概述

该策略基于日线的最高价和最低价绘制两条线,作为多空判断的依据。当价格上穿最高价线时,做多;当价格下穿最低价线时,做空。可以自动进行多空切换。

策略原理

该策略主要利用了日线的枢轴点来判断多空。所谓“枢轴”,就是昨日的最高价和最低价。这两条线构成一个交易区间,如果今日的价格突破这两个点中的任一个,那么就可以判断趋势发生转折。

具体来说,策略主要逻辑如下:

- 最高价线:绘制昨日的最高价水平线,如果今日收盘价突破该线则为多头信号

- 最低价线:绘制昨日的最低价水平线,如果今日收盘价突破该线则为空头信号

- 多头入场:收盘价上穿最高价线时,开多仓

- 空头入场:收盘价下穿最低价线时,开空仓

- 止损:多头止损位于最低价线附近,空头止损位于最高价线附近

这样,通过最高、最低价的突破来捕捉趋势,实现自动的多空切换。

优势分析

该策略主要有以下几个优势:

- 策略思路清晰,容易理解和实现

- 基于日线交易,时间周期长,不容易被短线噪音干扰

- 自动切换多空,最大程度规避非趋势市

- 止损点明确,有利于风险控制

风险分析

该策略也存在一些风险:

- 日线交易时间周期较长,无法及时止损

- 突破的假突破可能导致不必要的损失

- 持仓时间过长可能导致亏损扩大

针对这些风险,我们可以从以下几个方面进行优化:

- 在日线突破的同时,加入其他更高频指标的确认

- 优化突破判定的参数,过滤掉部分假突破

- 采用移动止损或trailers等方式及时止损

优化方向

该策略还有进一步优化的空间:

- 可以在更多品种和更长的数据上进行回测,验证策略的稳定性

- 可以探索其他突破指标的使用,如通道、布林带等

- 可以结合交易量指标,避免无量突破

- 可以加入更多过滤条件,减少假突破概率

- 可以尝试机器学习等方法对参数进行优化

总结

总的来说,该策略基于简单的日线枢轴思路,实现了多空自动切换。策略逻辑清晰易懂,通过优化可以进一步提高稳定性。投资者可以根据自己的风险偏好,选择合适的参数应用于实盘交易。

策略源码

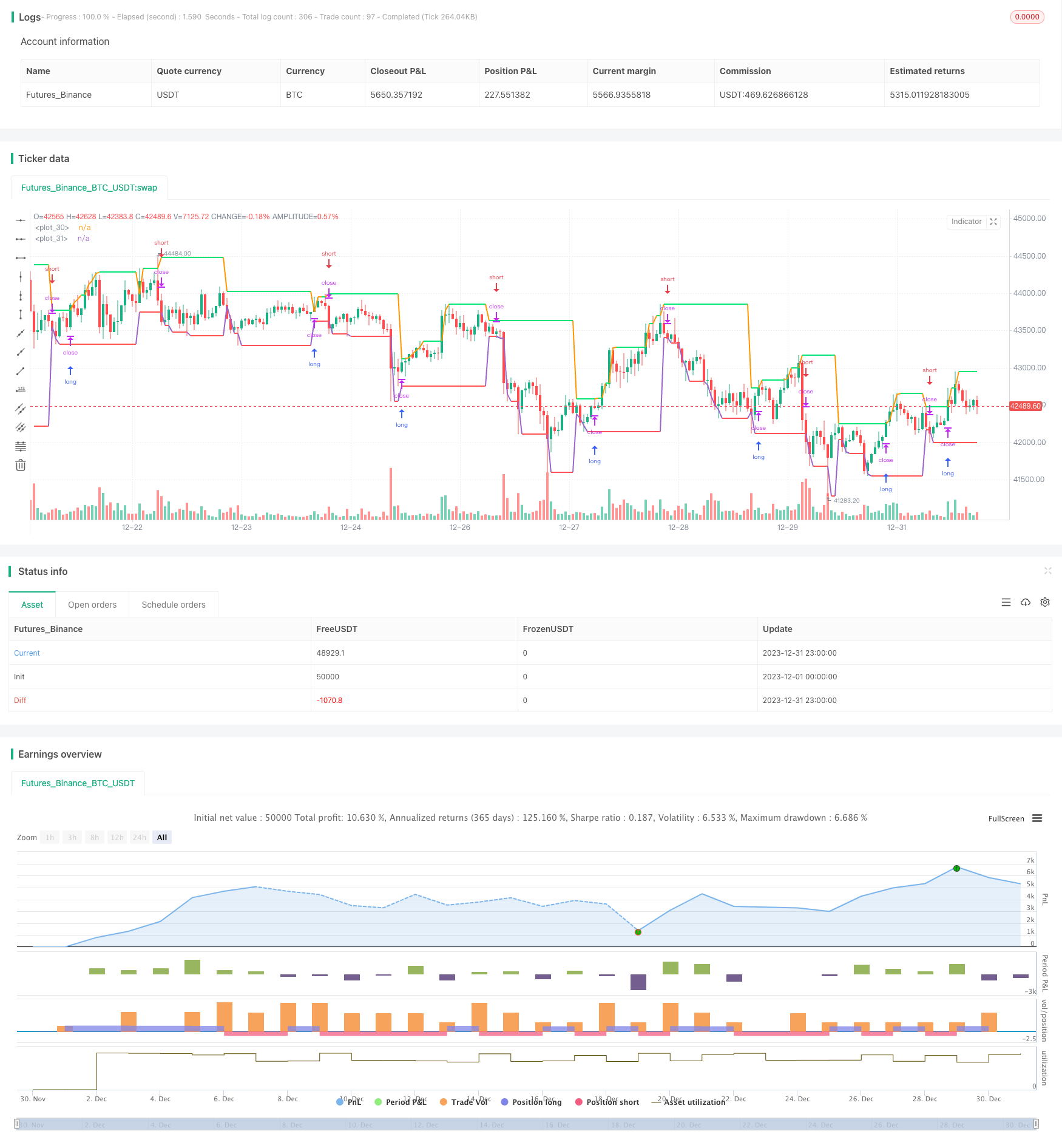

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2019

//@version=3

strategy(title = "Noro's DEX Strategy", shorttitle = "DEX str", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(false, defval = false, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Lot")

showlines = input(true, title = "Show lines")

showbg = input(false, title = "Show background")

showday = input(false, title = "Show new day")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//New day trand

bar = close > open ? 1 : close < open ? -1 : 0

newday = request.security(syminfo.tickerid, 'D', time)

//Lines

uplevel = request.security(syminfo.tickerid, 'D', high)

dnlevel = request.security(syminfo.tickerid, 'D', low)

upcolor = uplevel == uplevel[1] and showlines ? lime : na

dncolor = dnlevel == dnlevel[1] and showlines? red : na

plot(uplevel, offset = 1, linewidth = 2, color = upcolor)

plot(dnlevel, offset = 1, linewidth = 2, color = dncolor)

//Background

size = strategy.position_size

col = time == newday + 86400000 and showday ? blue : showbg and size > 0 ? lime : showbg and size < 0 ? red : na

bgcolor(col)

//Orders

lot = 0.0

lot := size != size[1] ? strategy.equity / close * capital / 100 : lot[1]

truetime = true

if uplevel > 0 and dnlevel > 0

strategy.entry("Long", strategy.long, needlong ? lot : 0, stop = uplevel, when = truetime)

strategy.entry("Close", strategy.short, needshort ? lot : 0, stop = dnlevel, when = truetime)