概述

Donchian渠道趋势跟踪策略是一种基于Donchian通道指标的趋势跟踪策略。它使用不同长度的Donchian通道来识别价格趋势,并在价格突破通道时产生交易信号。

该策略的主要思想是使用长周期的Donchian通道判断大趋势方向,使用短周期的Donchian通道作为入场和止损的信号。它旨在捕捉中长线的价格趋势,避免被市场中的短期波动所迷惑。

策略原理

计算长周期(如50日)的最高收盘价和最低收盘价构建Donchian通道。当价格突破通道上轨时看多,突破下轨时看空。这是判断大趋势的基础。

计算短周期(如20日)的最高收盘价和最低收闭作为入场和止损的标准。当价格突破长线通道时,如果收盘价也突破短线通道,则入场做多/空。

当持有多头头寸时,如果价格跌破短线下轨则止损。当持有空头头寸时,如果价格突破短线上轨则止损。

止损点设置为N倍ATR。这可以根据市场波动性来自动调整,有利于减少止损被激活的可能性。

可以选择在交易结束前平仓,或一直持仓直到止损。这可以通过一个输入参数来控制。

该策略同时考虑了趋势判断和利润止损,既可以捕捉价格趋势又可以控制风险,适合中长线操作。

优势分析

有效识别中长线趋势,避免被短期市场噪音干扰。

自动止损机制可以限制单笔损失。

ATR止损可以根据市场波动性调整止损距离,降低止损被冲击的可能性。

可选择在没法交易时自动平仓,管理交易风险。

策略逻辑简单清晰易于理解。

风险分析

在无明确趋势的市场中,策略会产生较多交易,这会增加交易成本和实现损失的可能。

虽然有止损机制,但在异常行情下,价格gaps可能直接跌破止损点造成重大损失。

ATR计算仅基于历史数据,无法准确预测未来走势和波动性,实际止损距离可能过大或过小。

在实盘中,止损单无法百分百确保得到执行。极端行情下可能被跳过造成损失。

优化方向

调整Donchian通道参数,优化识别趋势的效果。

结合其他指标确认交易信号,如MACD,KDJ等,提升策略稳定性。

增加移动止损,让止损点随价格一起移动,进一步限制损失。

测试不同持仓时间对总体效果的影响,确定最佳持仓周期。

考虑动态调整仓位规模,在趋势行情中加大仓位。

总结

Donchian渠道趋势跟踪策略整合了趋势判断与风险控制,通过趋势识别获取 excess return,同时止损机制控制尾部风险。该策略适用于识别和捕捉中长线价格趋势,在参数优化和机制补充后可以获得稳定的正向收益。

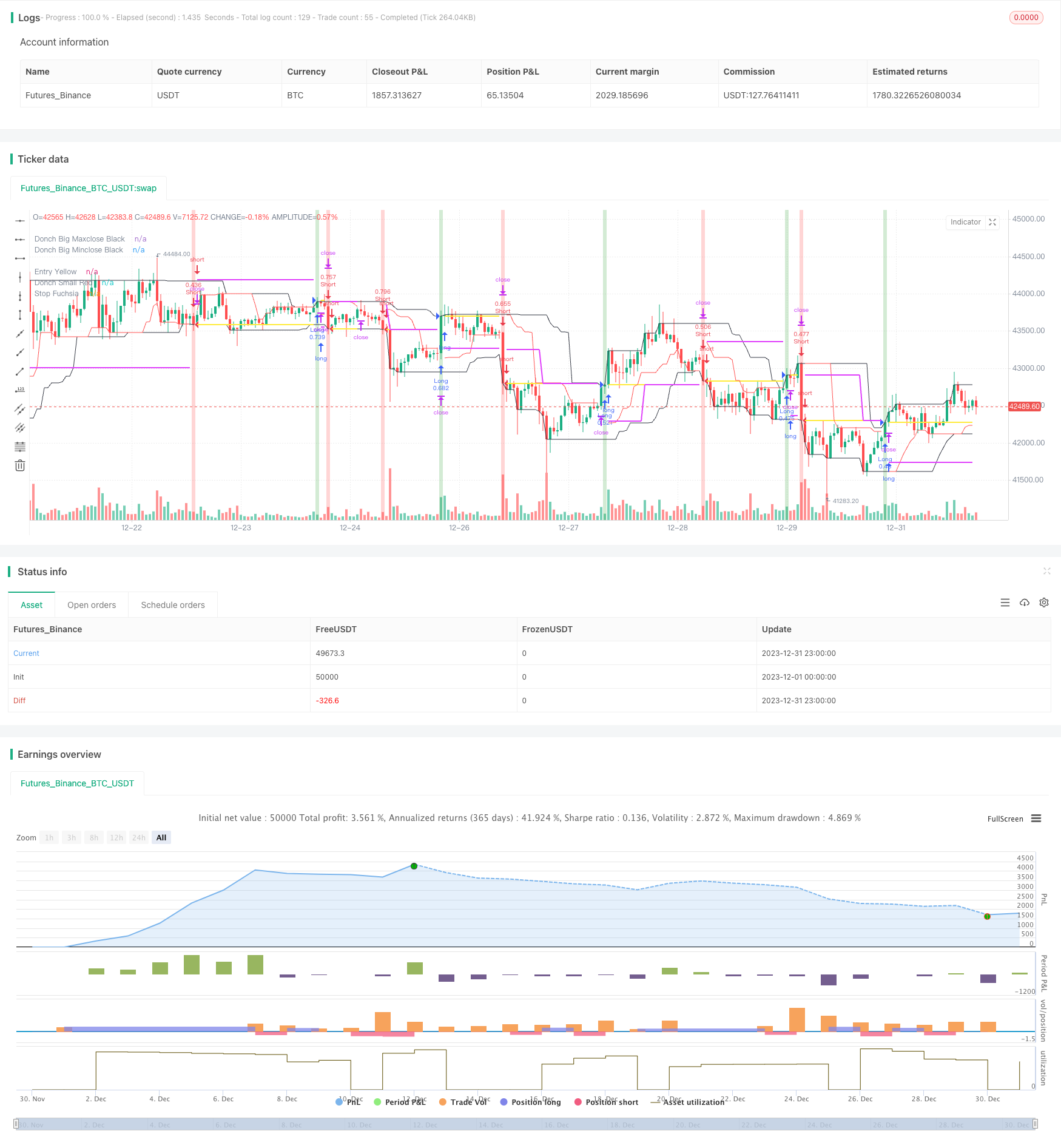

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Donchian", overlay=true, calc_on_every_tick=true)

// =============================================================================

// VARIABLES

// =============================================================================

donch_string = input.string(title="Lenght", options = ['20/10','50/20', '50/50', '20/20', '100/100'], defval='20/10')

permit_long = input.bool(title = 'Permit long', defval = true)

permit_short = input.bool(title = 'Permit short', defval = true)

risk_percent = input.float(title="Position Risk %", defval=0.5, step=0.25)

stopOffset = input.float(title="ATR mult", defval=2.0, step=0.5)

atrLen = input.int(title="ATR Length", defval=20)

close_in_end = input.bool(title = 'Close in end', defval = true)

permit_stop = input.bool(title = 'Permit stop', defval = true)

// =============================================================================

// CALCULATIONS

// =============================================================================

donch_len_big =

donch_string == '50/20' ? 50 :

donch_string == '50/50' ? 50 :

donch_string == '20/20' ? 20 :

donch_string == '20/10' ? 20 :

donch_string == '100/100' ? 100 :

na

donch_len_small =

donch_string == '50/20' ? 20 :

donch_string == '50/50' ? 50 :

donch_string == '20/20' ? 20 :

donch_string == '20/10' ? 10 :

donch_string == '100/100' ? 100 :

na

big_maxclose = ta.highest(close, donch_len_big)

big_minclose = ta.lowest(close, donch_len_big)

small_maxclose = ta.highest(close, donch_len_small)

small_minclose = ta.lowest(close, donch_len_small)

atrValue = ta.atr(atrLen)[1]

tradeWindow = true

// =============================================================================

// NOTOPEN QTY

// =============================================================================

risk_usd = (risk_percent / 100) * strategy.equity

atr_currency = (atrValue * syminfo.pointvalue)

notopen_qty = risk_usd / (stopOffset * atr_currency)

// =============================================================================

// LONG STOP

// =============================================================================

long_stop_price = 0.0

long_stop_price :=

strategy.position_size > 0 and na(long_stop_price[1]) ? strategy.position_avg_price - stopOffset * atrValue :

strategy.position_size > 0 and strategy.openprofit > risk_usd ? strategy.position_avg_price:

strategy.position_size > 0 ? long_stop_price[1] :

na

// =============================================================================

// SHORT STOP

// =============================================================================

short_stop_price = 0.0

short_stop_price :=

strategy.position_size < 0 and na(short_stop_price[1]) ? strategy.position_avg_price + stopOffset * atrValue :

strategy.position_size < 0 and strategy.openprofit > risk_usd ? strategy.position_avg_price :

strategy.position_size < 0 ? short_stop_price[1] :

na

// =============================================================================

// PLOT BG VERTICAL COLOR

// =============================================================================

cross_up = strategy.position_size <= 0 and close == big_maxclose and close >= syminfo.mintick and tradeWindow and permit_long

cross_dn = strategy.position_size >= 0 and close == big_minclose and close >= syminfo.mintick and tradeWindow and permit_short

bg_color = cross_up ? color.green : cross_dn ? color.red : na

bg_color := color.new(bg_color, 70)

bgcolor(bg_color)

// =============================================================================

// PLOT HORIZONTAL LINES

// =============================================================================

s1 = cross_up ? na : cross_dn ? na : strategy.position_size != 0 ? strategy.position_avg_price : na

s2 = cross_up ? na : cross_dn ? na : strategy.position_size > 0 ? small_minclose : strategy.position_size < 0 ? small_maxclose : na

s3 = cross_up ? na : cross_dn ? na : not permit_stop ? na :

strategy.position_size > 0 ? long_stop_price : strategy.position_size < 0 ? short_stop_price : na

plot(series=big_maxclose, style=plot.style_linebr, color=color.black, linewidth=1, title="Donch Big Maxclose Black")

plot(series=big_minclose, style=plot.style_linebr, color=color.black, linewidth=1, title="Donch Big Minclose Black")

plot(series=s1, style=plot.style_linebr, color=color.yellow, linewidth=2, title="Entry Yellow")

plot(series=s2, style=plot.style_linebr, color=color.red, linewidth=1, title="Donch Small Red")

plot(series=s3, style=plot.style_linebr, color=color.fuchsia, linewidth=2, title="Stop Fuchsia")

// =============================================================================

// ENTRY ORDERS

// =============================================================================

if strategy.position_size <= 0 and close == big_maxclose and close >= syminfo.mintick and tradeWindow and permit_long

strategy.entry("Long", strategy.long, qty=notopen_qty)

if (strategy.position_size >= 0) and close == big_minclose and close >= syminfo.mintick and tradeWindow and permit_short

strategy.entry("Short", strategy.short, qty=notopen_qty)

// =============================================================================

// EXIT ORDERS

// =============================================================================

if strategy.position_size > 0 and permit_stop

strategy.exit(id="Stop", from_entry="Long", stop=long_stop_price)

if strategy.position_size < 0 and permit_stop

strategy.exit(id="Stop", from_entry="Short", stop=short_stop_price)

// ==========

if strategy.position_size > 0 and close == small_minclose and not barstate.islast

strategy.close(id="Long", comment='Donch')

if strategy.position_size < 0 and close == small_maxclose and not barstate.islast

strategy.close(id="Short", comment='Donch')

// ==========

if close_in_end

if not tradeWindow

strategy.close_all(comment='In end')

// =============================================================================

// END

// =============================================================================