概述

大神波动带RSI交易策略通过结合波动带指标和相对强弱指数(RSI)指标,在价格突破上轨且RSI指标显示为超卖信号时产生买入信号;当价格跌破上轨且RSI指标显示为超买信号时产生卖出信号。该策略主要利用波动带指标判断市场波动的节奏变化,结合RSI指标发现超买超卖现象,在反转点位发出交易信号。

策略原理

该策略的核心逻辑基于以下几点:

计算20日的收盘价简单移动平均线作为基准中轨。

在中轨的基础上计算上下轨,上轨为中轨+2倍的20日收盘价标准差,下轨为中轨-2倍的20日收盘价标准差。构成波动带。

计算14日RSI指标判断超买超卖现象。RSI低于20为超卖,高于70为超买。

当收盘价由下向上突破上轨,且RSI指标显示超卖信号,产生买入信号。

当收盘价由上向下跌破上轨,且RSI指标显示超买信号,产生卖出信号。

该策略通过波动带指标判断价格波动的节奏和速度,并结合RSI指标发现反转点位,在可能的反转点发出交易信号。

优势分析

波动带指标能判断市场的波动节奏和方向,RSI指标判断超买超卖现象,两者结合形成有效的交易信号。

RSI指标参数可调节,可以根据不同市场设置不同的超买超卖水平,避免错误信号。

波动带参数也可以调整,根据市场波动范围和速度设定合适的参数,提高获利概率。

突破上轨形成买入信号,跌破上轨形成卖出信号,简单易懂的交易逻辑。

可同时用于股市、外汇和数字货币等市场。

风险分析

市场持续向上时,可能造成多次误判买入信号。可通过优化RSI参数降低错误信号率。

震荡行情中,波动带上下轨震荡频繁,可能导致频繁交易亏损。可适当放宽突破参数,减少无谓交易。

代码中假设超买超卖标准固定,实际上应该根据不同市场波动程度设定参数。

波动带和RSI指标都存在滞后,不能提前预测价格走势,只能追踪价格变化。

优化方向

根据不同市场的特点,调整波动带参数,增大波动带宽度,降低误交易概率。

RSI参数也需要针对不同市场调整,适当调高超买超卖标准,避免多次触发错误交易信号。

增加其他指标判断,如KDJ、MACD等,避免波动带和RSI单一指标判断错误。

增加止损策略,设定合理的止损点,避免单次亏损过大。

可考虑 Breakout 突破或回测测试参数优化,进一步提高策略稳定性。

总结

大神波动带RSI交易策略通过波动带指标判断价格波动速度和RSI指标判断超买超卖现象,在可能的反转点发出交易信号。该策略整合了多个指标优势,交易逻辑简单清晰,可广泛适用于股市、外汇、数字货币等交易市场,是一种有效的趋势交易策略。但也存在一定改进空间,可从调整参数、增设指标、止损机制等多方面进行优化,使策略更稳定可靠。

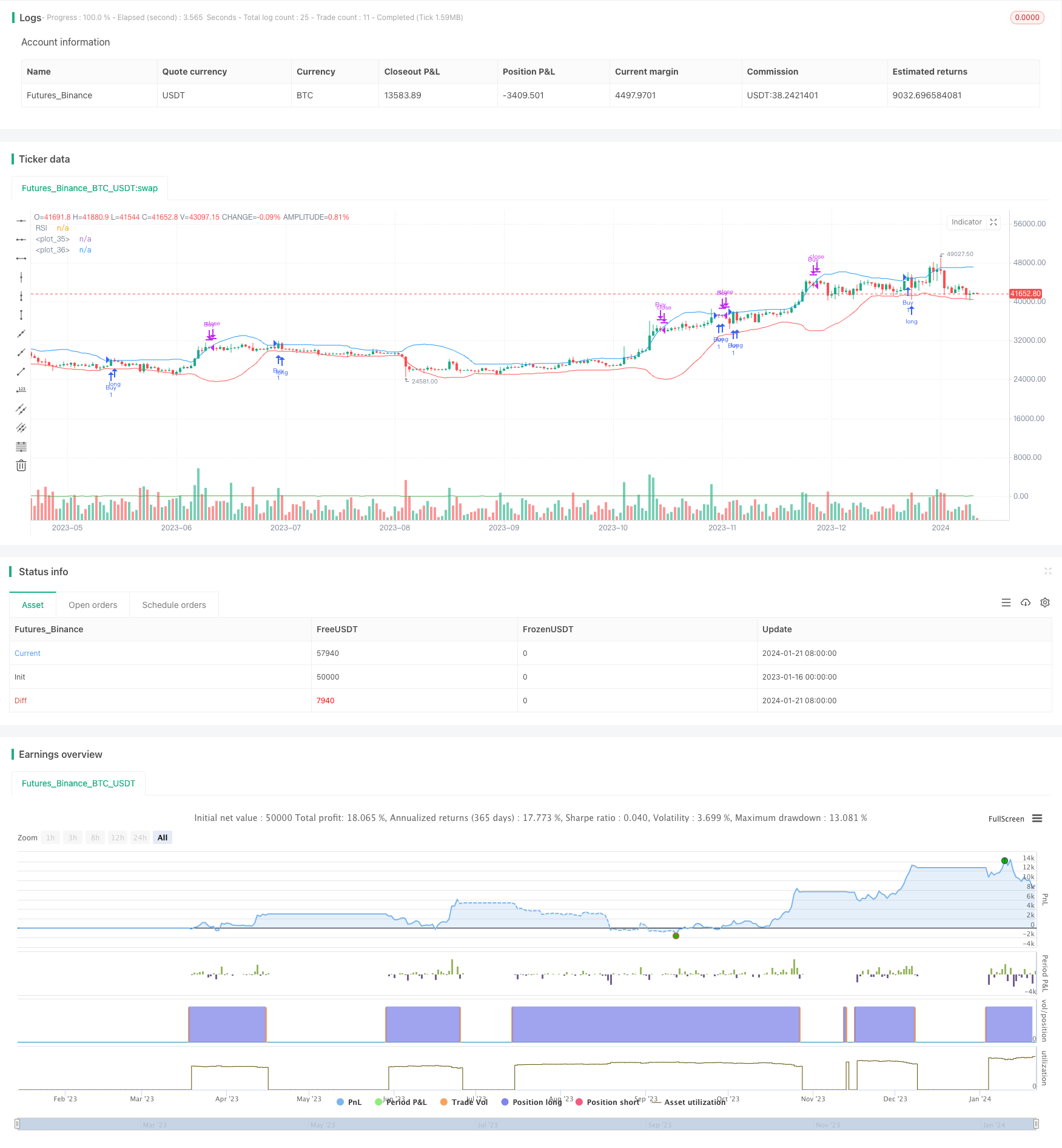

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger Band + RSI Strategy", overlay=true)

// Input variables

numCandlesOutsideBB = input(3, "Number of Candles Outside BB")

numCandlesOutsideUpperBB = input(3, "Number of Candles Outside Upper BB")

rsiLength = input(14, "RSI Length")

rsiOversoldLevel = input(20, "RSI Oversold Level")

rsiOverboughtLevel = input(70, "RSI Overbought Level")

// Bollinger Bands

length = input(20, minval=1, title="BB Length")

mult = input(2.0, minval=0.001, maxval=50, title="BB Standard Deviation")

basis = sma(close, length)

dev = mult * stdev(close, length)

upperBB = basis + dev

lowerBB = basis - dev

// RSI

rsi = rsi(close, rsiLength)

// Buy condition

buyCondition = crossover(close, upperBB) and rsi > rsiOversoldLevel

// Sell condition

sellCondition = crossunder(close, upperBB) and rsi > rsiOverboughtLevel

// Strategy

if buyCondition

strategy.entry("Buy", strategy.long)

if sellCondition

strategy.close("Buy")

// Plotting

plot(upperBB, color=color.blue)

plot(lowerBB, color=color.red)

plot(rsi, "RSI", color=color.green)