概述

这个策略是基于双移动平均线交叉的MACD技术指标来实现的自动交易策略。它利用MACD指标的快慢线交叉信号来判断趋势方向,实现趋势跟踪。

策略原理

该策略首先计算MACD指标的三条曲线:快线、慢线和离差线。快线是一定周期内的更快速的移动平均线,慢线是更长周期的移动平均线。离差线是快线和慢线的差值。当快线上穿慢线时为金叉信号,表示买入信号;当快线下穿慢线时为死叉信号,表示卖出信号。

该策略利用这个原理,在金叉时做多,在死叉时平仓;或者在死叉时做空,在金叉时平仓,实现自动跟踪趋势。同时,策略还判断MACD线的绝对值正负,避免假信号,确保真正捕捉趋势转折点。

策略优势

- 利用双移动平均线交叉判断趋势方向,精确捕捉趋势转折

- MACD技术指标减少假信号,提高信号质量

- 可灵活选择做多做空或只做多/空

- 参数可调整,适应不同市场环境

策略风险

- 双移动平均线交叉存在滞后,可能错过转折开始的部分利润

- MACD指标在震荡市中容易产生假信号

- 需要适当调整参数,避免过于灵敏或迟钝

风险解决方法:

- 结合其他指标过滤信号

- 调整参数,降低交易频率

- 只在趋势明显时才采取该策略

策略优化方向

该策略可以从以下几个方面进行优化:

结合其他指标确认信号,例如KDJ指标、布林带指标等,过滤假信号

改进入场机制,例如加入突破过滤,避免预期入场过早或过晚

优化参数设置,根据不同周期及市场环境调整快线慢线周期,适应市场

加入止损策略,控制单笔损失

可扩展至其他品种,例如外汇、数字货币等

总结

该双移动平均线交叉MACD趋势跟踪策略,利用MACD指标判断趋势方向,配合快慢线交叉过滤信号,可有效捕捉趋势转折,自动跟踪趋势。策略优势在于精准判断趋势,参数调整灵活,可根据市场环境优化。需要注意控制风险,避免产生假信号。若结合其他技术指标及参数调整,该策略效果会更好。

策略源码

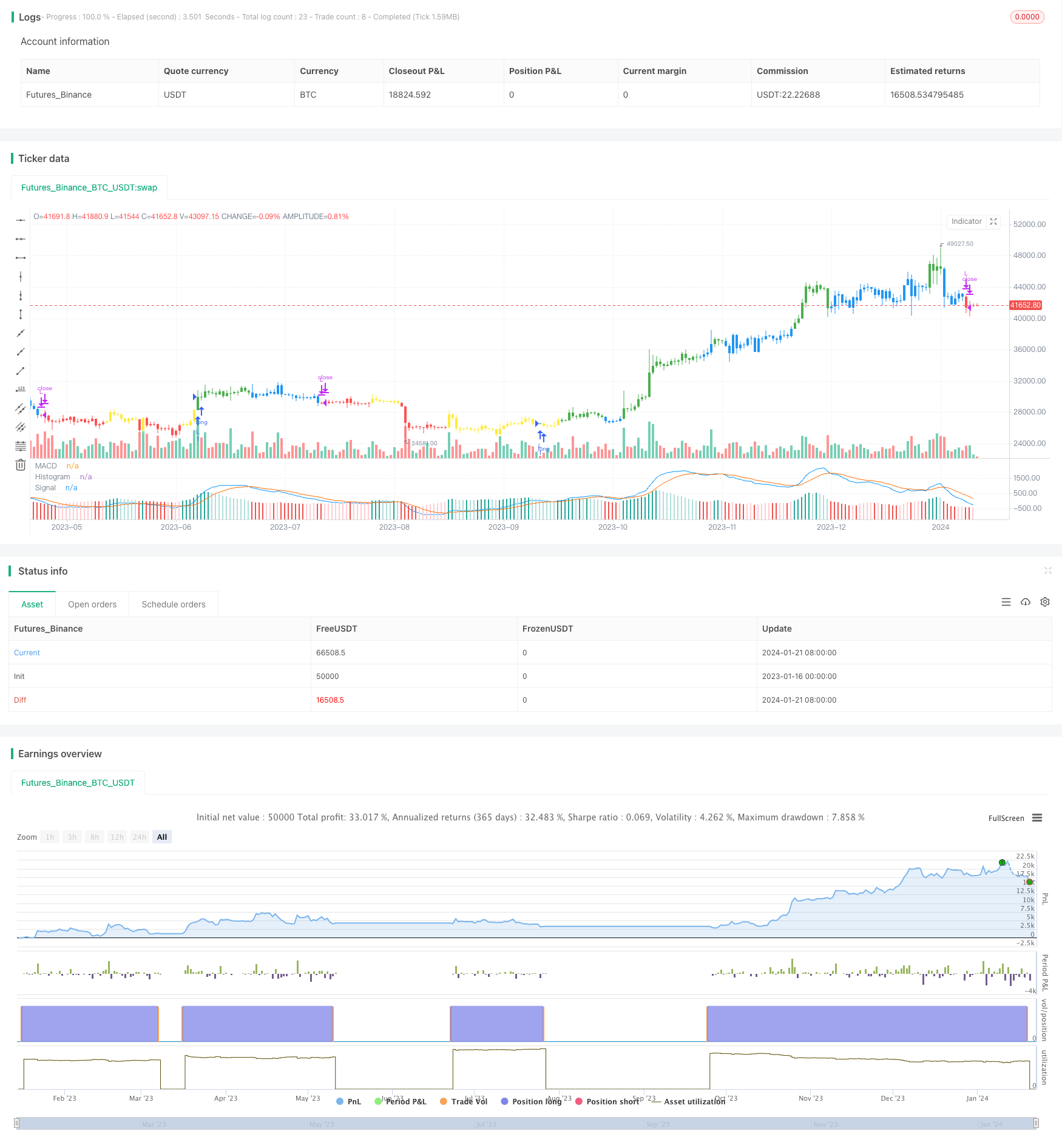

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DeMindSET

//@version=4

strategy("MACD Trend Follow Strategy", overlay=false)

// Getting inputs

LSB = input(title="Long/Short", defval="Long only", options=["Long only", "Short only" , "Both"])

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

//

Bull= macd > signal

Bear= macd < signal

ConBull=macd>0

ConBear=macd<0

//

Green= Bull and ConBull

Red= Bear and ConBear

Yellow= Bull and ConBear

Blue= Bear and ConBull

//

bcolor = Green ? color.green : Red ? color.red : Yellow ? color.yellow : Blue ? color.blue : na

barcolor(color=bcolor)

// === INPUT BACKTEST RANGE ===

FromYear = input(defval = 2019, title = "From Year", minval = 1920)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2009)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

if LSB == "Long only" and Green

strategy.entry("L",true)

if LSB == "Long only" and Red

strategy.close("L",qty_percent=100,comment="TP Long")

if LSB == "Both" and Green

strategy.entry("L",true)

if LSB == "Both" and Red

strategy.entry("S",false)

if LSB == "Short only" and Red

strategy.entry("S",false)

if LSB == "Short only" and Green

strategy.close("S",qty_percent=100,comment="TP Short")