概述

该策略是一个基于EMA均线的双线交叉判断趋势的策略。它使用长度不同的两个EMA均线,在盘整期通过判断EMA均线的位置关系确定目前处于上升趋势,在突破期通过判断价格与EMA均线的交叉情况来发出买入信号。该策略同时设置了止盈止损点来锁定利润和控制风险。

策略原理

该策略使用了30周期和60周期的两个EMA均线。EMA均线是一条平滑移动平均线,它对最近的价格赋予更高的权重,这样EMA均线可以更快地响应价格变化。

当短周期EMA均线上穿长周期EMA均线时生成买入信号,这表示当前处于上升趋势中。当价格从下向上突破短周期EMA均线时,在长期趋势的支持下,价格将继续向上运行,这时买入。

该策略同时设置了止盈止损点。止盈点设为过去10根K线最高价中的最高点,以锁定最大利润。止损点设为长周期EMA均线,以控制风险。

优势分析

该策略的主要优势有:

- 使用EMA均线判断趋势可靠性高,容易抓住趋势机会

- 双线交叉发出信号灵敏度高

- 设置止盈止损点,可以锁定利润,控制风险

风险分析

该策略主要的风险有:

- 当趋势反转时,EMA均线的响应不及时,可能导致亏损

- 双线交叉容易发出错误信号

- 止盈止损点设置不当可能导致过早止盈止损

对应解决方法:

- 优化EMA均线参数,更快响应趋势反转

- 增加过滤条件,避免错误信号

- 测试确定最佳止盈止损参数

优化方向

该策略的主要优化方向包括:

- 优化EMA均线参数,寻找最佳参数组合

- 增加其他指标作为辅助判断,如MACD,KDJ等

- 增加量能指标,避免量能不足的假突破

- 使用机器学习方法动态优化止盈止损点

- 测试不同品种参数健壮性,寻找最佳适配品种

总结

该策略整体是一个比较典型的基于EMA均线判断趋势方向并双线交叉发信号的策略。它利用EMA均线判断大趋势以及双线交叉提高信号精准度。但EMA均线对趋势反转的响应滞后以及双线交叉可能出现错误信号是该策略的主要风险。通过参数优化,辅助系统扩展,可以提高策略的稳定性和扩展性。总的来说,该策略具有一定的实用性。

策略源码

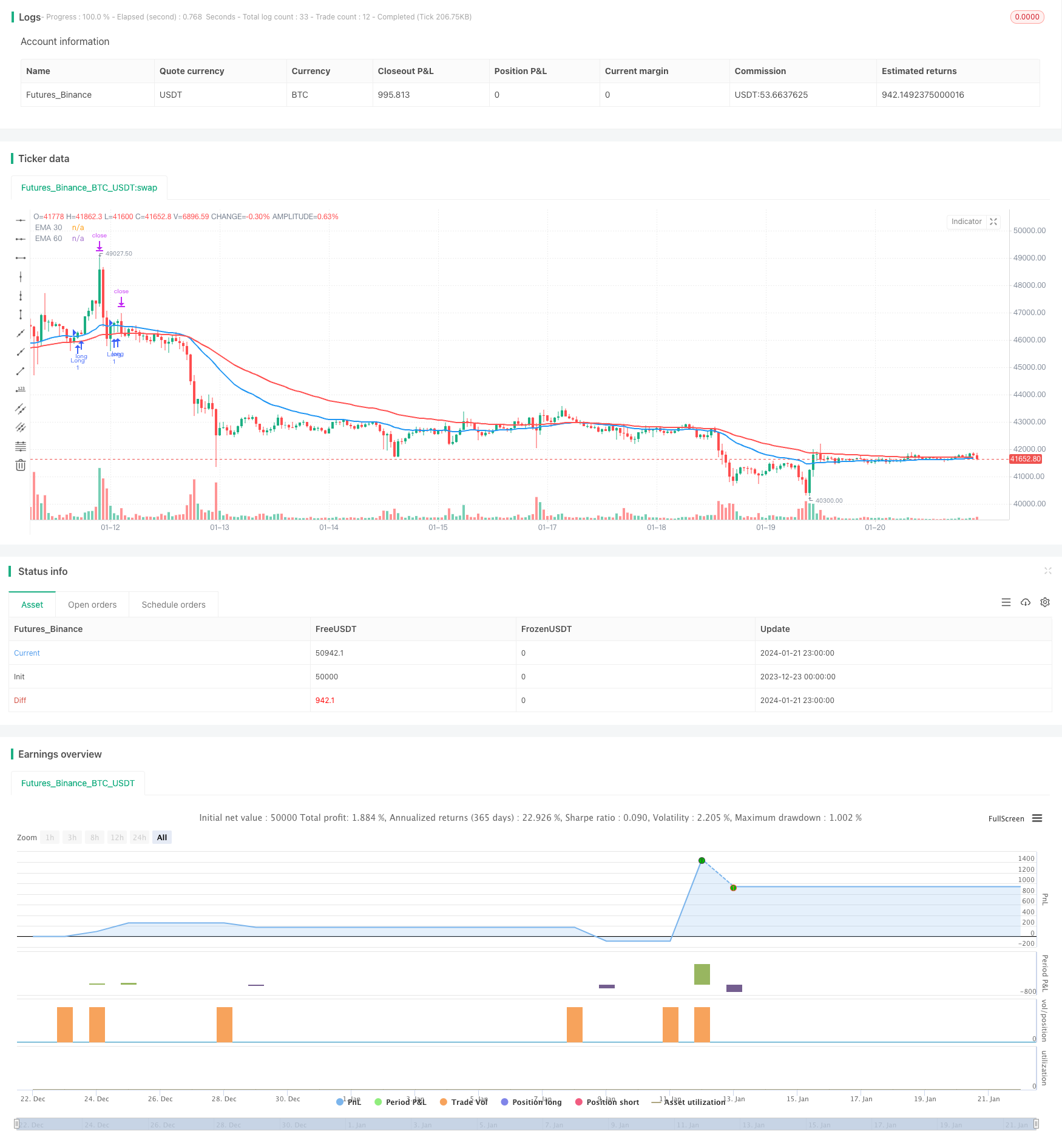

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Cross Strategy", overlay=true)

// 输入设置

ema30_length = input.int(30, title="EMA 30 Length", minval=1)

ema60_length = input.int(60, title="EMA 60 Length", minval=1)

// 计算EMA

ema30 = ta.ema(close, ema30_length)

ema60 = ta.ema(close, ema60_length)

// 绘制EMA

plot(ema30, title="EMA 30", color=color.blue, linewidth=2)

plot(ema60, title="EMA 60", color=color.red, linewidth=2)

// 判断上升趋势

uptrend = close > ema30 and ema30 > ema60

// 买入条件

buy_signal = ta.crossover(close, ema30) and close[1] < ema30[1] and close[1] > ema60[1] and uptrend

// 止盈止损

take_profit_level = ta.highest(high, 10)

stop_loss_level = ema60

// 执行交易

if (buy_signal)

strategy.entry("Long", strategy.long)

strategy.exit("Exit", "Long", stop=stop_loss_level, limit=take_profit_level)