概述

本策略利用简单移动平均线(SMA)的金叉死叉原理构建。策略以3日线和5日线的金叉作为入场信号,以止损或止盈为退出信号。

策略原理

该策略主要基于两个SMA,即3日线和5日线。其中,3日线代表了短期趋势,5日线代表较长的中期趋势。当短期快速上涨,即3日线上穿5日线时,代表着目前处于上涨行情,这个时候入场做多;反之,当短期快速下跌,即3日线下穿5日线时,代表着目前处于下跌行情,这个时候入场做空。 这样,通过捕捉短期和中期两个周期价格变化的交叉来判断行情,可以提高入场的成功率。

优势分析

该策略具有以下优势:

- 策略逻辑简单清晰,容易理解和实施。

- 均线交叉策略对市场的大趋势判断比较准确,入场概率高。

- 选取两个不同周期的均线,可以更好地把握市场的变化。

- 实现了止盈止损机制,有效控制了损失。

风险分析

该策略也存在一定的风险:

- 由于采用了较短的均线周期,容易被市场的短期波动所影响,可能会增加止损的概率。

- 策略较为机械化,无法对特殊的市场情况做出调整。

- 没有考虑大周期的趋势判断,会使策略在市场长期下行中遭受较大的亏损。

为降低风险,可以考虑优化入场的均线选取,或者增加长周期均线的辅助判断。同时,也可以调整止盈止损的点位,使其更贴合真实的市场情况。

优化方向

该策略可以从以下几个方面进行优化:

- 增加更多不同周期的均线,形成多级筛选,提高策略的稳定性。

- 加入其他技术指标判断,如MACD、强弱指标等,辅助入场。

- 对大周期趋势加入判断,避免在长期下跌行情中仍然入场做多。

- 优化止盈止损的点位,使其能更好适应市场的实际波动。

- 测试更长的回测周期,评估参数稳定性。

总结

本策略基于均线交叉原理构建,采取金叉入场、止盈止损出场的策略逻辑,简单易于实施,回测表现也较为稳定。通过加入更多辅助技术指标、优化参数以及扩大回测范围等措施,可以进一步提升策略的稳定性及盈利水平。总体来说,均线策略具有良好的市场适应性,值得进一步研究与应用。

策略源码

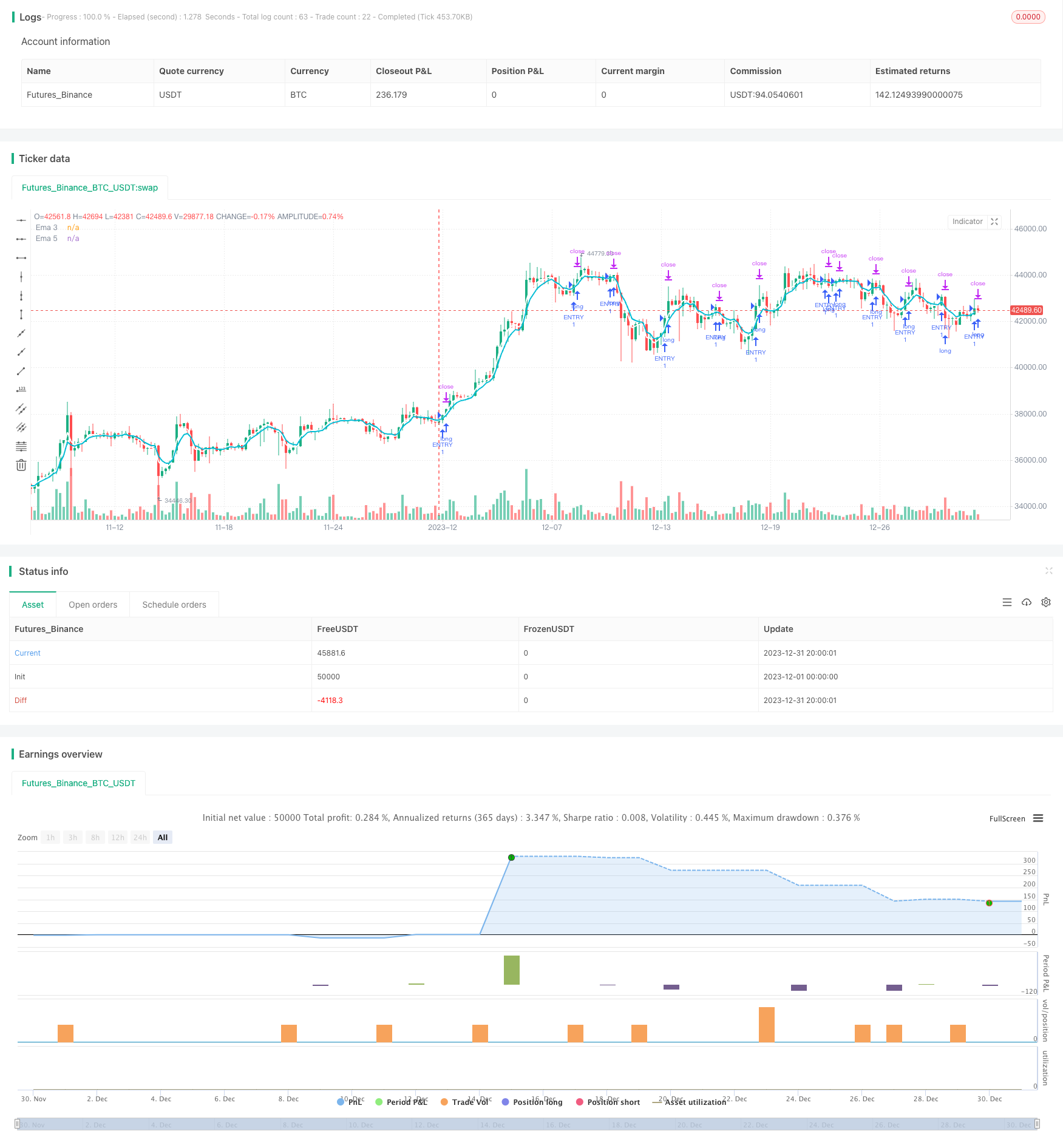

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 5h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Revolut v1.0", overlay=true)

// === GENERAL INPUTS ===

ATR = atr(3)

ema3 = ema(close, 3)

ema5 = ema(close, 5)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true// create function "within window of time"

// === PLOTTING ===

plot(ema3, title="Ema 3", color = white, linewidth = 2, transp=0)

plot(ema5, title="Ema 5", color = aqua, linewidth = 2, transp=0)

// === ENTRY POSITION LOGIC ===

entryCondition = crossover(ema(close, 3), ema(close, 5))

if (entryCondition)

strategy.entry("ENTRY", strategy.long, when=window())

// === EXIT POSTION LOGIC ===

//strategy.exit("Take Profit", "ENTRY", profit=6, loss=5, when=window())

strategy.exit("Take Profi Or STOP", "ENTRY", profit = 6, loss = 5, when=window())

// #####################################

// We can start to incorperate this into the script later

// We can program a emergency exit price

//strategy.close_all()

// You can use this if you want another exit

//strategy.exit("2nd Exit", "ENTRY", profit=1500, stop=500, when=window())