策略名称

RSI Bullish/Bearish Divergence Trading Strategy

概述

该策略利用 RSI 指标识别常规和隐藏的多头和空头背离信号,根据异常背离信号决定做多做空。

策略原理

当价格创新高价时,RSI 并未创新高点构成多头异常背离,视为卖出信号。当价格创新低点时,RSI 并未创新低点构成空头异常背离,视为买入信号。常规背离是价格与 RSI指标之间的明显的背离。隐藏背离是价格与 RSI 指标之间的较隐蔽的背离。根据常规和隐藏的多头空头背离信号决定做多或者做空。

优势分析

- 异常背离信号具有较高的可靠性,胜率较高。

- 同时识别常规和隐藏的多空头背离,覆盖面广。

- RSI 指标参数可调整,适用于不同市场环境。

风险分析

- 隐藏背离信号可能误判的概率较大。

- 需要人工review过滤误判信号。

- 效果与RSI参数设定有关。

优化方向

- 优化 RSI 参数,寻找最佳参数组合。

- 增加机器学习算法,自动识别真实信号。

- 结合更多指标验证信号可靠性。

总结

该策略识别 RSI 异常背离交易信号,根据常规和隐藏的多空头背离决定做多做空,具有较高的胜率。通过优化 RSI 参数,增加其他验证指标,可进一步提高策略效果。

策略源码

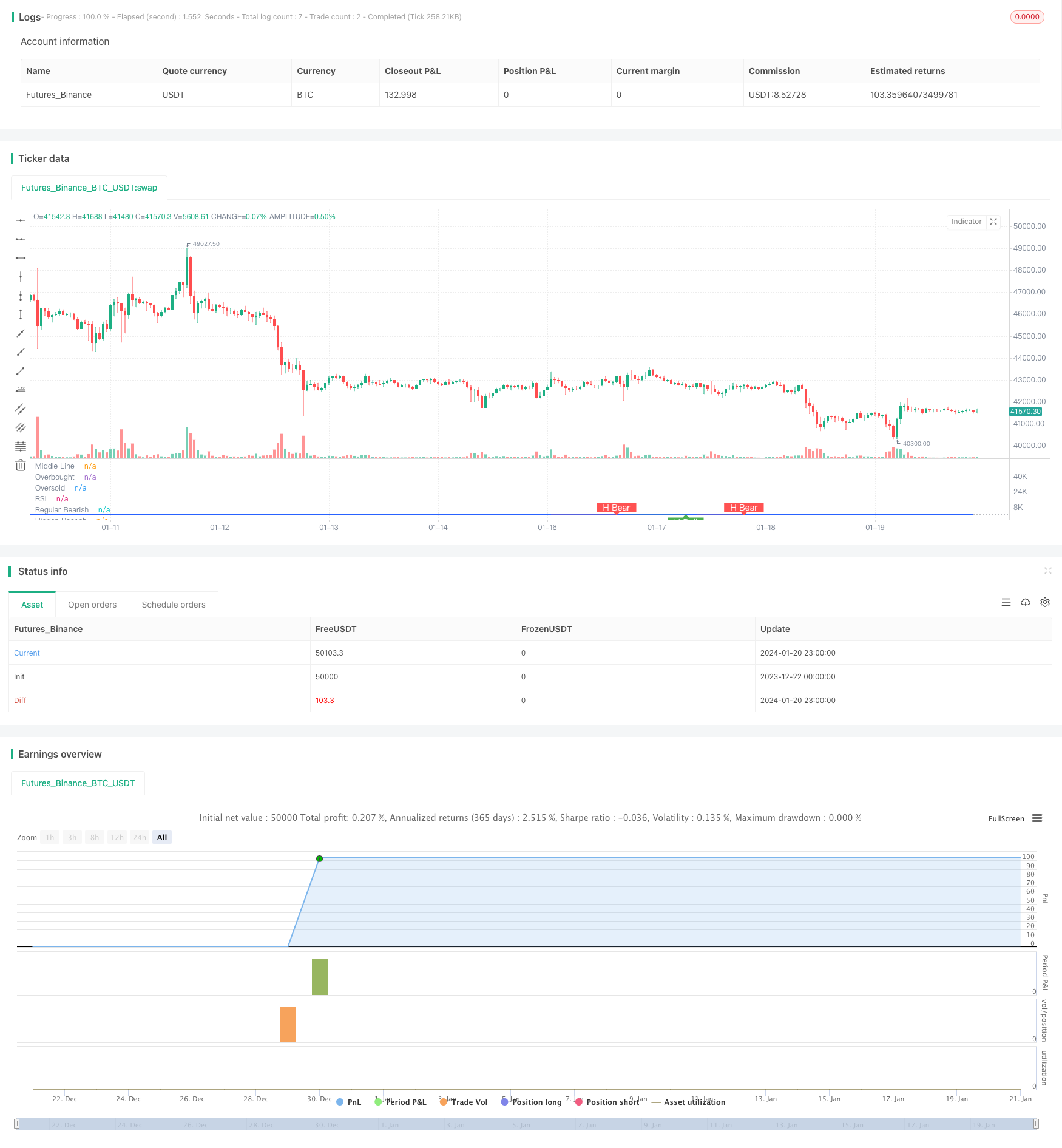

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Divergence Indicator")

len = input.int(title="RSI Period", minval=1, defval=14)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=5)

lbL = input(title="Pivot Lookback Left", defval=5)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = ta.rsi(src, len)

plot(osc, title="RSI", linewidth=2, color=#2962FF)

hline(50, title="Middle Line", color=#787B86, linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", color=#787B86, linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", color=#787B86, linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=color.rgb(33, 150, 243, 90))

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

// bull : 상승 Condition : 조건

bullCond = plotBull and priceLL and oscHL and plFound // 상승다이버전스?

strategy.entry("상승 다이버전스 진입", strategy.long, when = bullCond)

strategy.close("상승 다이버전스 진입", when = ta.crossover(osc, 50))

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor)

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

// strategy.entry("히든 상승 다이버전스 진입", strategy.long, when = hiddenBullCond)

// strategy.close("히든 상승 다이버전스 진입", when = ta.crossover(osc, 50))

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

// bear : 하락

bearCond = plotBear and priceHH and oscLH and phFound

// strategy.entry("하락 다이버전스 진입", strategy.short, when = bearCond)

// strategy.close("하락 다이버전스 진입", when = ta.crossunder(osc, 50))

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor)

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

// strategy.entry("히든 하락 다이버전스 진입", strategy.short, when = hiddenBearCond)

// strategy.close("히든 하락 다이버전스 진입", when = ta.crossunder(osc, 50))

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)