策略还有止损和止盈设置来锁定利润,可以有效控制风险。

风险分析

该策略最大的风险在于趋势判断错误。在行情转折点时,短期和长期平均线可能同时上翻或下翻,从而产生错误信号。此外,在震荡行情时,RSI也可能产生较多纠缠不清的交易信号。不过这些风险可以通过适当调整SMA和WMA周期以及RSI参数来减轻。

优化方向

该策略可以从以下几个方面进行优化: 1)测试不同长度的SMA、WMA和RSI,找到最佳参数组合 2)增加其他指标判断,如MACD、布林线等来验证信号可靠性 3)优化止损止盈策略,测试固定比例止损、余额滑点止损、跟踪止损等方法 4)加入资金管理模块,控制单笔投资规模和整体风险敞口 5)增加机器学习算法,通过大量回测找到有最好绩效的参数

总结

该策略充分利用了移动平均线和随机指标的优势,建立了一个较为可靠的趋势跟踪体系。通过多个时间框架和指标的验证,它能顺利捕捉中长线趋势的方向。同时止损止盈设置也让其承受了一定程度的市场震荡。不过仍有一定改进空间,如测试更多指标结合使用,引入机器学习方法寻找最优参数等。总的来说这是一个非常有前景的交易策略。

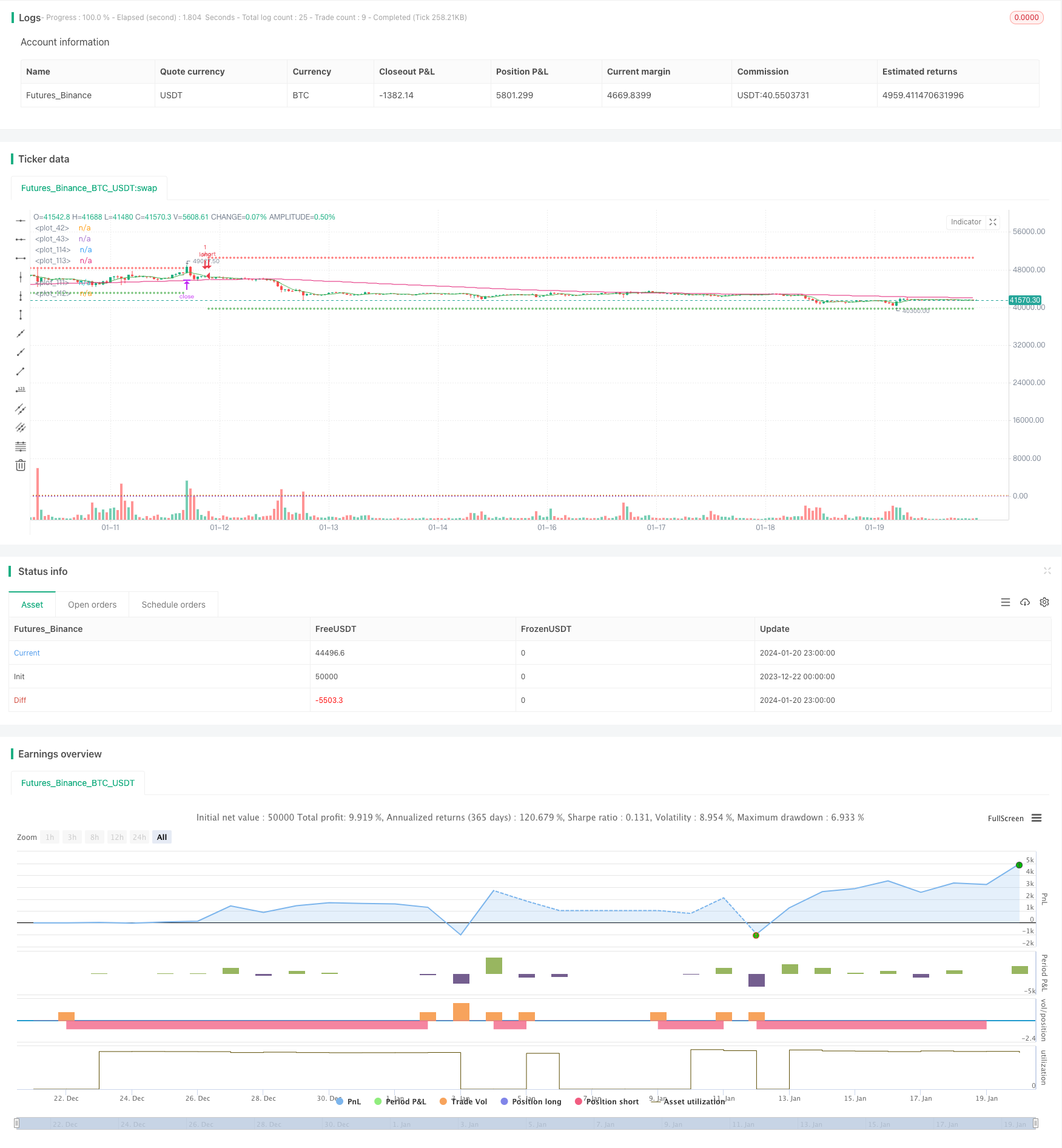

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © bufirolas

// Works well with a wide stop with 20 bars lookback

// for the SL level and a 2:1 reward ratio Take Profit .

// These parameters can be modified in the Inputs section of the strategy panel.

// "an entry signal it's a cross down or up on

// the stochastics. if you're in a downtrend

// on the hourly time frame you

// must also be in a downtrend on the five

// minute so the five period has to be below the 144

// as long as the five period is still trading below

// the 144 period on both the hourly and the five minutes

// we are looking for these short signals crosses down

// in the overbought region of the stochastic. Viceversa for longs"

//@version=4

strategy("Stoch + WMA + SMA strat", overlay=true)

//SL & TP Inputs

i_SL=input(true, title="Use Swing Lo/Hi Stop Loss & Take Profit")

i_SwingLookback=input(20, title="Swing Lo/Hi Lookback")

i_SLExpander=input(defval=10, step=1, title="SL Expander")

i_TPExpander=input(defval=30, step=1, title="TP Expander")

i_reverse=input(false, title="Reverse Trades")

i_TStop =input(false, title="Use Trailing Stop")

//Strategy Inputs

src4 = input(close, title="RSI Source")

stochOS=input(defval=20, step=5, title="Stochastics Oversold Level")

stochOB=input(defval=80, step=5, title="Stochastics Overbought Level")

//Stoch rsi Calculations

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

rsi1 = rsi(src4, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

h0 = hline(80, linestyle=hline.style_dotted)

h1 = hline(20, linestyle=hline.style_dotted)

//MA

wmalen=input(defval=144, title="WMA Length")

WMA = security(syminfo.tickerid, "60", wma(close, wmalen))

SMA = security(syminfo.tickerid, "60", sma(close, 5))

minWMA = wma(close, wmalen)

minSMA = sma(close, 5)

//Entry Logic

stobuy = crossover(k, d) and k < stochOS

stosell = crossunder(k, d) and k > stochOB

mabuy = minSMA > minWMA

daymabuy = SMA > WMA

//SL & TP Calculations

SwingLow=lowest(i_SwingLookback)

SwingHigh=highest(i_SwingLookback)

bought=strategy.position_size != strategy.position_size[1]

LSL=valuewhen(bought, SwingLow, 0)-((valuewhen(bought, atr(14), 0)/5)*i_SLExpander)

SSL=valuewhen(bought, SwingHigh, 0)+((valuewhen(bought, atr(14), 0)/5)*i_SLExpander)

lTP=(strategy.position_avg_price + (strategy.position_avg_price-(valuewhen(bought, SwingLow, 0)))+((valuewhen(bought, atr(14), 0)/5)*i_TPExpander))

sTP=(strategy.position_avg_price - (valuewhen(bought, SwingHigh, 0) - strategy.position_avg_price))-((valuewhen(bought, atr(14), 0)/5)*i_TPExpander)

islong=strategy.position_size > 0

isshort=strategy.position_size < 0

//TrailingStop

dif=(valuewhen(strategy.position_size>0 and strategy.position_size[1]<=0, high,0))

-strategy.position_avg_price

trailOffset = strategy.position_avg_price - LSL

var tstop = float(na)

if strategy.position_size > 0

tstop := high- trailOffset - dif

if tstop<tstop[1]

tstop:=tstop[1]

else

tstop := na

StrailOffset = SSL - strategy.position_avg_price

var Ststop = float(na)

Sdif=strategy.position_avg_price-(valuewhen(strategy.position_size<0

and strategy.position_size[1]>=0, low,0))

if strategy.position_size < 0

Ststop := low+ StrailOffset + Sdif

if Ststop>Ststop[1]

Ststop:=Ststop[1]

else

Ststop := na

//Stop Selector

SL= islong ? LSL : isshort ? SSL : na

if i_TStop

SL:= islong ? tstop : isshort ? Ststop : na

TP= islong ? lTP : isshort ? sTP : na

//Entries

if stobuy and mabuy and daymabuy

strategy.entry("long", long=not i_reverse?true:false)

if stosell and not mabuy and not daymabuy

strategy.entry("short", long=not i_reverse?false:true)

//Exit

if i_SL

strategy.exit("longexit", "long", stop=SL, limit=TP)

strategy.exit("shortexit", "short", stop=SL, limit=TP)

//Plots

plot(i_SL ? SL : na, color=color.red, style=plot.style_cross)

plot(i_SL ? TP : na, color=color.green, style=plot.style_cross)

plot(minWMA)

plot(minSMA, color=color.green)