概述

本策略基于价格偏离指标,结合费波那契回调区域,实现趋势的识别和追踪。当价格从某一方向偏离越来越远时,可判断为趋势形成,从而产生交易信号。

策略原理

该策略使用VWAP作为价格的中轴线。然后根据价格中的波动性,计算出上下各1.618倍和2.618倍标准差的价格偏离带。当价格从下向上突破下轨时,产生做多信号;当价格从上向下突破上轨时,产生做空信号。

做多做空后的止损 EXIT 信号是:做多止损线为下轨,做空止损线为上轨。

具体来说,有以下几个步骤:

计算VWAP作为价格的中轴线

计算价格的标准差sd作为衡量价格波动性的指标

根据sd计算上下轨:上轨为 VWAP + 1.618*sd 和 VWAP + 2.618*sd;下轨为 VWAP - 1.618*sd 和 VWAP - 2.618*sd

当价格从下向上突破1.618倍下轨时,产生做多信号;当价格从上向下突破1.618倍上轨时,产生做空信号

做多止损 EXIT:价格突破2.618倍下轨;做空止损 EXIT:价格突破2.618倍上轨

优势分析

该策略具有以下优势:

使用价格偏离指标,可以有效判断价格趋势和追踪趋势

结合费波那契回调区域,使 entrada 入场和止损退出更加明确

VWAP作为价格中轴线,也提高了指标的参考价值

通过参数调整,可以适应不同品种和周期

风险分析

该策略也存在一些风险:

在趋势反转时,可能出现较大亏损

参数设置不当也会影响策略效果

价格剧烈波动时,止损风险较大

对策:

适当缩短持仓周期,及时止损

优化参数,寻找最佳参数组合

加大仓位管理,控制单笔亏损

优化方向

该策略还可以从以下几个方向进行优化:

结合趋势指标,避免逆势交易

加入仓位管理机制

优化参数设置

在多时间周期上进行回测优化

总结

本策略基于价格偏离思想,结合 VWAP 和费波那契标准差倍数区域,实现了对趋势的识别和追踪。相比单一使用均线等指标,本策略判断更为清晰,风险控制也更为明确。通过参数调整和优化,该策略可以适用于不同品种和周期,从而获取较好的策略效果。

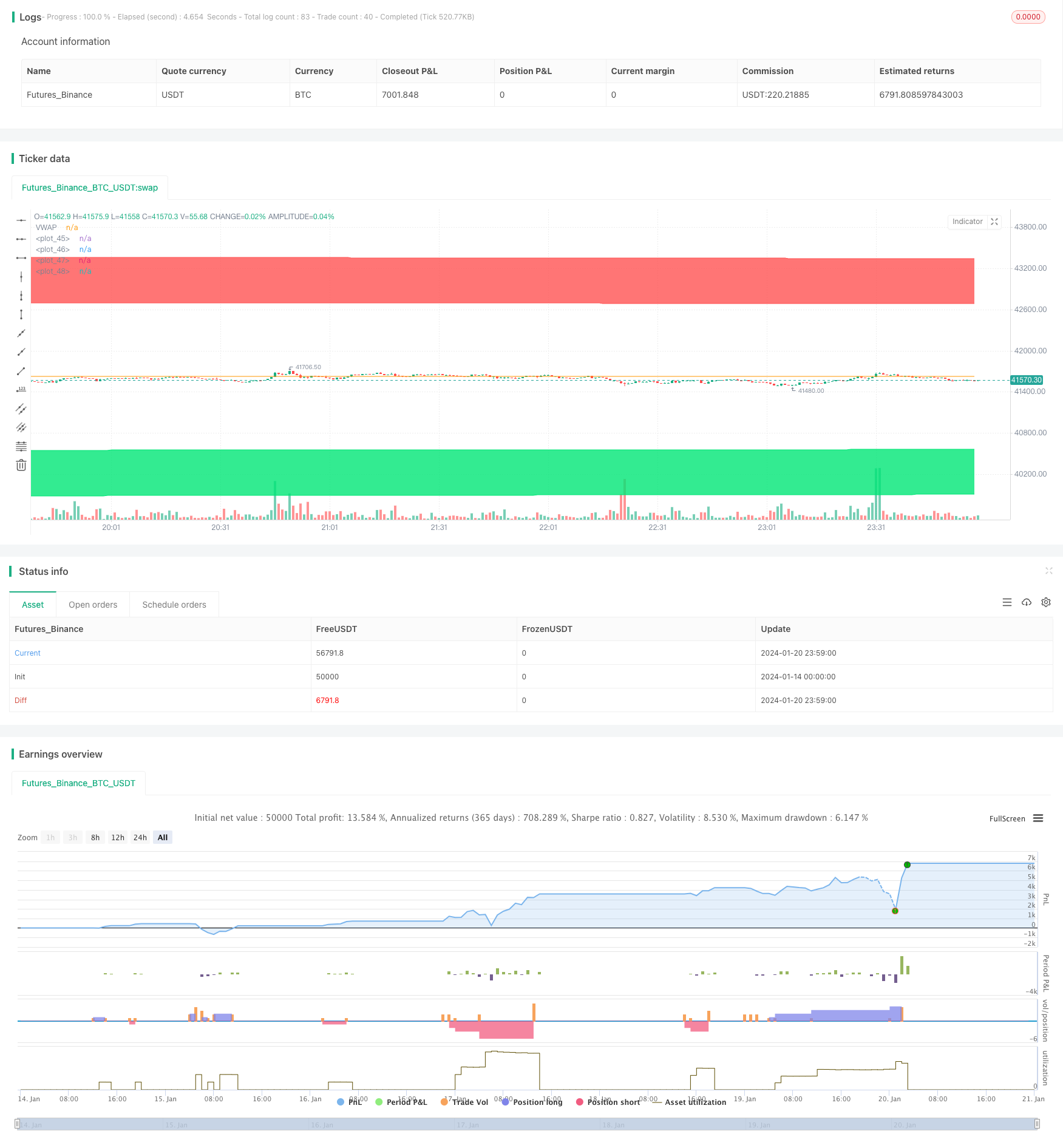

/*backtest

start: 2024-01-14 00:00:00

end: 2024-01-21 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Mysteriown

//@version=4

strategy(title="VWAP + Fibo Dev Extensions Strategy", overlay=true, pyramiding=5, commission_value=0.08)

// -------------------------------------

// ------- Inputs Fibos Values ---------

// -------------------------------------

fib1 = input(title="Fibo extension 1", type=input.float, defval=1.618)

fib2 = input(title="Fibo extension 2", type=input.float, defval=2.618)

reso = input(title="Resolution VWAP", type=input.resolution, defval="W")

dev = input(title="Deviation value min.", type=input.integer, defval=150)

// -------------------------------------

// -------- VWAP Calculations ----------

// -------------------------------------

t = time(reso)

debut = na(t[1]) or t > t[1]

addsource = hlc3 * volume

addvol = volume

addsource := debut ? addsource : addsource + addsource[1]

addvol := debut ? addvol : addvol + addvol[1]

VWAP = addsource / addvol

sn = 0.0

sn := debut ? sn : sn[1] + volume * (hlc3 - VWAP[1]) * (hlc3 - VWAP)

sd = sqrt(sn / addvol)

Fibp2 = VWAP + fib2 * sd

Fibp1 = VWAP + fib1 * sd

Fibm1 = VWAP - fib1 * sd

Fibm2 = VWAP - fib2 * sd

// -------------------------------------

// -------------- Plots ----------------

// -------------------------------------

plot(VWAP, title="VWAP", color=color.orange)

pFibp2 = plot(Fibp2, color=color.red)

pFibp1 = plot(Fibp1, color=color.red)

pFibm1 = plot(Fibm1, color=color.lime)

pFibm2 = plot(Fibm2, color=color.lime)

fill(pFibp2,pFibp1, color.red)

fill(pFibm2,pFibm1, color.lime)

// -------------------------------------

// ------------ Positions --------------

// -------------------------------------

bull = crossunder(low[1],Fibm1[1]) and low[1]>=Fibm2[1] and low>Fibm2 and low<Fibm1 and sd>dev

bear = crossover(high[1],Fibp1[1]) and high[1]<=Fibp2[1] and high<Fibp2 and high>Fibp1 and sd>dev

//plotshape(bear, title='Bear', style=shape.triangledown, location=location.abovebar, color=color.red, offset=0)

//plotshape(bull, title='Bull', style=shape.triangleup, location=location.belowbar, color=color.green, offset=0)

// -------------------------------------

// --------- Strategy Orders -----------

// -------------------------------------

strategy.entry("Long", true, when = bull)

strategy.close("Long", when = crossover(high,VWAP) or crossunder(low,Fibm2))

strategy.entry("Short", false, when = bear)

strategy.close("Short", when = crossunder(low,VWAP) or crossover(high,Fibp2))